From Replacement to Regulation: DBDPE Regulatory Trends in 2025

This blog was originally posted on 13th November, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY VALENTINA MARCHETTI, SENIOR REGULATORY COMPLIANCE SPECIALIST AND TEAM LEAD, COMPLIANCE & RISKS

A Familiar Story is Repeating Itself

Manufacturers across multiple sectors have faced a reckoning over the past two decades. The widely used flame retardant decabromodiphenyl ether (DecaBDE) – once a mainstay of fire safety in electronics, vehicles, textiles, and building materials – was progressively restricted under frameworks such as RoHS and REACH and listed under the Stockholm Convention for elimination. In response, many manufacturers turned to Decabromodiphenyl Ethane (DBDPE) as a substitute.

DBDPE offered similar flame-retardant performance, excellent thermal stability, and low migration, quickly becoming a preferred replacement across plastics, electronics, building materials, textiles, and automotive components.

Recently, however, the regulatory landscape has shifted. Authorities in Canada, Australia, and the European Union have concluded that DBDPE’s persistence and bioaccumulation outweigh its benefits. A substance once considered a “safe alternative” is now under coordinated global scrutiny.

What is DBDPE and Why it Matters

Decabromodiphenyl Ethane (CAS 84852-53-9) is an additive, non-polymeric brominated flame retardant used to prevent or slow combustion in polymeric materials such as polyethylene, polypropylene, polystyrene, and elastomers.

Its applications span multiple sectors:

- Electrical and electronic equipment: connectors, enclosures, printed circuit boards, and cable insulation

- Automotive and transport: wires, cables, and interior components

- Building materials: foams and insulation

- Textiles: back-coatings and flame-resistant fabrics

DBDPE’s widespread adoption stems from its high stability and resistance to degradation, qualities that ensure consistent flame-retardant performance during manufacturing and throughout a product’s lifespan. However, these same characteristics also contribute to its environmental persistence, now a central focus of regulatory concern.

Because DBDPE is not chemically bound to the materials it protects, it can migrate into dust, sediments, and the wider environment. Monitoring studies have detected it in wildlife and even in remote regions, mirroring trends previously observed with DecaBDE.

Assessments by the European Chemicals Agency (ECHA) and Environment and Climate Change Canada (ECCC) classify DBDPE as very persistent and very bioaccumulative (vPvB). While human exposure is considered low, long-term accumulation in ecosystems, particularly through e-waste recycling and landfill disposal, poses significant ecological risks.

Interested in learning more about the regulation of chemicals? Check out our whitepaper ‘2025 Update on EU REACH and POPs Restrictions: Key Insights‘.

Global Regulatory Developments in 2025

Canada – Declared Toxic Under CEPA

On 14 February 2025, DBDPE was added to Part 2 of Schedule 1 of the Canadian Environmental Protection Act (CEPA, 1999) through Order SOR/2025-27, officially designating it as “toxic to the environment”. This listing allows Canada to develop risk management measures, likely including restrictions on manufacture, import, and use, following the trajectory previously applied to DecaBDE.

The regulatory process began with an initial proposal in 2019, followed by a further draft in 2022 titled “Prohibition of Certain Toxic Substances Regulations, 2022” which sought to restrict the manufacture, use, sale, and import of DBDPE, with time-limited exemptions for specific sectors such as electrical and electronic equipment and vehicles.

Although the 2022 draft is still under consideration, the 2025 decision formalizes DBDPE’s designation as toxic and establishes the basis for forthcoming risk management measures. This marks a consistent regulatory trajectory toward eventual restrictions or prohibitions on DBDPE, while allowing transitional periods for affected industries to adapt.

Australia – Prohibition Under IChEMS

In Australia, the Department of Climate Change, Energy, the Environment and Water (DCCEEW) amended Schedule 6 of the Industrial Chemicals Environmental Management (Register) Instrument 2022 on 25 June 2025. The amendment prohibits the import, manufacture, use, and export of DBDPE from 1 January 2027, with specific exemptions.

Exemptions apply in cases of:

- Trace contamination, defined as ≤10 mg/kg in substances or ≤500 mg/kg in articles.

- Essential uses – finished articles that must comply with fire retardancy standards and where no viable alternative is available. These essential uses include:

- Aerospace applications (until 1 July 2037)

- Automotive, marine, rail, and other transport applications (until 1 July 2037)

- Defence applications (to be reviewed after 1 July 2033)

- Electrical and electronic equipment (EEE) (until 1 July 2037)

- Building and construction materials (until 1 July 2037)

- Agricultural, construction, manufacturing, and mining equipment and machinery (until 1 July 2037)

- Garden, forestry, and outdoor power equipment (until 1 July 2037)

- Industrial machinery, nonroad mobile machinery, and stationary power equipment (until 1 July 2037)

- Replacement parts for all of the above applications (until end of service life or 1 July 2052)

- Research and environmentally sound disposal

Australia also imposes clear obligations on importers and users. Importers must determine and communicate the concentration by weight of DBDPE in articles to the supply chain. Both importers and users are required to maintain up-to-date records and provide them to regulatory authorities upon request. These records should include the identity of the chemical and the articles it is present in, the concentration by weight and estimated annual introduction volume (where feasible), and a justification for its use.

European Union – Candidate List Inclusion

On 5 November 2025, the ECHA Member State Committee added DBDPE to the REACH Candidate List as a Substance of Very High Concern (SVHC) due to its very persistent and very bioaccumulative (vPvB) properties. This inclusion triggers several obligations for suppliers and importers of DBDPE as a substance, in mixtures, and in articles.

For articles containing DBDPE:

- Communication to customers and consumers: Suppliers must inform customers and end users if articles contain DBDPE at concentrations of 0.1% (w/w) or higher.

- Notification to ECHA: Importers and producers of articles must notify ECHA within six months of inclusion (i.e., by 5 May 2026) if an article contains DBDPE above 0.1% (w/w) and the total quantity of DBDPE in those articles exceeds one ton per year.

- SCIP notification: Suppliers must submit information to the SCIP database under the Waste Framework Directive for articles containing DBDPE above 0.1% (w/w).

- Potential EU Ecolabel ineligibility: Articles containing DBDPE may not qualify for the EU Ecolabel, reflecting environmental concerns.

For DBDPE as a substance or in mixtures:

- Updating Safety Data Sheets (SDS): Suppliers must provide or update SDS for DBDPE and any mixtures containing it.

Inclusion also opens the path toward future authorization or restriction under REACH.

Alternatives and Considerations

The feasibility of replacing DBDPE depends on specific applications and materials. Non-halogenated flame retardants, including magnesium hydroxide and phosphorus-based derivatives, can substitute in many cases. Some applications, especially in automotive wiring, electrical components, and textiles, may require material reformulation to maintain flame-retardant performance.

Beyond chemical substitution, manufacturers can consider product redesign – using inherently non-flammable materials or physical barriers. While these approaches may require additional research and development, they align with the broader move toward sustainable materials and circular economy principles, reducing environmental impact over the long term.

Conclusion

In 2025, DBDPE faced coordinated global regulation due to its persistence, bioaccumulation, and environmental impact.

For manufacturers and downstream users in electronics, automotive, textiles, and construction, the key takeaway is to monitor evolving restrictions, assess DBDPE in products, and plan for substitutions or process adjustments.

The DBDPE story underscores the importance of proactive chemical management, regulatory compliance, and substitution planning. Aligning performance, safety, and environmental responsibility is no longer optional – it is essential for sustainable operations and uninterrupted market access.

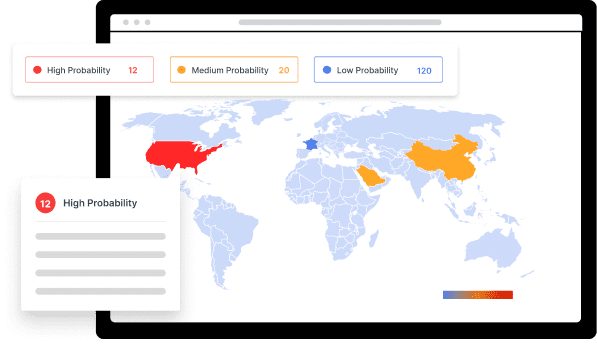

Experience the Future of ESG Compliance

The Compliance & Risks Sustainability Platform is available now with a 30-day free trial. Experience firsthand how AI-driven, human-verified intelligence transforms regulatory complexity into strategic clarity.

👉 Start your free trial today and see how your team can lead the future of ESG compliance.

The future of compliance is predictive, verifiable, and strategic. The only question is: Will you be leading it, or catching up to it?

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.