Online Marketplaces are Accountable for Products Sold on their Platforms – EU Digital Services Act

This blog was originally posted on 19th May, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY JOYCE COSTELLO, SENIOR REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

The EU’s Digital Services Act (Regulation (EU) 2022/2065, the ‘DSA’), in effect since 17 February 2024, increases obligations on online marketplaces to ensure the safety and legality of products sold on their platforms by making them more responsible for the traders they host and requiring them to take action against illegal and unsafe listings.

The central aim of the DSA rules is to promote greater online safety by, among other things, holding online intermediaries, such as marketplaces, accountable for products they list for sale.

Obligations under the DSA complement the due diligence requirements introduced under Regulation (EU) 2023/988, the ‘GPSR’, in enhancing consumer protection in the age of the digital market.

The DSA is a substantial law, with significant implications for online marketplaces and other online intermediary service providers.

This blog introduces the most pressing compliance considerations of the Act with a focus on online marketplaces.

Who Must Comply with the Provisions of the Digital Services Act?

The DSA applies to organizations that provide online intermediary services in the EU, including online marketplaces.

Do These Rules Apply to Companies that are Based Outside of the EU?

Yes. The rules apply to online intermediaries established outside of the European Union that offer their services in the single market.

Companies outside the EU that offer services in the Union must appoint a legal representative who is in the EU, provide information relating to their legal representatives to the relevant authorities and make it publicly available.

How are Online Marketplaces Considered ‘Intermediaries’?

Online marketplaces act as intermediaries in their role of connecting consumers with goods by intermediating the sale of products between traders and consumers.

What are the Key Obligations that Online Marketplaces Need to Fulfil?

Any company providing an online marketplace must:

Remove illegal goods

- Platforms must put procedures in place that will allow them to swiftly remove listings of illegal goods

Keep consumers informed

- If a marketplace becomes aware that an illegal product was sold, they must inform the consumers who bought it in the last six months. In the event that they do not have contact details, this information must be made public on their platform

Trace traders

- Marketplaces are obligated to know their business customers. Efforts must also be made to enhance the traceability of products including through the use of advanced technological solutions

Enable trader compliance

- Traders have their own information obligations towards consumers, and should be facilitated to do so by the online platform interface

Conduct reasonable checks

- Marketplaces must randomly check against existing databases whether products on their sites are compliant

Be transparent

- Better information on terms and conditions is essential. Intermediaries should also be transparent about their use of algorithms for recommending products to users

Avoid ‘dark patterns’

- The marketplace interface must not employ misleading tricks that manipulate users into choices they do not intend to make

Respect trusted flaggers

- Trusted flaggers are designated entities with proven expertise in identifying illegal online content, including products. The DSA requires their notifications to platforms to be prioritized and processed without delay

Adopt measures against misuse

- Online marketplaces are obligated to suspend, for a reasonable period and after a prior warning, the provision of their services to recipients (e.g., sellers) who frequently provide manifestly illegal products

Transparency Reporting

All online marketplaces must make publicly available, at least once a year, reports on any content moderation that they engaged in during the relevant period. The concept of ‘content moderation’ includes the vetting of products listed for sale online, detections of unsafety or illegality, and removal of related listings. In addition, online marketplaces must indicate in their Terms and Conditions explanations of how they vet products.

The annual report should incorporate information on disputes submitted to certified out-of-court dispute settlement bodies, and the number of suspensions imposed.

Greater Oversight of ‘VLOPs’

The DSA imposes enhanced obligations on certain intermediaries which are designated by the EU Commission as ‘Very Large Online Platforms’ (‘VLOPs’), generally those reaching at least 45 million users.

Once a platform has been designated as a VLOP, it has 4 months to comply with additional obligations applicable specifically to Very Large Online Platforms. These encompass supplementary risk management obligations, obligations to provide access to data for vetted researchers and obligations to submit their services to an audit.

The audited risk assessment includes an analysis on their vulnerability to illegal goods on their platforms. Mitigation measures taken at the organizational level are now also subject to annual audits.

VLOPs must publish reports biannually, and bear a stricter reporting burden than other online intermediaries. For example, these providers are expected to specify the human resources dedicated to content moderation, and information on the average monthly recipients of their service for each Member State.

Standardized Reporting Template Must Be Used from 1 July 2025

Whether VLOP-designated or not, providers must use the standardized templates and categories for their reports from 1 July 2025. Regulation (EU) 2024/2835 lays down the mandatory templates for these transparency reports, providing guidance on the form, content and other details of the mandated reporting, including harmonized reporting periods. Reports cover the calendar year and should be published by the end of February the following year (and again six months thereafter, for VLOPs).

What are the Consequences of a Breach of the DSA

“Providers of online marketplaces play a crucial role in the supply chain, allowing economic operators to reach a greater number of consumers, and therefore also in the product safety system.” – Recital (45), GPSR

In recognition of the above, companies providing online marketplaces face significant consequences for non-compliance with the EU Digital Services Act, particularly Very Large Online Platforms (VLOPs).

Failure to comply with the rules can result in significant fines, and presents significant reputational risk.

Fines of up to 6 % of global annual turnover in the preceding financial year could be levied for breaches of DSA obligations, particularly where the Commission finds intentional or negligent infringement of the Act. It will consider aggravating factors relating to the nature, gravity, duration and recurrence of the infringement.

Additionally, periodic penalties of up to 5% of average daily turnover may be imposed for each day of delayed compliance with any corrective measures ordered.

Stay Ahead Of Regulatory Changes like the EU Digital Services Act

Want to stay ahead of regulatory developments like the EU Digital Services Act?

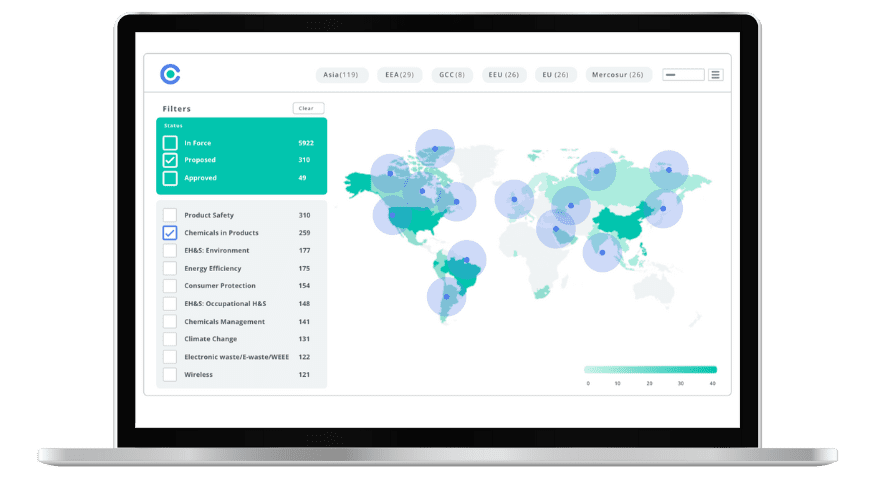

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

EU & UK Product Compliance: What’s Hot in 2025 & Beyond

Join us for expert insights into the latest developments, upcoming changes, and how to prepare for the evolving EU and UK regulatory landscape in 2025 and beyond.