25 Critical Stats Every Chief Compliance Officer Needs to Know in 2025

This blog was originally posted on 17th July, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

Introduction

It’s 2025, and the landscape for Chief Compliance Officers (CCOs) continues its relentless evolution. Compliance leaders are grappling with an explosion of new regulations – global rulemaking has surged dramatically in recent years – alongside sophisticated cyber threats, complex ESG mandates, and the integration of emerging technologies like AI. In short, compliance trends for 2025 show that compliance is no longer just about box-ticking; it’s a strategic imperative underpinning business resilience and reputation. Below, we present 25 key compliance statistics every CCO should know this year, grouped by theme. These insights highlight the top regulatory changes, technology and automation shifts, cybersecurity and data privacy challenges, ESG compliance developments, supply chain risks, workforce and culture trends, and the costs and investments shaping the compliance function. Use these data points to validate your strategy, inform your risk management and ESG compliance efforts, and proactively position compliance as a business enabler.

With that, let’s dive into some of the compliance statistics of 2025 that matter most. If you have further insights or statistics you believe should be added, please reach out – we love hearing from and collaborating with industry experts!

25 Critical Stats Every Chief Compliance Officer Should Know

How Complex is the Regulatory Landscape for CCOs in 2025?

1. 85% of Respondents Report Increased Compliance Complexity. Global regulation is adding unprecedented complexity and cost. A striking 97% of Irish respondents in PwC’s 2025 Global Compliance Survey stated that compliance requirements have become more complex in the last three years. This figure was 85% globally, underscoring a consistent trend across industries.

2. 64% of CEOs View the Regulatory Environment as a Barrier to Value Creation. According to PwC’s 27th Global CEO Survey (informing 2025 perspectives), 64% of CEOs agree that the regulatory environment inhibits their company from creating, delivering and capturing value, highlighting the ongoing challenge of balancing compliance with innovation and growth.

3. 59% of Executives Gain Confidence Through Better Coordination in Compliance. PwC’s 2025 Global Compliance Survey found that 59% of respondents reported increased confidence in decision-making related to compliance due to better coordination.

Stay on-top of complex regulatory changes – take a look through our expert webinars, focused on the topics that matter to you the most.

How Are CCOs Leveraging Technology and Automation in 2025?

4. 82% of Companies Plan to Increase Investment in Compliance Technology. Recognizing the need for modern solutions, 82% of companies surveyed by PwC for their 2025 Global Compliance Survey plan to invest more in at least one technology to automate and optimize compliance activities, indicating strong momentum towards digitizing compliance models.

5. 71% of Respondents Believe AI Will Have a Net Positive Impact on Compliance. The adoption of AI is becoming a game-changer for compliance. Most respondents (71%) in PwC’s 2025 Global Compliance Survey believe that AI will have a net positive impact overall on compliance, particularly in areas like data and predictive analytics.

6. 56% of Enterprises Will Have Shifted Compliance Systems to the Cloud by July 2025. Cloud-based compliance solutions are gaining significant traction for their scalability and real-time updates. By July 2025, 56% of enterprises will have shifted from traditional compliance systems to cloud environments, indicating a strong move towards more agile and secure platforms.

7. Companies Using Automated Regulatory Tracking Cut Delays by 50%. Keeping pace with regulatory changes is a major challenge, but automation offers a significant advantage. Businesses utilizing automated regulatory tracking have reduced compliance-related delays by half, ensuring policies adjust instantly to new laws.

8. 91% of Companies Plan to Implement Continuous Compliance in the Next Five Years. The shift towards proactive and real-time compliance is gaining momentum. A 2025 trends overview highlights that 91% of companies are planning to implement continuous compliance in the next five years, indicating a strategic move away from periodic, manual checks towards integrated, ongoing monitoring.

What Are the Key Cybersecurity and Data Privacy Challenges in 2025?

9. Over 30,000 New Security Vulnerabilities Were Identified in 2024, Highlighting Ongoing Threats. Despite widespread awareness, software vulnerabilities remain a critical entry point for cyber threats. Over 30,000 new security vulnerabilities were identified in 2024, reflecting a 17% year-over-year increase, underscoring the ongoing need for robust patch management and security hygiene to prevent breaches and maintain compliance.

10. The Average Time to Identify and Contain a Data Breach Stands at 258 Days. Globally, the speed of breach detection and containment is crucial for minimizing damage and regulatory impact. The average time required to identify and contain a data breach stands at 258 days, with breaches involving lost or stolen credentials taking even longer (292 days), emphasizing the need for advanced detection capabilities for CCOs.

11. The Average Global Cost of a Data Breach Climbed to USD$4.88 Million in 2024. The financial impact of data breaches continues its upward trajectory. According to the IBM, the average global breach cost has reached USD$4.88 million – a significant increase and an all-time high.

12. New Global Regulations are Intensifying Cybersecurity Demands on Businesses. Governments worldwide are intensifying legislative efforts to bolster cyber defenses and resilience. This trend of stricter cyber governance is mirrored by new regulations and frameworks emerging across other major jurisdictions globally, placing greater compliance burdens on businesses.

Learn more about key data privacy changes in our whitepaper on The Evolving State of US Privacy: Navigating US Data Protection Legislation in 2025.

What Does ESG and Ethical Compliance Look Like in 2025?

13. Mandatory Sustainability Reporting is Continuing to Rapidly Expand Globally, with 86% of Large Companies Disclosing Some Information. ESG reporting is continuing to swiftly transition from voluntary best practices to mandatory disclosures across a growing number of jurisdictions. A 2025 insights report highlights that 86% of large companies globally are already disclosing some sustainability information, confirming that adherence to these frameworks is now a mainstream business imperative.

14. Companies are Actively Aligning with New Sustainability Reporting Standards as they Become Applicable. The global landscape for sustainability reporting is rapidly formalizing. Organizations are actively preparing to align their reporting practices with new mandatory standards which are forming the baseline for emerging global requirements, ensuring increased transparency and comparability in environmental, social, and governance disclosures.

15. 42% Cite Data Volume as a Key Challenge for ESG Reporting, and 90% Expect AI to Help. As ESG reporting becomes mandatory, companies are turning to technology to manage the complexity. In a 2025 Reuters Events survey of sustainability professionals, 42% of respondents said managing the volume of data is a top challenge in achieving CSRD. Gathering and verifying a vast array of ESG metrics (from carbon emissions to DEI data) is proving difficult with existing tools. To cope, nearly 90% of respondents in the same research expect AI to have a material impact on sustainability reporting processes. Early adopters are already using AI and automation for data collection and validation, and to generate insights from ESG data sets.

For more insights, check out our recent webinars on Asia’s ESG & Sustainability Landscape: Compliance Essentials for 2025 and ESG Regulatory Developments in the US.

What Are the Risks in Third-Party and Supply Chain Compliance?

16. Over 82% of Compliance Leaders Affected by Third-Party Risks in the Past Year. Third-party and supply chain risks continue to pose significant challenges. Gartner’s 2025 compliance trends highlight that over 82% of compliance leaders have faced consequences due to third-party risks, emphasizing the critical need for robust vendor oversight.

17. Heightened Supply Chain Risks Driven by Geopolitical Instability and Protectionism. The global geopolitical landscape, marked by ongoing conflicts and protectionism, is significantly increasing supply chain risks. Internal auditors are urged to assess the maturity and resilience of supply chains, including robust risk management of outsourced relationships.

What’s the State of the Compliance Workforce and Culture?

18. 73% of Compliance Professionals Would Choose Their Career Again. Despite the challenges, job satisfaction within the compliance field remains high. A BarkerGilmore 2025 CCO Compensation Report indicates that nearly 73% of compliance professionals would choose a compliance career again if they started over.

19. Nearly 90% of CCOs report broader responsibilities than three years ago. The role of the CCO keeps expanding. PwC’s Global Compliance Survey found that almost 90% of compliance executives say the breadth of their compliance responsibilities has increased in the last three years. Compliance officers are now accountable for a wider spectrum of risks – from traditional areas like anti-corruption and data protection to newer domains like ESG metrics, AI ethics, and supply chain oversight. This widening remit can strain resources and blur lines with other functions.

20. 34% of Organizations Foresee a Shortage in Specialist Compliance Skills. The demand for skilled compliance professionals continues to outpace supply. PwC’s 2025 Global Compliance Survey indicates that 34% of organizations anticipate a shortage in specialist compliance skills in the coming year, highlighting a talent gap.

What Are the Key Compliance Costs and Investments in 2025?

21. Compliance Data Management Market Projected to Reach $16.6 billion in 2025. Businesses are investing heavily in compliance technology and services. Market research estimates that the compliance data management market will grow to roughly USD 16.60 billion in 2025, on its way to over $41 billion by 2034. This includes spend on software platforms for managing regulations, requirements, evidence, and related data. The projected growth (over 10% CAGR) is driven by increasing regulatory requirements and the rise of data-driven compliance strategies. In short, organizations are recognizing that manual spreadsheets and ad-hoc tools can’t scale; they’re dedicating budget to purpose-built compliance solutions (often cloud-based, as noted) that can streamline workflows and improve oversight. Analyst forecasts from Gartner likewise show compliance departments expecting higher tech budgets year-over-year. The takeaway for CCOs is that you may need to make the business case for these investments – industry benchmarks indicate many of your peers are already doing so to handle mounting compliance complexity.

22. 80% of CCOs say inadequate resources or staffing impact their performance. Compliance budgets, while rising, often remain tight relative to growing demands. In BarkerGilmore’s recent survey of compliance leaders, 4 out of 5 reported that limited budgets or headcount have hindered their performance or ability to address all compliance needs. Forward-looking organizations are trying to bridge this gap by quantifying compliance’s ROI and securing the funds needed to mitigate vulnerabilities. It’s worth noting that 95% of firms increased compliance spending in 2023 according to an Oxford Economics study, and 61% expect to spend more on compliance in the next two years.

23. Outdated Internal Systems (64%) and Complex Regulatory Environments (59%) Are Top Challenges for Compliance Programs. While a specific percentage for “manual processes” is hard to source from non-competitors for 2025, a leading ethics and compliance effectiveness report identifies outdated internal systems and complex regulatory environments as top challenges. These factors directly contribute to the persistence of manual processes and a need for greater automation.

24. 71% of C-suite Leaders View ESG Investment as a Competitive Advantage. Beyond regulatory adherence, compliance, especially in ESG, is increasingly seen as a driver of business value. A 2025 survey highlights that 71% of C-suite leaders believe investments in ESG provide a competitive advantage, leading to enhanced brand reputation, talent attraction, and long-term financial performance. This demonstrates how compliance investments yield strategic returns.

25. For Every 10% Increase in Emphasis on Material ESG Concerns, Company Value Rises by 1.4%. A research paper ‘When Nonmateriality is Material: Impact of ESG Emphasis on Firm Value‘ demonstrated the clear financial link between ESG materiality and corporate performance. Specifically, for every 10% increase in focus on material ESG issues (those relevant to a company’s core business), the organization’s value rises by approximately 1.4%. This underscores the growing investor and regulatory expectation for companies to prioritize material sustainability issues – not as a sideline, but as a core part of strategy and operations. As ESG regulations tighten and market scrutiny sharpens, CCOs and boards should recognize that ESG compliance is now a value driver, not a cost center.

On-demand viewing is now available for EU & UK Product Compliance: What’s Hot in 2025 & Beyond – one of our most popular webinars this year!

Conclusion

The compliance landscape in 2025 is defined by escalating complexity, intensified regulatory scrutiny, and an imperative to integrate technology and data into compliance management. For Chief Compliance Officers, staying informed of these evolving statistics and trends is essential for proactive risk management and for elevating compliance’s strategic role within the organization. The numbers above tell a clear story: regulatory requirements are multiplying, but so are the tools and practices to manage them more efficiently. By leveraging insights like these – whether it’s making the case for a bigger tech budget, sharpening third-party due diligence, or investing in talent and training – CCOs can develop more robust, data-driven compliance strategies that not only ensure adherence but also drive business value.

Importantly, compliance done well can be a competitive advantage. The most forward-thinking organizations are using compliance analytics to speed up go-to-market, using strong ESG performance to attract capital, and using operational resilience to build customer trust. As you navigate 2025, focus on building a compliance program that is agile, technology-enabled, and embedded in decision-making. The goal is a program that safeguards your brand and propels sustainable growth.

How Can Compliance & Risks Support Your Compliance Priorities in 2025?

At Compliance & Risks, we understand the intricate and dynamic environment CCOs face. Our mission is to empower global companies with the tools and intelligence needed to build safe, sustainable products in a world of constant change. For over two decades, we’ve honed our digital tools, expertise, and content to help you monitor, assess, and prove your products’ compliance, safeguarding your brand and fostering growth through our unrivalled software platform, C2P.

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

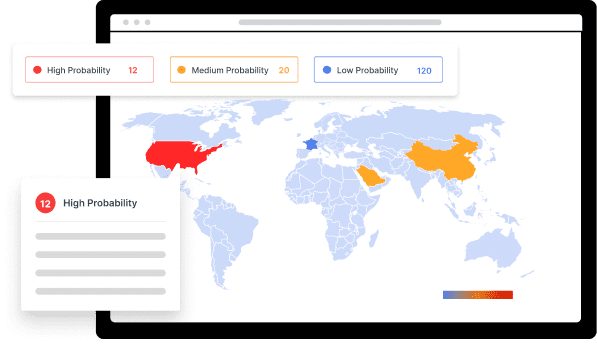

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

US Product Compliance 2025: Key Federal & State Changes to Watch

Join us as we explore recent developments in US product compliance, focusing on both federal & state-level legislation and trends to watch in 2025.

Stat Sources

PWC, KPMG, IBM, Gartner, Thomson Reuters, Ponemon Institute, Global Growth Insights, Riseworks, Drata, Asee, Athennian, Morningstar, BarkerGilmore, Market Research Future, LRN, Wharton.