Regulatory Developments in the Middle East: Key 2025 Updates

This blog was originally posted on 18th August, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY JUMANA IGHBARIA HAMAM, REGULATORY COMPLIANCE SPECIALIST, AND NEDAA YOUSEF, REGULATORY COMPLIANCE ANALYST, COMPLIANCE & RISKS

This overview summarizes the key regulatory developments across the Middle East in 2025, grouped by thematic areas including product safety, automotive regulations, packaging and circular economy, energy efficiency, data protection, emerging technology governance, and sustainability initiatives.

Countries across the region are aligning with Gulf, EU, and international standards to boost compliance, consumer safety, and environmental performance.

Dive into the highlights below!

How Have Middle Eastern Countries Advanced Their Product Safety Frameworks?

Several Middle Eastern countries made major strides in strengthening product safety frameworks:

- In July 2025, Saudi Arabia proposed draft technical regulations that aim to recast several existing regulations. These include machinery, electric personal mobility devices, LPG gas appliances, simple pressure vessels, and motorcycles, setting strict safety design rules, conformity assessment procedures, labelling in Arabic, and active market surveillance with recall obligations. Packaging rules now mirror EU packaging waste legislation, with supplier duties and material specifications.

- In March 2025, the UAE adopted 538 Gulf standards spanning textiles, leather products, packaging for dangerous goods, and medical device testing, aligning its national requirements with regional norms.

- In the first quarter of 2025, Jordan updated its national standards for labeling, packaging, and machinery emissions, as well as replacing outdated specifications.

- Bahrain adopted Gulf standards for household electrical switches, while in the first few months of 2025, Turkey updated labeling requirements for consumer products containing animal-derived components and tightened import controls across a wide range of goods.

- Israel began a phased introduction of a new standardization track based on alignment with over 40 EU regulations. This reform, which started in January 2025, is intended to improve market efficiency, reduce costs, and align Israeli standards with international norms. The reform is gradually rolled out. Products that can follow the new EU track include electronics, medical devices, machinery, toys, cosmetics, food and beverages, automotive parts, construction materials, chemicals, textiles, and energy-efficient products.

- The Palestinian Standards Institution updated and adopted official Palestinian standards in various fields. The new standards cover, among others, household electrical appliances, medical devices, and RF cables.

- Egypt mandated Egyptian standard specifications for AV and ICT equipment and vehicles.

What’s Driving Change in Automotive Regulations?

The region also saw significant automotive-related regulatory updates:

- In Saudi Arabia, new technical regulations set essential safety standards and compliance procedures for electric vehicles, autonomous vehicles, and motorcycles.

- Jordan amended its electric vehicle conformity assessment instructions, introducing a clarified vehicle definition, import restrictions for non‑compliant EVs, and recognition of certain international certifications.

- Turkey aligned driver assistance system rules with EU requirements, refined type approval processes, and extended compliance deadlines for certain categories of two‑ and three‑wheeled vehicles.

- In Cyprus, an amendment to the Vehicle Type Approval Law of 2005 was published to introduce a new article on motor vehicle recall.

- In Egypt, E-Mark certification remains mandatory for importing certain vehicle components and complete vehicles. However, Decision No. 112 of 2025, issued by the Minister of Industry and Transport, canceled the obligation to comply with standard specifications for products on List No. 44, which includes automotive products such as filament lamps, replacement exhaust catalysts, speedometers, and headlights.

- In July 2025, Israel proposed an amendment to the Clean Air Regulations that would update disclosure formats and color keys for air pollution data from motor vehicles in advertisements.

Packaging and Circular Economy Initiatives

Packaging regulation was a particular focus in Saudi Arabia, with its July 2025 draft aligned with EU rules on packaging waste, covering multiple material types and requiring conformity assessments and labeling.

Turkey advanced circular economy measures with a proposed regulation on recycled plastics in food contact materials and stricter import rules for used and refurbished goods.

Iraq adopted the General Technical Requirement in May 2025, which concerns polypropylene and similar plastics used in food-contact products.

Looking for a deeper understanding of EPR reporting for packaging globally? Our whitepaper is free to download.

Energy Efficiency Measures

Bahrain introduced Minimum Energy Performance Standards for washing machines, expanding similar requirements to refrigerators, freezers, and clothes dryers, along with efficiency labeling and water use limits.

Saudi Arabia updated its energy efficiency specifications, while Turkey reinforced energy efficiency certification rules. In Israel, a regulation was issued in July 2025 to repeal the regulation on energy labeling for electric heaters.

What’s New in Data Protection and Privacy?

Data protection frameworks were strengthened across the region:

- Saudi Arabia proposed an amendment to its Personal Data Protection Implementing Regulation, introducing explicit consent requirements, extended record‑keeping, mandatory Data Protection Officers, and risk assessments for cross‑border transfers.

- Jordan implemented its Data Disclosure System Regulation, defining controller obligations and permitted exceptions.

- Turkey issued notices on administrative fines under its data protection law and maintained oversight over processing activities.

Interested in exploring the latest cybersecurity & data protection impacts on Product Compliance? Don’t miss our webinar-on-demand.

Emerging Technology Governance and Digital Regulation

Several countries are setting the rules for new technology adoption:

- Saudi Arabia proposed a law to establish a Global Center for Artificial Intelligence Systems, and Qatar published a position paper on IoT and machine‑to‑machine technologies to guide safe and effective integration into national infrastructure.

- Turkey strengthened cybersecurity requirements through a new law mandating certification, conformity, and reporting for critical infrastructure operators.

- In Cyprus, the implementation of Regulation (EU) 2022/2065 on a Single Market for Digital Services was enacted.

- Egypt published its National Artificial Intelligence Strategy 2025-2030, second edition, which builds upon the first one from 2020, focusing on responsible AI deployment to foster socio-economic growth, address ethical concerns, and ensure inclusive development.

- Iraq is drafting regulations for Short-Range Devices (SRD) and Ultra-Wideband (UWB) that contain regulatory provisions and technical conditions for licensing and use. The draft regulations are in accordance with international standards and Iraqi laws.

2025 Medical Device Updates

- Saudi Arabia advanced multiple guidance documents for medical devices and diagnostics to encourage local manufacture, align with ISO 13485 quality systems, and clarify definitions for wellness devices and companion diagnostics.

- Qatar enacted Law No. 6/2025 on licensing and approvals for clinical trials involving medical devices.

- Bahrain adopted Gulf standards for implantable and in vitro diagnostic devices, while Jordan updated testing, compliance, and market control requirements for medical products, sterilizers, disinfectants, and cosmetics.

- Turkey issued new tracking, classification, and import controls for medical devices and materials.

- In the past few months Egypt issued several decisions, one of which was Decision No. 153 that was published in April 2025; this Decision applies to applications for marketing licenses and import approvals for laboratory and diagnostic reagents. Additionally, in February 2025, the Egyptian Drugs Authority (EDA) published an updated guide on procedures for registering and issuing import approvals for laboratory and diagnostic medical devices. The EDA also published Decision No. 161 in April 2025, which amends a previous decision and requires all entities in the Egyptian market that deal with medical supplies to use a unified coding system based on unique identification numbers. This must be done through companies approved by the International Medical Device Regulators Forum (IMDRF) via the ‘Me Device’ electronic platform.

Chemicals Management, Chemicals in Products, and RoHS

- In February 2025, Jordan expanded its list of prohibited and restricted chemicals, including limits on lead in paint and brominated flame retardants in textile products.

- Turkey introduced stricter controls on importing certain hazardous substances, updated sampling and testing criteria for perfluoroalkyl substances (PFAS) in food, and reinforced environmental protection through import inspections of regulated chemicals.

- In July 2025, Saudi Arabia proposed a new technical regulation regarding the Restriction on the Use of Hazardous Substances in Electrical and Electronic Equipment (RoHS). The draft would recast the existing national RoHS measure by aligning provisions with the Product Safety Law, clarifying the economic operator’s obligations and adding four phthalates to the restricted substances, among other changes.

- The Israeli Ministry of Environmental Protection released a draft procedure detailing the conditions for submitting and processing permit applications for the import and export of mercury in August 2025. This draft aligns with the Hazardous Materials Regulations that came into force in January 2025, which require importers and exporters of mercury to obtain permits.

- Also in August, the Turkish Ministry of Environment, Urbanization and Climate Change adopted the KKDİK Enforcement Principles and Procedures, introducing finalized transitional registration deadlines to advance the implementation of KKDİK (Turkey REACH) and its phased chemicals registration process.

What’s Changing in Labor and Employment?

- In Egypt, Labor Law No. 14 was published in May 2025. According to the law, the existing Training and Qualification Fund will continue to operate, and workers will keep any rights or benefits they received under previous laws.

- In Cyprus, several labor and employment regulations were issued. These include an amendment to the law on paternity, parental, caring, and force majeure leave. Other regulations concern the prevention of violence and harassment in the workplace, and an amendment to the law on the protection of maternity, specifically on breastfeeding protection.

- In Israel, recent labor and employment regulations have dealt with emergency situations. These include an amendment to the Protection of Workers in Times of Emergency Law of 2006 regarding protections for workers during ongoing military operations, and an amendment to the Employment of Women Law of 1954 concerning the absence of a spouse due to the hospitalization of a premature child.

What’s Fueling Climate Change Action?

In April 2025, Israel submitted its first Biennial Transparency Report to the UNFCCC, outlining efforts to cut greenhouse gas emissions and build climate resilience under the Paris Agreement.

In July, Turkey adopted a Climate Law establishing procedures for emissions reduction, adaptation, planning, permitting, inspection, funding, and institutional frameworks to address climate change.

Conclusion

To conclude, it is clear from the overview above that the regulatory landscape across the Middle East is undergoing a dynamic shift toward global alignment, innovation, and enhanced product safety.

Countries in that region are rapidly updating and modernizing their frameworks across diverse areas with a specific focus on consumer safety, environmental protection, and economic efficiency. By aligning with regional, EU, and international norms, countries are not only boosting compliance and market access but also establishing robust frameworks for emerging technologies and sustainability initiatives.

However, despite these advances, some countries in that region remain relatively inactive in this space, resulting in fragmented compliance and challenges for businesses seeking consistent standards across the Middle East.

Stay Ahead Of Regulatory Developments in the Middle East

Want to stay ahead of regulatory developments in the Middle East?

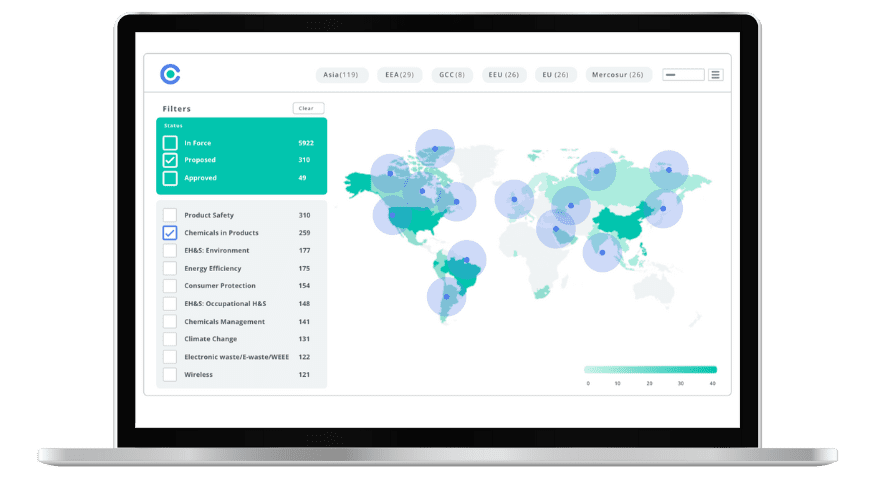

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.