Compliance Risk Assessment Methodologies: A Strategic Guide to Protecting Your Organization

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Modern businesses face a stark reality: the average cost of non-compliance is 2.7 times higher than maintaining proper compliance programs. With regulatory penalties reaching unprecedented heights – GDPR fines alone can cost organizations millions – implementing robust compliance risk assessment methodologies has evolved from regulatory necessity to strategic imperative.

This comprehensive guide explores the frameworks, models, and advanced techniques that enable organizations to identify, evaluate, and prioritize compliance risks effectively. You’ll discover actionable methodologies for building risk heatmaps, developing scoring systems, and choosing between qualitative and quantitative approaches that align with your organizational needs and regulatory environment.

Whether you’re establishing your first compliance risk assessment program or modernizing existing processes with AI and ESG considerations, this guide provides the strategic insights and practical tools to transform compliance from cost center to competitive advantage.

Table of Contents

- The Business Case for Strategic Compliance Risk Assessment

- Core Assessment Methodologies: Qualitative vs. Quantitative Approaches

- The Seven-Step Framework for Comprehensive Compliance Risk Assessment

- Building Effective Risk Scoring Systems and Heatmaps

- Advanced Techniques: AI and Predictive Analytics

- Integrating ESG into Compliance Risk Assessment

- Selecting the Right Methodology for Your Organization

- Industry Standards and Best Practices

- Frequently Asked Questions

- Implementation Roadmap and Next Steps

The Business Case for Strategic Compliance Risk Assessment

The financial implications of non-compliance have reached critical levels. Recent studies reveal that organizations spend between $5.5 million and $7.7 million annually on compliance programs, while non-compliance costs range from $14.8 million to $30.9 million per year. Since 2011, these costs have risen by 45%, reflecting increasing regulatory complexity and enforcement.

Beyond immediate financial penalties, non-compliance creates cascading consequences that extend far beyond regulatory fines. Organizations face breach remediation costs, class-action lawsuits, productivity losses averaging $3.8 million, revenue losses of $4 million annually, and perhaps most critically, lasting reputational damage that affects customer trust and market position.

The shift in regulatory enforcement patterns amplifies these risks. Regulators increasingly view effective compliance programs as evidence of organizational commitment to ethical business practices. The Department of Justice explicitly considers the quality of compliance risk assessments when determining prosecution decisions and penalty calculations. Organizations with robust, regularly updated risk assessment methodologies often receive more favorable treatment during regulatory investigations.

However, compliance risk assessment delivers value beyond risk mitigation. Forward-thinking organizations recognize compliance as a strategic enabler that creates competitive advantages through enhanced operational efficiency, improved stakeholder trust, and better decision-making capabilities. Research indicates that 70% of compliance professionals now view their function as strategic rather than purely defensive.

Effective compliance risk assessment methodologies provide the foundation for this strategic transformation. They enable organizations to allocate resources efficiently, prioritize initiatives based on actual risk exposure, and demonstrate to regulators, investors, and stakeholders their commitment to responsible business practices.

Core Assessment Methodologies: Qualitative vs. Quantitative Approaches

Organizations implementing compliance risk assessments face a fundamental choice between qualitative, quantitative, and hybrid methodologies. Each approach offers distinct advantages and limitations that must be carefully weighed against organizational capabilities, data availability, and regulatory requirements.

Qualitative Assessment Methodologies

Qualitative approaches rely on expert judgment, subjective analysis, and descriptive assessments to evaluate compliance risks. These methodologies typically employ risk matrices that combine likelihood and impact assessments using descriptive scales (low, medium, high) rather than numerical values.

Strengths of Qualitative Approaches:

- Rapid implementation with minimal data requirements

- Effective for assessing risks that are difficult to quantify

- Incorporates expert knowledge and institutional experience

- Suitable for organizations with limited analytical resources

- Flexible and adaptable to changing circumstances

Limitations of Qualitative Assessment:

- Susceptible to cognitive biases and inconsistent interpretations

- Difficulty in aggregating results across different business units

- Limited precision for resource allocation decisions

- Challenges in demonstrating objective risk reduction over time

Qualitative assessments excel in scenarios involving emerging regulations, cultural or behavioral risks, and situations where historical data is unavailable or unreliable. They prove particularly valuable during initial compliance program development or when assessing risks in new markets or business lines.

Quantitative Assessment Methodologies

Quantitative approaches utilize numerical data, statistical analysis, and mathematical models to assess compliance risks. These methodologies assign specific numerical values to risk factors, enabling precise calculations of risk exposure and comparative analysis across different risk categories.

Strengths of Quantitative Approaches:

- Objective, data-driven risk assessments with mathematical precision

- Enables sophisticated risk aggregation and portfolio analysis

- Supports advanced analytical techniques including scenario modeling

- Provides clear metrics for tracking risk reduction over time

- Facilitates resource allocation based on quantified risk exposure

Limitations of Quantitative Assessment:

- Requires substantial data collection and analytical capabilities

- May create false precision when underlying data is uncertain

- Limited effectiveness for assessing behavioral or cultural risks

- Significant initial investment in systems and expertise

- Potential overconfidence in numerical results

Quantitative assessments work best for organizations with robust data management capabilities, established compliance programs, and risks that can be meaningfully quantified through historical data, industry benchmarks, or statistical modeling.

Hybrid Methodologies: The Best of Both Worlds

Leading organizations increasingly adopt hybrid approaches that combine qualitative insights with quantitative analysis. These methodologies recognize that compliance risk assessment requires both objective data analysis and expert judgment to produce actionable results.

Hybrid methodologies typically begin with qualitative risk identification and categorization, then apply quantitative techniques where sufficient data exists. For example, an organization might use expert workshops to identify and categorize risks, then employ statistical analysis to quantify financial and operational impacts for high-priority risks.

Comparison Matrix: Methodology Selection Criteria

| Criteria | Qualitative | Quantitative | Hybrid |

|———-|————-|————–|———|

| Data Requirements | Low | High | Medium |

| Implementation Speed | Fast | Slow | Medium |

| Resource Investment | Low | High | Medium |

| Precision | Low | High | Medium-High |

| Flexibility | High | Low | Medium |

| Regulatory Acceptance | Medium | High | High |

| Best for New Risks | High | Low | Medium |

| Stakeholder Understanding | High | Low | High |

The Seven-Step Framework for Comprehensive Compliance Risk Assessment

Effective compliance risk assessment requires a systematic, repeatable process that ensures comprehensive coverage while remaining practical for organizational implementation. This seven-step framework synthesizes best practices from leading compliance programs and regulatory guidance.

Step 1: Establish Assessment Context and Scope

The foundation of effective compliance risk assessment lies in clearly defining the assessment’s purpose, scope, and boundaries. This step determines the regulatory universe that applies to your organization and establishes the framework for all subsequent analysis.

Begin by cataloging all applicable laws, regulations, and standards that govern your organization’s operations. This regulatory universe includes not only primary regulations in your industry but also cross-cutting requirements like data privacy, environmental standards, and employment law. Consider both current and anticipated future regulations, particularly in rapidly evolving areas like artificial intelligence and sustainability reporting.

Define the organizational scope of your assessment, including all business units, geographic locations, and operational activities. Pay particular attention to areas where regulatory requirements overlap or create potential conflicts. Establish clear accountability for risk assessment activities and ensure appropriate resources are allocated for comprehensive evaluation.

Step 2: Identify Risk Contact Points

Risk contact points represent specific organizational activities, processes, or decisions where non-compliance could occur. These touchpoints span the entire organizational ecosystem, from strategic decision-making to operational execution.

Conduct systematic reviews of key business processes to identify where regulatory requirements intersect with organizational activities. Common risk contact points include:

Legal and Regulatory Compliance Points:

- Contract negotiation and execution

- Product development and testing

- Marketing and advertising activities

- Financial reporting and disclosure

- Data collection and processing

Operational Risk Contact Points:

- Supply chain management and vendor relationships

- Employee hiring, training, and management

- Customer interactions and service delivery

- Technology implementation and cybersecurity

- Environmental impact and waste management

Financial and Reporting Risk Points:

- Financial controls and reporting systems

- Tax compliance and transfer pricing

- Investment and capital allocation decisions

- Insurance and risk transfer arrangements

Map these contact points to specific regulatory requirements and identify the stakeholders responsible for compliance in each area. This mapping creates the foundation for targeted risk assessment and control evaluation.

Step 3: Analyze Risk Characteristics and Drivers

Once risk contact points are identified, conduct detailed analysis of the factors that drive compliance risk in each area. This analysis should consider both inherent risk (the risk before controls) and residual risk (the risk after considering existing controls).

Evaluate risk drivers across multiple dimensions:

Regulatory Complexity: Assess the clarity and stability of applicable regulations. Ambiguous or frequently changing requirements create higher compliance risk than well-established, clearly defined standards.

Organizational Exposure: Consider the extent of organizational activities subject to specific regulations. Higher exposure creates greater potential for non-compliance through increased interaction volume.

Historical Performance: Analyze past compliance issues, regulatory citations, and internal control failures. Historical patterns often predict future risk areas.

Industry Context: Benchmark your organization against industry peers and regulatory enforcement trends. Industries under increased regulatory scrutiny face elevated compliance risk.

Cultural and Behavioral Factors: Assess organizational culture, incentive structures, and behavioral patterns that might encourage or discourage compliance. Cultural misalignment with compliance requirements creates systematic risk.

Step 4: Evaluate and Score Risk Impact and Likelihood

Risk evaluation requires systematic assessment of both the likelihood of non-compliance and the potential impact if non-compliance occurs. This step transforms risk analysis into actionable prioritization criteria.

Likelihood Assessment: Evaluate the probability of non-compliance occurring within a specific timeframe, typically one year. Consider factors such as:

- Control effectiveness and reliability

- Process complexity and frequency

- Staff competency and training levels

- Historical compliance performance

- External factors and regulatory changes

Impact Assessment: Analyze the potential consequences of non-compliance across multiple impact categories:

Financial Impact: Direct regulatory penalties, remediation costs, legal fees, and business interruption costs. Include both immediate costs and longer-term financial implications.

Operational Impact: Business disruption, process modifications required for compliance, resource diversion, and operational constraints imposed by regulators.

Reputational Impact: Customer trust erosion, media attention, stakeholder confidence loss, and competitive disadvantage. Quantify these impacts through customer retention analysis, brand value assessments, and market share implications.

Strategic Impact: Regulatory restrictions on business activities, licensing implications, market access limitations, and strategic initiative delays.

Step 5: Build Risk Scoring Systems and Prioritization Matrix

Effective risk prioritization requires consistent scoring methodologies that enable comparison across different risk types and business areas. Develop scoring scales that reflect your organization’s risk tolerance and decision-making needs.

Likelihood Scoring (1-5 Scale):

- 1 (Very Low): Less than 5% probability within one year

- 2 (Low): 5-15% probability within one year

- 3 (Medium): 15-35% probability within one year

- 4 (High): 35-65% probability within one year

- 5 (Very High): Greater than 65% probability within one year

Impact Scoring (1-5 Scale):

- 1 (Very Low): Minimal financial impact (<$50K), no operational disruption

- 2 (Low): Limited financial impact ($50K-$500K), minor operational disruption

- 3 (Medium): Moderate financial impact ($500K-$5M), significant operational disruption

- 4 (High): Major financial impact ($5M-$50M), severe operational disruption

- 5 (Very High): Catastrophic financial impact (>$50M), business-threatening disruption

Calculate composite risk scores by multiplying likelihood and impact scores. This creates a 25-point scale that enables clear prioritization:

- Critical Risk (20-25): Immediate action required

- High Risk (15-19): Action required within 30 days

- Medium Risk (8-14): Action required within 90 days

- Low Risk (4-7): Monitor and review annually

- Very Low Risk (1-3): Accept risk level

Step 6: Assess Control Effectiveness and Identify Gaps

Evaluate existing controls for each identified risk to determine their effectiveness in preventing or detecting non-compliance. This assessment should consider both the design adequacy and operational effectiveness of controls.

Control Design Assessment: Determine whether controls are appropriately designed to address identified risks. Consider:

- Completeness: Do controls address all aspects of the identified risk?

- Relevance: Are controls aligned with current regulatory requirements?

- Precision: Do controls operate at an appropriate level of detail?

- Authorization: Are approval requirements appropriate for risk levels?

Operating Effectiveness Assessment: Evaluate how consistently and effectively controls operate in practice:

- Consistency: Are controls applied uniformly across all relevant activities?

- Timeliness: Do controls operate within required timeframes?

- Competency: Do personnel have appropriate skills and training?

- Documentation: Are control activities properly documented and reviewed?

Identify control gaps where risks are not adequately addressed by existing controls. Prioritize gap remediation based on risk scores calculated in Step 5, focusing first on critical and high-risk areas.

Step 7: Develop Monitoring and Continuous Improvement

Compliance risk assessment is not a one-time activity but an ongoing process that must adapt to changing regulations, business activities, and risk environments. Establish systematic monitoring and review processes to ensure your assessment remains current and effective.

Regulatory Change Management: Implement processes to identify, assess, and respond to regulatory changes that affect your risk profile. Subscribe to regulatory updates, participate in industry associations, and maintain relationships with regulatory experts.

Performance Monitoring: Track key compliance metrics and risk indicators to identify emerging issues before they become significant problems. Establish dashboards that provide real-time visibility into compliance performance across all risk areas.

Annual Assessment Reviews: Conduct comprehensive annual reviews of your entire risk assessment, updating risk scores, control evaluations, and prioritization decisions based on current information.

Stakeholder Engagement: Maintain regular communication with key stakeholders about risk assessment results, control effectiveness, and emerging risks. Ensure senior management receives appropriate reporting on compliance risk status and mitigation activities.

Building Effective Risk Scoring Systems and Heatmaps

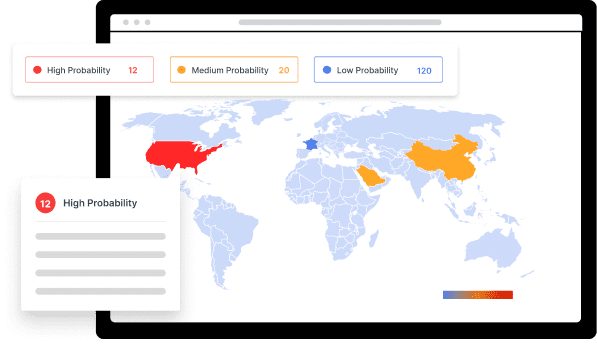

Visual risk representation through heatmaps and scoring systems transforms complex compliance data into actionable insights that drive effective decision-making. These tools enable organizations to communicate risk status clearly to stakeholders at all levels while supporting sophisticated risk management decisions.

Designing Effective Risk Heatmaps

Risk heatmaps provide intuitive visual representation of your compliance risk landscape by plotting risks on a matrix that displays likelihood versus impact. Effective heatmaps balance simplicity with sufficient detail to support decision-making.

Heatmap Construction Principles:

- Use consistent color coding that intuitively represents risk levels (green for low, yellow for medium, red for high)

- Size risk markers proportionally to potential financial impact

- Include risk identifiers that link to detailed risk descriptions

- Update heatmaps regularly to reflect current risk status

- Customize views for different stakeholder groups and decision-making needs

Multi-Dimensional Heatmap Analysis:

Advanced organizations create multiple heatmap views that display risks across different dimensions:

- Financial impact versus reputational impact

- Short-term versus long-term likelihood

- Control effectiveness versus inherent risk

- Geographic or business unit comparisons

These multi-dimensional views reveal patterns and relationships that single-dimension heatmaps might obscure, enabling more sophisticated risk management strategies.

Advanced Scoring Methodologies

While basic likelihood-times-impact scoring provides a solid foundation, advanced scoring methodologies incorporate additional factors that affect compliance risk management decisions.

Risk Velocity Scoring: Some risks develop slowly over time, while others can materialize rapidly. Incorporate risk velocity into your scoring to reflect the speed at which risks might develop from initial indicators to full impact.

Control Maturity Weighting: Adjust risk scores based on the maturity and effectiveness of existing controls. Risks with mature, well-tested controls might receive lower adjusted scores even if inherent risk is high.

Regulatory Attention Multipliers: Apply multipliers to risks currently receiving high regulatory attention or enforcement focus. This ensures your risk assessment reflects the current regulatory environment.

Interconnected Risk Analysis: Evaluate how individual risks might amplify or mitigate other risks. Some compliance failures create domino effects that increase the likelihood or impact of other risks.

Dynamic Risk Monitoring Systems

Static risk assessments quickly become outdated in dynamic regulatory environments. Implement systems that continuously monitor risk indicators and update risk scores as conditions change.

Key Risk Indicators (KRIs): Develop quantitative metrics that provide early warning of increasing compliance risk:

- Regulatory change frequency in applicable areas

- Control failure rates and trends

- Staff turnover in compliance-critical roles

- Customer complaint volumes related to compliance issues

- Vendor or partner compliance performance

Threshold-Based Alerting: Establish KRI thresholds that trigger automatic alerts when risk levels exceed acceptable parameters. This enables proactive risk management rather than reactive problem-solving.

Automated Data Integration: Connect risk monitoring systems to operational data sources that provide real-time information about risk status. Examples include transaction monitoring systems, employee training records, audit findings databases, and regulatory change feeds.

Advanced Techniques: AI and Predictive Analytics

Artificial intelligence and machine learning technologies are revolutionizing compliance risk assessment by enabling more sophisticated analysis, predictive capabilities, and automated monitoring. However, these technologies also introduce new risks that must be carefully managed.

AI Applications in Compliance Risk Assessment

Pattern Recognition and Anomaly Detection: Machine learning algorithms excel at identifying patterns in large datasets that might indicate compliance risks. These systems can analyze transaction data, communication patterns, behavioral indicators, and operational metrics to identify potential compliance issues before they fully develop.

Predictive Risk Modeling: AI systems can analyze historical compliance data, regulatory actions, and external factors to predict where compliance risks are most likely to emerge. These models consider factors such as regulatory change patterns, industry enforcement trends, and organizational risk patterns to provide forward-looking risk assessments.

Natural Language Processing for Regulatory Analysis: NLP technologies can automatically analyze regulatory texts, enforcement actions, and guidance documents to identify requirements applicable to your organization. This capability is particularly valuable for organizations operating across multiple jurisdictions with complex regulatory landscapes.

Real-Time Monitoring and Assessment: AI systems can continuously monitor operational data streams to provide real-time risk assessment updates. This enables immediate response to emerging risks and ensures risk assessments reflect current conditions rather than historical snapshots.

Managing AI-Related Risks in Compliance

The integration of AI into compliance risk assessment creates new categories of risk that must be carefully managed:

Model Risk Management: AI models can produce biased, inaccurate, or unreliable results if not properly designed, trained, and monitored. Implement robust model governance that includes:

- Regular model validation and testing

- Bias detection and mitigation procedures

- Performance monitoring and drift detection

- Clear model limitations documentation

Data Quality and Privacy Risks: AI systems require large amounts of data, creating potential privacy and security risks. Ensure data governance programs address AI-specific requirements including:

- Data minimization and purpose limitation

- Algorithmic transparency requirements

- Data retention and deletion obligations

- Cross-border data transfer compliance

Explainability and Auditability: Regulators increasingly expect organizations to explain AI-driven decisions, particularly those affecting compliance determinations. Design AI systems with appropriate explainability features and maintain audit trails that demonstrate decision-making processes.

Building AI Governance Frameworks

Organizations implementing AI in compliance risk assessment should establish comprehensive AI governance frameworks that address both opportunities and risks:

AI Ethics and Responsible Use: Establish clear principles for AI use in compliance contexts, including fairness, transparency, accountability, and human oversight requirements.

Technical Risk Management: Implement technical controls including model validation procedures, adversarial testing, and continuous monitoring capabilities.

Regulatory Alignment: Ensure AI governance frameworks align with emerging regulatory requirements such as the NIST AI Risk Management Framework, EU AI Act, and ISO/IEC 42001.

Integrating ESG into Compliance Risk Assessment

Environmental, Social, and Governance (ESG) factors are rapidly becoming central to compliance risk assessment as regulators worldwide implement new reporting requirements and stakeholders increasingly demand sustainable business practices.

ESG Compliance Risk Categories

Environmental Compliance Risks:

- Climate disclosure requirements under frameworks like TCFD and CSRD

- Environmental impact assessments and permitting

- Waste management and pollution prevention

- Supply chain environmental compliance

- Carbon reporting and reduction commitments

Social Compliance Risks:

- Human rights due diligence requirements

- Labor standards and working conditions compliance

- Diversity, equity, and inclusion obligations

- Community impact assessments

- Data privacy and algorithmic fairness

Governance Compliance Risks:

- Board composition and independence requirements

- Executive compensation disclosure and justification

- Stakeholder engagement and materiality assessments

- Anti-corruption and business ethics programs

- Supply chain governance and due diligence

Hybrid Assessment Approaches for ESG

ESG compliance risks often require hybrid assessment methodologies that combine quantitative metrics with qualitative stakeholder insights:

Quantitative ESG Metrics:

- Greenhouse gas emissions and intensity ratios

- Diversity representation across organizational levels

- Executive pay ratios and equity metrics

- Waste generation and recycling rates

- Supply chain compliance audit results

Qualitative ESG Assessment:

- Stakeholder engagement feedback and concerns

- Cultural assessment and employee sentiment

- Community relationship quality and reputation

- Board effectiveness and oversight quality

- Leadership commitment to ESG objectives

Stakeholder Impact Analysis: ESG compliance assessment must consider impacts on diverse stakeholder groups including employees, communities, customers, investors, and regulators. This requires engagement processes that systematically gather stakeholder perspectives and incorporate them into risk assessment.

ESG Risk Prioritization and Materiality

ESG compliance risks should be prioritized based on materiality assessments that consider both stakeholder importance and business impact:

Double Materiality Assessment: Evaluate ESG factors from two perspectives:

- Financial Materiality: How ESG factors affect organizational financial performance

- Impact Materiality: How organizational activities affect ESG outcomes

Stakeholder Materiality Mapping: Systematically assess which ESG factors are most important to different stakeholder groups and how stakeholder influence affects organizational risk.

Dynamic Materiality Assessment: ESG materiality changes over time as stakeholder expectations evolve and regulatory requirements develop. Implement processes to regularly reassess ESG materiality and update risk prioritization accordingly.

Selecting the Right Methodology for Your Organization

Organizations must carefully match compliance risk assessment methodologies to their specific circumstances, capabilities, and objectives. This selection process requires honest assessment of organizational readiness and strategic alignment.

Organizational Readiness Assessment

Data Maturity Evaluation:

Assess your organization’s ability to collect, manage, and analyze compliance-related data. Organizations with robust data management capabilities can leverage quantitative methodologies, while those with limited data infrastructure should focus on qualitative approaches initially.

Analytical Capabilities:

Evaluate existing analytical skills and resources. Quantitative methodologies require statistical analysis, modeling capabilities, and specialized software. Consider whether to develop internal capabilities or partner with external experts.

Stakeholder Sophistication:

Consider the analytical sophistication of key stakeholders who will use risk assessment results. Some stakeholders prefer detailed quantitative analysis, while others respond better to qualitative risk descriptions and visual representations.

Regulatory Environment Complexity:

Organizations operating in highly complex regulatory environments with frequent changes may benefit from flexible qualitative approaches, while those in stable regulatory environments can invest in sophisticated quantitative systems.

Methodology Selection Decision Tree

Start Simple for New Programs: Organizations implementing their first formal compliance risk assessment should begin with qualitative methodologies that can be implemented quickly and refined over time.

Scale Sophistication with Maturity: As compliance programs mature and organizational capabilities develop, consider migrating to more sophisticated hybrid or quantitative approaches.

Match Methodology to Risk Type: Different risk categories may require different assessment approaches. Use quantitative methods for risks with good historical data and qualitative methods for emerging or behavioral risks.

Consider Resource Availability: Quantitative methodologies require significant ongoing resource investment. Ensure sustainable resource commitment before implementing sophisticated approaches.

Implementation Phasing Strategy

Phase 1: Foundation Building (Months 1-6)

- Implement basic qualitative risk assessment

- Establish risk governance structure

- Develop stakeholder engagement processes

- Create initial risk inventory and prioritization

Phase 2: Enhancement and Integration (Months 6-18)

- Integrate quantitative data where available

- Implement risk monitoring systems

- Develop specialized assessments for high-risk areas

- Enhance stakeholder reporting and communication

Phase 3: Advanced Capabilities (Months 18+)

- Deploy AI and predictive analytics capabilities

- Implement continuous monitoring systems

- Integrate ESG and emerging risk categories

- Develop industry-leading practices and thought leadership

Industry Standards and Best Practices

Aligning compliance risk assessment methodologies with recognized industry standards enhances credibility, ensures comprehensiveness, and facilitates regulatory acceptance.

Regulatory Guidance Integration

Department of Justice Guidance: The DOJ’s Evaluation of Corporate Compliance Programs provides clear expectations for compliance risk assessment, emphasizing the need for:

- Risk-based resource allocation

- Regular assessment updates reflecting business changes

- Integration with business processes and decision-making

- Clear accountability and oversight structures

Financial Services Regulatory Guidance: Banking regulators provide specific guidance on compliance risk assessment including:

- Integration with overall risk management frameworks

- Stress testing and scenario analysis requirements

- Board and senior management oversight expectations

- Documentation and audit trail requirements

International Standards Framework

ISO 31000 Risk Management: This international standard provides principles and guidelines for effective risk management that can be adapted for compliance risk assessment:

- Risk management principles and framework

- Risk assessment process guidance

- Integration with organizational governance

- Continuous improvement methodologies

COSO Enterprise Risk Management: The COSO framework offers comprehensive guidance for integrating compliance risk assessment with broader enterprise risk management:

- Risk strategy and objective setting guidance

- Risk identification and assessment methodologies

- Risk response and control activity design

- Information, communication, and monitoring requirements

NIST Risk Management Framework: While originally designed for cybersecurity, the NIST framework provides valuable insights for compliance risk assessment:

- Risk framing and assessment processes

- Risk monitoring and communication strategies

- Continuous improvement and adaptation approaches

Industry-Specific Considerations

Financial Services: Banks, insurance companies, and investment firms face unique compliance risk assessment requirements including:

- Model risk management for AI and algorithmic decision-making

- Customer due diligence and anti-money laundering assessments

- Market conduct and fair lending analysis

- Operational resilience and business continuity evaluation

Healthcare and Life Sciences: Organizations in these sectors must address:

- Patient safety and clinical trial compliance

- Drug and device safety monitoring

- Data privacy and security in healthcare contexts

- Supply chain integrity and traceability

Technology and Data: Tech companies face evolving compliance landscapes including:

- Data privacy and protection across multiple jurisdictions

- AI ethics and algorithmic fairness requirements

- Platform content and user safety obligations

- Cybersecurity and incident response requirements

Frequently Asked Questions

- Q: What is the most important element of a compliance risk assessment methodology?

The most critical element is establishing clear scope and context that aligns with your organization’s business model, regulatory environment, and strategic objectives. Many organizations fail because they attempt to assess everything rather than focusing on the risks that matter most to their specific circumstances. Effective methodologies prioritize comprehensiveness within defined boundaries over attempting universal coverage. - Q: How often should organizations conduct comprehensive compliance risk assessments?

Leading practices suggest annual comprehensive assessments with quarterly updates for high-risk areas and monthly monitoring for critical risks. However, frequency should be risk-based rather than calendar-based. Organizations in rapidly changing regulatory environments or those with significant compliance violations should conduct more frequent assessments. - Q: What’s the difference between inherent risk and residual risk in compliance assessment?

Inherent risk represents the natural level of risk before considering any controls or mitigation measures. Residual risk is the remaining risk after accounting for existing controls and mitigation strategies. Understanding this distinction is crucial for effective resource allocation – you might accept high inherent risk if strong controls reduce residual risk to acceptable levels. - Q: Should small organizations use the same risk assessment methodologies as large enterprises?

Small organizations should adopt scaled methodologies that reflect their resource constraints and simpler risk profiles. Start with qualitative approaches focusing on the highest-impact risks, then gradually add sophistication as the organization grows. The key is ensuring the methodology is sustainable and produces actionable results rather than overwhelming the organization with complexity. - Q: How do you handle compliance risks that span multiple jurisdictions?

Multi-jurisdictional compliance risks require careful analysis of regulatory overlap, conflicts, and gaps. Map each risk to all applicable jurisdictions, identify the most stringent requirements, and develop controls that satisfy the highest standard. Consider engaging local experts in each jurisdiction and implementing centralized monitoring with local execution capabilities. - Q: What role should external experts play in compliance risk assessment?

External experts provide valuable objectivity, specialized knowledge, and industry benchmarking insights. They’re particularly valuable for initial methodology design, specialized risk areas, and periodic independent validation. However, organizations should maintain internal ownership of the process and avoid over-reliance on external resources for ongoing assessment activities. - Q: How do you measure the effectiveness of a compliance risk assessment program?

Effectiveness metrics should include both leading indicators (assessment completeness, stakeholder engagement levels, control improvement rates) and lagging indicators (compliance violations, regulatory citations, financial losses). Track trends over time rather than focusing on point-in-time measurements, and regularly benchmark against industry peers and regulatory expectations. - Q: What are the most common mistakes organizations make in compliance risk assessment?

The most frequent mistakes include: treating risk assessment as a one-time project rather than ongoing process, focusing on documentation over actual risk reduction, failing to integrate assessment results with business decision-making, over-relying on generic risk categories rather than organization-specific analysis, and neglecting to update assessments when business or regulatory conditions change. - Q: How do you integrate compliance risk assessment with overall enterprise risk management?

Integration requires aligning risk taxonomies, reporting structures, and governance processes while maintaining the specialized focus that compliance risks require. Compliance risks should be reported through enterprise risk management channels but with sufficient detail to support compliance-specific decision-making. Ensure compliance risk assessment feeds into strategic planning and resource allocation processes. - Q: What emerging trends should organizations consider in their compliance risk assessment methodologies?

Key trends include increasing regulatory focus on AI ethics and algorithmic fairness, expanding ESG disclosure requirements, growing emphasis on supply chain compliance and human rights due diligence, enhanced data privacy and cybersecurity requirements, and regulatory expectations for real-time monitoring and rapid response capabilities.

Implementation Roadmap and Next Steps

Implementing effective compliance risk assessment methodologies requires systematic planning, stakeholder alignment, and sustained commitment to continuous improvement. Organizations should approach implementation as a journey rather than a destination, building capabilities incrementally while maintaining focus on practical value creation.

Immediate Action Items (30 Days)

Begin by conducting a stakeholder alignment session with senior leadership to establish clear expectations, success criteria, and resource commitments for your compliance risk assessment program. Document your current regulatory universe and identify high-priority risk areas that require immediate attention.

Perform an initial qualitative assessment of your top 10 compliance risks using the framework outlined in this guide. This rapid assessment will provide immediate value while identifying areas where more sophisticated analysis is needed.

Establish basic governance structure including risk assessment roles, responsibilities, and review cycles. Even simple governance structures provide the foundation for more sophisticated approaches as your program matures.

Medium-Term Development (90 Days)

Develop comprehensive risk inventory and initial prioritization using consistent scoring methodologies. Focus on building sustainable processes rather than perfect initial assessments – you can refine scoring and prioritization as you gain experience.

Implement basic monitoring and reporting systems that provide regular visibility into your highest-priority risks. Simple dashboards and regular reporting create accountability and demonstrate program value to stakeholders.

Begin developing organizational capabilities through training, technology investments, and process documentation. Consider whether to build internal expertise or partner with external specialists for specialized risk areas.

Long-Term Capability Building (12+ Months)

As your program matures, gradually incorporate more sophisticated methodologies including quantitative analysis, predictive modeling, and automated monitoring capabilities. Ensure each enhancement provides demonstrable value rather than just increased complexity.

Develop industry-leading practices in emerging areas like AI governance and ESG integration. This positions your organization as a thought leader while ensuring readiness for evolving regulatory expectations.

Create feedback loops that continuously improve your methodology based on practical experience, stakeholder input, and changing business conditions. The most successful compliance risk assessment programs evolve continuously rather than following static methodologies.

The path forward requires balancing immediate practical needs with long-term strategic objectives. Start with approaches that provide immediate value, then build sophistication as organizational capabilities and stakeholder expectations develop. Remember that the best compliance risk assessment methodology is the one that actually gets implemented and continuously improved rather than the most theoretically sophisticated approach that overwhelms organizational capabilities.

Success in compliance risk assessment comes not from perfect initial implementation but from sustained commitment to continuous improvement, stakeholder engagement, and practical value creation. Organizations that master these fundamentals position themselves not just to manage compliance risk effectively, but to transform compliance from defensive necessity into competitive advantage.

Experience the Future of ESG Compliance

The Compliance & Risks Sustainability Platform is available now with a 30-day free trial. Experience firsthand how AI-driven, human-verified intelligence transforms regulatory complexity into strategic clarity.

👉 Start your free trial today and see how your team can lead the future of ESG compliance.

The future of compliance is predictive, verifiable, and strategic. The only question is: Will you be leading it, or catching up to it?

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.