China Advances 2030 ESG Roadmap with Public Consultation on Draft Climate Disclosure Standard

This blog was originally posted on 12th May, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY LYNN CHIAM, REGULATORY COMPLIANCE SPECIALIST, AND HANNAH JANKNECHT, REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

The global focus on Environmental, Social, and Governance (ESG) principles is intensifying, and China is stepping up its efforts to integrate sustainability into its economic framework.

As part of a broader strategy to establish comprehensive sustainability reporting by 2030, China is rolling out both national and regional initiatives, including the recent release of draft climate disclosure standards on 30 April 2025.

This blog explores the latest milestones in China’s ESG journey, highlighting major regulatory developments and their implications for companies operating in the region.

How is China’s national ESG reporting framework developing?

In December 2024, the Ministry of Finance issued the Basic Standards (Trial) for Sustainability Disclosures. The Standards constitute China’s first unified guidelines for corporate sustainability disclosures, and they are open for use by all types of companies operating in China.

Initially, disclosing sustainability information in accordance with the standards is voluntary. The Ministry has, however, announced plans to develop criteria for mandatory adoption in the near future. Although a specific timeline for mandatory disclosure has yet to be released, the Ministry has signaled that it intends to first introduce mandatory requirements for listed companies, with a gradual expansion to include non-public companies until 2030 at the latest.

While the content of the Chinese standards builds on international developments such as IFRS S1 and S2, they are adapted to the Chinese context, including aspects of rural development and social metrics.

Hot off the press, the exposure draft standard on Climate-related disclosures was released on 30 April 2025, designed to complement the Basic Standards (Trial) for Sustainability Disclosures.

The climate-specific standard requires companies to disclose detailed information on their governance, strategy, risk management, and metrics related to climate-related risks and opportunities, including the roles of governing bodies and management.

Interested parties are invited to submit comments on the exposure draft until 31 May 2025.

The Ministry is looking for feedback, particularly on the disclosure of climate-related impact information, the incorporation of the Greenhouse Gas Protocol (GHG Protocol) and provisions on financing emissions.

Are there any mandatory ESG disclosure requirements in China?

In April 2024, the Shanghai Stock Exchange (SSE), Shenzhen Stock Exchange (SZSE), and Beijing Stock Exchange (BSE) issued guidelines mandating sustainability reporting for specific listed companies, with first reports to be submitted by 30 April 2026 for the financial year 2025. After this, reports are due within four months after each fiscal year ends, aligned with annual financial reporting.

In scope of the reporting requirements are the 180 biggest companies on the Shanghai Stock Exchange (SSE), the 100 biggest companies on the Shenzhen Stock Exchange, the 50 biggest companies on the Shanghai Science and Technology Innovation Board Index, the 100 biggest companies on the Shenzhen Stock Exchange’s ChiNext board, and companies with a dual listing.

The guidelines cover a broad range of environmental, social and governance issues, including climate change, pollution, waste management, social contributions and contributions to rural development.

Companies not covered by the mandatory reporting obligations are strongly encouraged to voluntarily disclose their ESG reports.

How are cities driving ESG reporting in China?

In addition to China’s efforts to implement sustainability disclosures at the national level, several local initiatives promote ESG disclosures and provide some interesting insights into the future of corporate sustainability in China.

Beijing

The Beijing Municipal Development and Reform Commission published its implementation plan for promoting the development of a high-quality environment, social and governance (ESG) system (2024-2027).

The plan aims to position Beijing as a national and international ESG city, specifying the following targets:

- By the end of 2027, the ESG information disclosure rate of listed companies in Beijing, including A-share and H-share, should meet 70%;

- By the end of 2035, efficient ESG disclosures will be legally required, and the establishment of standards will be complete.

Shanghai

Similarly, Shanghai Municipal Commission of Commerce published its Three-Year Action Plan for Accelerating the Improvement of the Environmental, Social and Governance (ESG) Capabilities of the City’s Foreign-Related Enterprises (2024-2026).

The objective is to create a collaborative ESG ecosystem involving various stakeholders to enhance the ESG capabilities of its foreign-related enterprises, focusing on foreign investment, overseas projects, and trade by 2026.

State-owned enterprises will take the lead in ESG reporting, with support extended to private firms. The plan also encourages collaboration with multinational corporations to share best practices. Shanghai aims to become a leading ESG hub by fostering international cooperation, developing ESG financial products, training professionals, coordinating across departments, and aligning with global standards to drive sustainable economic growth.

Shenzhen

Based on its Work Plan for Promoting the Construction of an Environmental and Social Governance (2025-2027), Shenzhen intends to establish an ESG ecosystem by 2027. The system should be characterized by strong corporate practices, green supply chains, and a thriving sustainable finance market. Key milestones include achieving full ESG disclosure for municipal and state-owned listed companies, a 60% disclosure rate for key A-share companies, the creation of at least 10 ESG standards guidelines, the cultivation of over 10 ESG service providers, and the development of 30 internationally recognized ESG pioneers.

How can companies prepare?

While ESG reporting remains voluntary for companies in China not subject to Stock Exchange guidelines, it is highly recommended for businesses to familiarize themselves with the Basic Trial Standard and the upcoming climate disclosure trial standard. These frameworks offer valuable insights into the mandatory requirements expected to be introduced by 2030. Companies operating in the Chinese market should closely monitor announcements from Chinese authorities, as the regulatory landscape is evolving rapidly and new ESG requirements and guidelines are likely to be introduced soon.

Stay Ahead Of Regulatory Changes in ESG in China

Want to stay ahead of regulatory developments in ESG in China?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

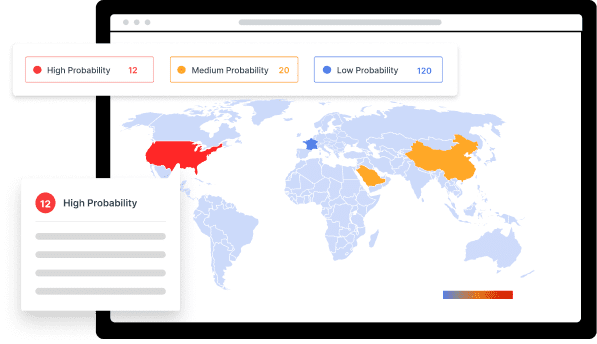

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Authors

Lynn Chiam,

Regulatory Analyst

Lynn joined the Global Regulatory Compliance team in Compliance & Risks as a Regulatory Analyst in November 2022. She is responsible for monitoring regulatory developments in China, Thailand and Malaysia and helps clients with questions on food contact materials, the transport of dangerous of goods and chemicals in products. Prior to joining C&R, Lynn worked for a law firm where she drafted legal memorandums and conducted legal research in civil law matters.

Hannah Janknecht,

Regulatory Compliance Specialist

Hannah joined the Global Regulatory Compliance team in Compliance & Risks as a Regulatory Specialist in September 2022. She is responsible for the monitoring of regulatory developments in German-speaking countries and helps clients with questions on Textiles, ESG Reporting, Illegal Logging and Supply Chain Due Diligence. Hannah studied law in Germany (University of Bonn) and holds an LL.M. in Environmental and Natural Resources Law from University College Cork. Prior to joining Compliance and Risks, Hannah worked for various government agencies in Germany, mainly in the area of the Common Agricultural Policy.