EPR Fee Calculation and Reporting Frameworks: Multi-Jurisdictional Compliance Strategies

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Extended Producer Responsibility (EPR) has evolved from environmental policy theory into a complex financial reality affecting manufacturers across global markets. As regulations expand from the EU’s established frameworks into North American states and APAC regions, businesses face an intricate web of fee structures, reporting requirements, and compliance obligations that demand strategic navigation.

This comprehensive guide demystifies EPR fee calculation methodologies across major jurisdictions, providing the analytical framework and practical tools needed to accurately forecast compliance costs, optimize packaging decisions through eco-modulation incentives, and establish robust reporting processes. Whether you’re evaluating compliance pathways for the first time or seeking to streamline existing multi-jurisdictional obligations, this resource delivers the insights necessary for informed decision-making.

Table of Contents

- Understanding EPR Fee Structures: The Financial Reality

- Core Calculation Methodologies Across Jurisdictions

- Weight-Based Fee Systems: The Universal Standard

- Eco-Modulation Incentives: Strategic Fee Reduction

- Regional Framework Analysis

- European Union: The Established Model

- North America: Emerging Complexity

- APAC: Developing Frameworks

- Annual Reporting Standards and Deadlines

- Compliance Pathway Decision Framework

- Implementation Best Practices

- Frequently Asked Questions

Understanding EPR Fee Structures: The Financial Reality

EPR fee structures represent the monetization of environmental policy, transforming packaging waste responsibility into quantifiable financial obligations. The fundamental principle underlying all EPR schemes involves producers paying fees that correlate to the environmental cost of managing their packaging materials at end-of-life.

The OECD’s analysis of global EPR schemes reveals three primary fee determination factors that consistently appear across jurisdictions: material weight, recyclability characteristics, and collection complexity. These factors combine to create fee matrices that can vary dramatically.

Understanding this financial landscape requires recognizing that EPR fees serve dual purposes: generating revenue for waste management infrastructure while incentivizing design improvements that reduce environmental impact. This dual function explains why fee structures incorporate both base rates and modulation factors that reward or penalize specific packaging characteristics.

The business implications extend beyond simple compliance costs. Companies reporting across multiple jurisdictions face fee variations that can influence packaging standardization decisions, supplier selection, and market entry strategies. A multinational manufacturer might discover that packaging optimization for German eco-modulation requirements conflicts with cost-effective compliance in emerging US state programs, creating complex strategic trade-offs.

Core Calculation Methodologies Across Jurisdictions

EPR fee calculations follow remarkably consistent methodologies despite varying regulatory frameworks. The universal formula underlying virtually all schemes operates as:

Modulated Fee = (Weight of Material) × (Base Fee per Material) × (Recyclability Factor)

This core structure accommodates jurisdictional variations through different coefficient values rather than fundamental formula changes. Base rates establish the foundation, typically expressed as currency per ton, while material modifiers account for recycling infrastructure costs and market values for recovered materials.

Eco-modulation factors represent the most dynamic element, designed to incentivize packaging improvements. These multipliers can reduce fees by up to 50% for easily recyclable designs or increase them by 100% or more for problematic packaging. The Italian CONAI system exemplifies this approach, where beverage bottles using compatible materials and labels achieve significant fee reductions, while packaging with non-detachable components faces penalty multipliers.

North American programs increasingly adopt similar methodologies while adapting to local waste management realities. California’s EPR framework mirrors EU approaches but incorporates factors reflecting the state’s unique recycling infrastructure and contamination challenges. The methodology remains consistent, but coefficient values adjust to local conditions.

Weight-Based Fee Systems: The Universal Standard

Weight-based fee calculation has emerged as the global standard for EPR schemes, chosen for its simplicity, measurability, and correlation with environmental impact. This approach requires producers to report packaging weights by material category, enabling straightforward fee calculations that scale proportionally with usage.

The practical implementation of weight-based systems demands accurate data collection across product portfolios. Companies must establish processes for:

- Primary Packaging Measurement: Direct product packaging including bottles, boxes, and wrapping materials. These components typically represent the largest weight contribution and face standard fee rates.

- Secondary Packaging Assessment: Transportation and retail packaging such as shrink wrap, display boxes, and protective materials. Many jurisdictions include secondary packaging in EPR obligations, particularly when it reaches end consumers.

- Tertiary Packaging Evaluation: Bulk shipping materials like pallets and strapping. Most programs exclude tertiary packaging, but comprehensive tracking helps identify cost optimization opportunities.

Data accuracy becomes critical given fee magnitudes. A company underestimating plastic packaging weight by 10 tons faces unexpected fees exceeding £4,000 in the UK system alone. Robust measurement protocols and verification processes protect against costly reporting errors while supporting optimization initiatives.

Weight-based systems also facilitate cross-jurisdictional comparison and planning. A standardized measurement approach across markets enables manufacturers to evaluate total EPR exposure and identify material substitution opportunities that deliver consistent benefits across multiple compliance obligations.

Eco-Modulation Incentives: Strategic Fee Reduction

Eco-modulation represents EPR’s most powerful mechanism for driving packaging innovation, offering substantial fee reductions for designs that improve recyclability, reduce environmental impact, or support circular economy objectives. Understanding and leveraging these incentives can transform EPR from compliance cost to competitive advantage.

The fundamental principle underlying eco-modulation involves bonus-malus systems that reward positive packaging characteristics while penalizing problematic designs. These systems typically evaluate:

- Design for Recyclability: Packaging components that facilitate separation, cleaning, and processing receive bonus multipliers. Single polymer bottles with compatible labels might achieve 20-30% fee reductions compared to multi-layer constructions.

- Material Selection: Bio-based, recycled content, or readily recyclable materials often qualify for reduced rates. The German system offers specific bonuses for packaging incorporating post-consumer recycled content above threshold levels.

- Contamination Prevention: Designs that minimize contamination during collection and processing earn favorable treatment. Barrier coatings that don’t interfere with recycling processes receive better modulation than those requiring special handling.

- End-of-Life Infrastructure: Packaging compatible with existing collection and processing systems typically faces lower fees than materials requiring new infrastructure development.

Italy’s CONAI system demonstrates sophisticated eco-modulation implementation. Plastic bottles meeting specific design criteria – including compatible polymer-label combinations and detachable closures – achieve fee reductions approaching 50%. Conversely, packaging with non-separable components faces penalty multipliers that more than double standard rates.

Practical eco-modulation strategy requires analyzing trade-offs between design changes and fee impacts across relevant jurisdictions. A packaging modification delivering significant savings in one market might trigger penalties elsewhere, necessitating comprehensive cost-benefit evaluation.

Companies achieving eco-modulation success typically establish cross-functional teams linking packaging development, procurement, and regulatory affairs. These teams evaluate proposed design changes against eco-modulation criteria across target markets, identifying modifications that deliver consistent benefits while avoiding inadvertent penalties.

Regional Framework Analysis

European Union: The Established Model

The European Union’s EPR landscape represents the most mature and sophisticated framework globally, with member states implementing harmonized principles through locally adapted systems. Understanding EU frameworks provides insights into global EPR evolution while revealing compliance complexities for companies operating across multiple European markets. It is also increasingly difficult to be a producer across the EU, such as the need to appoint authorized representatives separately for every Member State.

EU EPR schemes operate through Producer Responsibility Organizations (PROs) that collect fees and organize waste management activities. Each member state designates PROs with specific operational parameters, creating a network of interconnected but distinct compliance obligations.

France’s CITEO Program demonstrates advanced eco-modulation implementation, with bonus-malus systems that can triple fees for problematic packaging while offering substantial reductions for optimized designs. The program’s transparency regarding fee calculation criteria enables strategic packaging decisions that align cost optimization with environmental objectives.

Netherlands Extended Producer Responsibility focuses heavily on collection system alignment, with fees reflecting actual costs for different waste streams. The Dutch approach emphasizes real-world recycling performance over theoretical recyclability, creating incentives for packaging that succeeds in practice rather than laboratory conditions.

Cross-border complexity emerges from requirements for separate compliance in each member state where packaging is placed on market. A company selling identical products in Germany, France, and Netherlands faces three distinct EPR obligations with different PROs, fee structures, and reporting requirements.

The EU’s Packaging and Packaging Waste Directive revision process promises increased harmonization while potentially disrupting established systems. Companies must balance compliance with current frameworks against preparation for evolving requirements that could fundamentally alter fee structures and reporting obligations.

North America: Emerging Complexity

North American EPR development represents a dynamic landscape where individual states implement programs based on EU models while adapting to local waste management realities. This evolution creates a patchwork of requirements that challenges multi-state operations while offering insights into EPR adaptation to different regulatory environments.

California’s EPR Framework leads US development through comprehensive legislation requiring PRO establishment and eco-modulated fee systems. The framework mirrors EU approaches while incorporating factors specific to California’s waste management infrastructure and environmental priorities. Fee calculations will consider recycling facility capabilities, contamination challenges, and market development needs for recovered materials.

Colorado’s Producer Responsibility Program emphasizes stakeholder collaboration in fee-setting processes, requiring economic analyses that balance environmental objectives with industry impact considerations. The program’s phased implementation approach allows learning and adjustment while building compliance infrastructure.

Oregon’s Recycling Modernization Act integrates EPR with broader circular economy initiatives, creating synergies between packaging responsibility and complementary environmental programs. Fee structures incorporate factors reflecting Oregon’s specific waste composition and processing capabilities.

Canada’s Federal Approach involves coordinating provincial EPR programs while supporting national policy objectives. Quebec’s existing program provides operational precedent while other provinces develop frameworks adapted to local conditions.

The emerging North American landscape creates unique challenges for companies familiar with established EU systems. Key differences include:

Strategic planning for North American EPR requires monitoring regulatory development across multiple jurisdictions while preparing for implementation timelines that span several years. Early engagement with program development processes can influence final requirements while building relationships essential for successful compliance.

APAC: Developing Frameworks

The Asia-Pacific region represents the frontier of EPR development, with diverse economies implementing programs adapted to local conditions while learning from established EU and emerging North American models. Understanding APAC frameworks reveals both opportunities and challenges for global companies expanding compliance obligations.

Australia’s National Packaging Targets combine voluntary commitments with regulatory backstops, creating hybrid systems that encourage industry leadership while maintaining compliance mechanisms. The 2025 National Packaging Targets include specific recyclability and recycled content objectives supported by data collection requirements that parallel EPR reporting obligations.

Japan’s Extended Producer Responsibility focuses heavily on material recovery and recycling efficiency, with fee structures reflecting the country’s advanced waste processing infrastructure and resource recovery priorities. The system’s emphasis on actual recycling outcomes rather than theoretical capabilities creates incentives for packaging compatible with existing facilities.

South Korea’s EPR Program demonstrates sophisticated integration with broader waste management policy, including deposit systems and material recovery facilities. Fee calculations incorporate factors reflecting Korea’s high-density urban environments and advanced recycling technologies.

China’s Packaging Regulation Development represents potentially the largest future EPR market, with draft regulations suggesting systems combining elements from multiple international models while addressing China’s specific waste management challenges and manufacturing capabilities.

APAC framework characteristics include:

- Resource Recovery Emphasis: Many programs prioritize material recovery and reprocessing over waste diversion, creating different optimization strategies

- Technology Integration: Several frameworks explicitly incorporate advanced sorting and processing technologies into fee calculation methodologies

- Export Considerations: Programs often address packaging materials destined for export markets, creating compliance obligations that extend beyond domestic sales

For multinational companies, APAC EPR development requires balancing immediate compliance obligations in established programs with preparation for emerging requirements in key markets. The region’s diversity demands flexible compliance strategies that accommodate varying regulatory approaches while maintaining operational efficiency.

Annual Reporting Standards and Deadlines

EPR reporting requirements create the data foundation for fee calculations while establishing accountability mechanisms that ensure program integrity. Understanding reporting standards across jurisdictions enables companies to develop efficient data collection processes and avoid costly compliance failures.

Data Collection Requirements typically encompass packaging materials by weight, organized into specific categories defined by each program. Most systems require reporting:

- Material composition breakdowns (plastic types, paper grades, metal categories)

- Packaging function classifications (primary, secondary, tertiary where applicable)

- Geographic distribution data indicating where packaging enters waste streams

- Design characteristic information supporting eco-modulation calculations

Reporting Deadlines vary significantly across jurisdictions but generally follow annual cycles with quarterly or semi-annual interim requirements. EU systems typically require annual submissions between February and May for previous calendar year data. Emerging North American programs propose similar timelines while incorporating transition periods for implementation.

Verification Requirements increasingly include third-party auditing for large producers, particularly those claiming eco-modulation benefits or recycled content credits. The German system requires certified audits for companies with significant packaging volumes, while proposed California regulations include verification provisions for fee calculation accuracy.

Data Management Systems range from simple spreadsheet templates to sophisticated online platforms integrated with PRO databases. France’s CITEO system offers web-based reporting tools that validate submissions and calculate fees automatically. Other programs provide templates requiring manual calculation and submission processes.

Cross-jurisdictional reporting complexity emerges from different categorization systems, deadline schedules, and verification requirements. A company operating in multiple markets must maintain data collection processes that satisfy the most demanding requirements while organizing information appropriately for each submission.

Best Practice Approaches for multinational reporting include:

- Establishing global data collection standards that exceed any single jurisdiction’s requirements

- Implementing verification processes throughout the year rather than relying on annual audits

- Maintaining documentation supporting eco-modulation claims across all relevant markets

- Creating calendar management systems that track all reporting deadlines and interim requirements

Successful reporting depends on organizational processes that extend beyond compliance teams to encompass procurement, product development, and operations functions that generate underlying data. Companies achieving reporting excellence typically embed EPR obligations into standard business processes rather than treating them as isolated compliance activities.

Compliance Pathway Decision Framework

Selecting optimal compliance pathways requires evaluating multiple factors that influence both costs and operational complexity. The fundamental choice between Producer Responsibility Organization membership and individual compliance affects fee structures, reporting obligations, and strategic flexibility across all EPR jurisdictions.

Producer Responsibility Organization (PRO) Membership represents the standard approach for most companies, offering established infrastructure and expertise while potentially limiting strategic control over operations. PRO evaluation criteria should include:

Fee Competitiveness: Total costs including membership fees, usage-based charges, and any premium services required. Some PROs offer volume discounts or multi-jurisdiction packages that reduce overall expenses.

Service Quality: Reporting support, regulatory guidance, and customer service capabilities that reduce internal compliance burdens. Leading PROs provide dedicated account management and proactive regulatory updates.

Strategic Alignment: PRO policy positions and advocacy efforts that support long-term business objectives. Some organizations actively promote policies favorable to specific industries or packaging approaches.

Operational Integration: Technology platforms and processes that integrate efficiently with existing business systems. Advanced PROs offer API connections and automated data exchange capabilities.

Individual Compliance options exist in some jurisdictions but typically require substantial internal capabilities and regulatory expertise. This pathway suits companies with:

- Significant packaging volumes that justify dedicated compliance infrastructure

- Unique packaging characteristics requiring specialized waste management approaches

- Strategic objectives that benefit from direct control over compliance activities

- Existing relationships with waste management service providers

Hybrid Approaches combine PRO membership for standard obligations with individual arrangements for specific materials or markets. This strategy enables optimization for unique circumstances while maintaining operational efficiency for routine compliance.

The decision framework must account for regulatory evolution that could affect pathway viability. Some emerging programs limit individual compliance options or modify PRO operational requirements, potentially disrupting established strategies.

Multi-Jurisdictional Coordination adds complexity when companies operate across markets with different pathway options. Strategic approaches include:

- Selecting PROs that provide services across multiple jurisdictions

- Establishing internal capabilities that support individual compliance where advantageous

- Negotiating agreements that provide flexibility for changing regulatory requirements

- Building relationships across compliance pathways to facilitate strategy adjustments

Optimal pathway selection requires ongoing evaluation as regulatory frameworks evolve and business operations change. Companies achieving compliance excellence regularly reassess their approaches and adjust strategies based on performance data and regulatory developments.

Implementation Best Practices

Successful EPR implementation requires systematic approaches that integrate compliance obligations into standard business processes while maintaining flexibility for regulatory evolution. Leading companies establish frameworks that exceed basic compliance requirements while supporting strategic business objectives.

Organizational Structure for EPR management typically involves cross-functional teams linking regulatory affairs, packaging development, procurement, and operations. Effective structures include:

Executive Sponsorship: Senior leadership engagement that ensures adequate resources and strategic alignment with business objectives. EPR costs increasingly influence packaging decisions and market strategies.

Compliance Coordination: Dedicated roles responsible for monitoring regulatory developments, managing vendor relationships, and ensuring timely submissions across all jurisdictions.

Technical Integration: Packaging engineers and procurement specialists who understand EPR implications of design and material selection decisions.

Data Management: Information systems specialists who maintain accurate databases supporting reporting requirements and optimization analyses.

Process Development should address both routine compliance activities and strategic planning for regulatory evolution:

Material Database Maintenance: Comprehensive tracking of packaging specifications including weights, material compositions, and design characteristics relevant to eco-modulation.

Supplier Integration: Procurement processes that capture EPR-relevant information and incorporate compliance costs into sourcing decisions.

Product Development Workflows: Design review processes that evaluate EPR implications of packaging changes across all target markets.

Performance Monitoring: Regular analysis of compliance costs, optimization opportunities, and regulatory development impacts.

Technology Infrastructure supporting EPR compliance ranges from basic spreadsheet systems to sophisticated platforms integrated with enterprise resource planning systems. Key capabilities include:

- Multi-jurisdictional reporting support with appropriate categorization for each market

- Calculation engines that apply current fee structures and eco-modulation factors

- Document management for audit support and regulatory correspondence

- Integration capabilities for data exchange with PROs and internal systems

Vendor Management encompasses relationships with PROs, compliance consultants, and technology providers. Successful approaches include:

- Regular performance reviews that evaluate cost, service quality, and strategic support

- Contract terms that provide flexibility for changing regulatory requirements

- Relationship management that ensures access to regulatory intelligence and best practices

- Backup arrangements that maintain compliance if primary vendors experience disruptions

Continuous Improvement processes enable companies to optimize EPR compliance over time while adapting to regulatory evolution:

- Regular benchmark studies comparing performance across jurisdictions and peer companies

- Systematic evaluation of packaging modifications for EPR cost reduction potential

- Pilot programs testing new compliance approaches or optimization strategies

- Training programs that maintain organizational capabilities as personnel and regulations change

Frequently Asked Questions

- Q: What factors determine EPR fee amounts?

EPR fees are calculated based on three primary factors: packaging weight (measured in tons), material type (with different base rates for plastic, glass, paper, etc.), and design characteristics that affect recyclability. Base rates vary significantly by material. - Q: How do eco-modulation incentives work in practice?

Eco-modulation systems evaluate packaging characteristics against specific criteria to determine bonus or penalty multipliers. In Italy’s CONAI system, beverage bottles using compatible polymer-label combinations can achieve fee reductions approaching 50%, while packaging with non-separable components faces penalty multipliers that double standard rates. Companies must evaluate their packaging against published criteria for each jurisdiction, documenting design choices that qualify for favorable treatment. - Q: What are the key differences between EU and North American EPR systems?

EU systems operate through established PROs with mature fee structures and sophisticated eco-modulation criteria developed over decades. EU EPR systems are also more developed and established with a greater list of eco-design requirements for products. North American programs, while based on EU models, emphasize stakeholder consultation in program design and often include performance-based fee adjustments tied to actual recycling outcomes rather than fixed schedules. North American programs also typically provide longer implementation timelines and more explicit innovation incentives for new technologies or materials. - Q: How should companies handle EPR reporting across multiple jurisdictions?

Multinational EPR reporting requires establishing data collection standards that exceed any single jurisdiction’s requirements while organizing information appropriately for each submission. Best practices include implementing global data collection processes, maintaining verification throughout the year rather than relying on annual audits, and creating calendar management systems that track all reporting deadlines. Many companies find success in establishing centralized processes that feed into jurisdiction-specific submissions. - Q: What compliance pathway offers the best value: PRO membership or individual compliance?

PRO membership typically provides the most cost-effective compliance approach for companies without unique packaging characteristics or specialized waste management needs. PROs offer established infrastructure, regulatory expertise, and often volume discounts that reduce total costs compared to individual compliance. However, companies with significant packaging volumes or unique operational requirements may benefit from individual compliance pathways that provide greater control over waste management activities and potential cost optimization opportunities. - Q: How can companies optimize packaging to reduce EPR fees?

EPR fee optimization focuses on design choices that improve recyclability and align with eco-modulation criteria. Key strategies include selecting single polymer materials over multi-layer constructions, using compatible label-container combinations that don’t interfere with recycling processes, and incorporating post-consumer recycled content where programs offer bonuses. Companies should evaluate packaging modifications against eco-modulation criteria across all target markets to ensure changes deliver consistent benefits without triggering penalties elsewhere. - Q: What documentation do companies need to support EPR compliance?

EPR compliance requires comprehensive documentation including detailed packaging specifications (weights, material compositions, design characteristics), supplier certifications for recycled content or bio-based materials, and audit trails supporting calculation accuracy. Companies claiming eco-modulation benefits must maintain technical documentation demonstrating compliance with specific design criteria. Third-party verification requirements in some jurisdictions demand independently auditable records throughout the reporting period. - Q: How do EPR requirements affect packaging design decisions?

EPR obligations increasingly influence packaging design through direct cost incentives and regulatory requirements. Eco-modulation systems create financial rewards for recyclable designs while penalizing problematic packaging, making EPR costs a factor in material selection and structural design decisions. Forward-looking companies integrate EPR implications into product development processes, evaluating proposed changes against compliance obligations and optimization opportunities across target markets.

EPR fee calculation and reporting represents a critical competency for companies operating in global markets where extended producer responsibility continues expanding. Success requires understanding complex regulatory frameworks while developing systematic approaches that transform compliance obligations into strategic advantages.

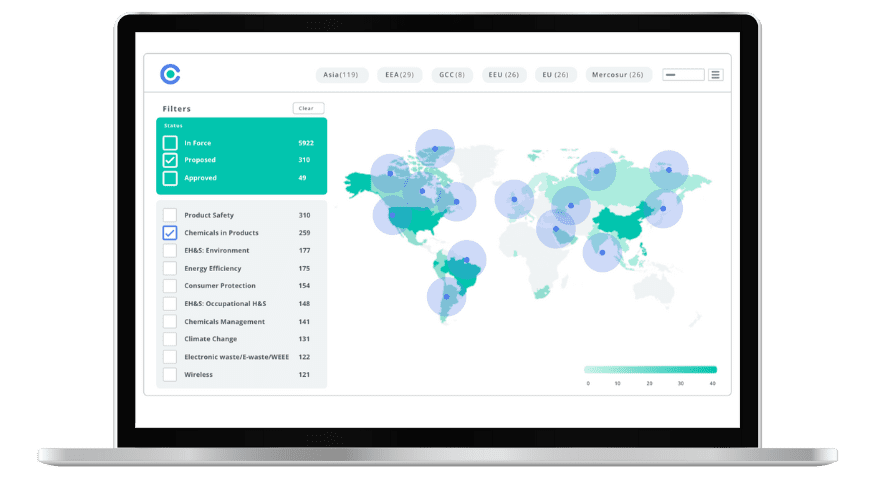

The landscape’s continued evolution demands ongoing attention to regulatory developments, optimization opportunities, and implementation best practices. Companies that establish robust EPR management capabilities position themselves advantageously for future regulatory expansion while achieving immediate cost optimization and operational efficiency benefits. For organizations seeking to enhance their EPR compliance capabilities, comprehensive regulatory intelligence and systematic implementation support can accelerate success while reducing execution risks inherent in complex multi-jurisdictional requirements. Compliance & Risks offers enterprise solutions through its C2P platform to help companies navigate the evolving EPR landscape and maintain compliance across global markets.

Stay Ahead Of Regulatory Changes in Corporate Sustainability

Want to stay ahead of regulatory developments in sustainability?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.