EPR Take-Back Program Monitoring

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Extended Producer Responsibility (EPR) take-back programs have become critical business operations requiring sophisticated monitoring frameworks. With enforcement intensifying globally—from California’s SB 54 authorizing penalties up to $50,000 per day to the UK’s 25% increase in packaging producer-responsibility audits in 2024¹—organizations need strategic monitoring approaches that ensure compliance while optimizing operations.

This implementation guide addresses EPR monitoring across all major product categories including packaging, electronics (WEEE), batteries, end-of-life vehicles (ELV), and textiles. You’ll discover practical systems and processes that transform regulatory obligations into data-driven operations while positioning your organization ahead of expanding EPR legislation worldwide.

Table of Contents

- Why Traditional Monitoring Approaches Fail

- The Strategic Monitoring Framework

- Essential Monitoring Components

- Technology Implementation Strategies

- Performance Optimization Through Data Analytics

- Common Implementation Pitfalls

- Getting Started: Your Implementation Roadmap

Why Traditional Monitoring Approaches Fail

Extended Producer Responsibility has evolved into a complex global regulatory framework spanning multiple product categories. Current EPR systems cover packaging, electronics (WEEE), batteries, end-of-life vehicles, and textiles across developed markets worldwide, with global advances made including South Korea’s Promotion of Saving and Recycling Resources Act (1992)², Japan’s Promotion of Sorted Collection and Recycling of Containers and Packaging Law (1995)³, and South Africa’s Extended Producer Responsibility Regulations (2020)⁴.

The landscape has transformed dramatically from pilot programs in select jurisdictions to comprehensive requirements across multiple states and countries. In the United States alone, packaging EPR now covers the entire West Coast with Washington’s Recycling Reform Act joining California and Oregon’s established programs⁵. The EU’s new Packaging and Packaging Waste Regulation entered into force February 11, 2025, creating harmonized requirements across member states⁶.

Most organizations still approach EPR monitoring reactively, creating three critical vulnerabilities:

- Risk Concentration: Manual processes increase error likelihood and missed deadlines. Oregon’s Department of Environmental Quality can assess civil penalties up to $25,000 per day under the Recycling Modernization Act⁷. These penalties aren’t theoretical—enforcement actions have increased significantly as programs mature and regulatory agencies develop enforcement capabilities.

- Operational Inefficiency: Without integrated systems, teams spend 60-80% of their time on data compilation rather than program optimization. This reactive cycle prevents identification of cost-saving opportunities, performance improvements, or strategic planning that could reduce long-term compliance costs.

- Strategic Blindness: Fragmented data provides no visibility into performance trends, collection optimization opportunities, or service provider benchmarks. Organizations cannot improve what they cannot measure systematically, leading to missed opportunities for operational excellence and cost reduction.

The traditional spreadsheet-and-email approach becomes increasingly untenable as EPR requirements expand across jurisdictions and product categories. Organizations need systematic frameworks that treat EPR programs as strategic operations deserving analytical rigor comparable to other business functions.

The Strategic Monitoring Framework

Effective EPR monitoring requires systematic approaches that address data management, operational tracking, performance measurement, and regulatory reporting. This framework applies across all EPR product categories and scales with regulatory expansion while reducing operational overhead.

Foundation Requirements

Comprehensive Data Architecture: Establish systems capturing, storing, and validating information from multiple sources while maintaining integrity and accessibility. Product placement data forms the baseline, including units placed on market by material type, weight specifications, packaging categories, and geographic distribution. Data sources typically include ERP systems, sales databases, and distribution records.

Collection infrastructure data tracks networks of collection points, drop-off locations, retailer take-back sites, and municipal programs. This must include location details, capacity specifications, operational schedules, and accessibility information required for regulatory coverage calculations.

Material flow data monitors movement of collected materials through sorting, processing, and final disposition stages, including weights by material category, contamination rates, processing facility destinations, and final disposition methods.

Advanced Integration Capabilities: Connect internal ERP, inventory, and sales systems with service provider data feeds and regulatory reporting portals. The EU’s new Packaging and Packaging Waste Regulation mandates national producer registers to monitor EPR compliance⁸, requiring seamless data integration across multiple systems and stakeholders.

Modern EPR programs generate data across numerous touchpoints requiring integration capabilities that harmonize information while maintaining source traceability. Key integration points include internal systems integration, service provider data feeds, regulatory system interfaces, and third-party data validation services.

Robust Quality Validation: Implement real-time validation rules flagging inconsistencies, missing data, outliers, and formatting errors before data enters systems. Cross-reference validation compares data across sources ensuring consistency between placement and collection requirements.

Temporal validation monitors data patterns over time identifying sudden changes that may indicate quality issues or process changes requiring investigation. Stakeholder verification establishes regular processes with service providers and internal teams to confirm accuracy and completeness.

Performance Measurement Architecture

Collection Rate Optimization: Most EPR laws require collection rates calculated as (Total Weight Collected ÷ Total Weight Placed on Market) × 100, though methodologies vary between jurisdictions requiring system flexibility. California’s approach differs significantly from EU PPWR requirements, necessitating configurable calculation engines.

Recovery and Recycling Efficiency: Track successful material recovery through recycling, reuse, or energy recovery to meet regulatory targets. The EU’s Battery Regulation establishes comprehensive requirements including critical raw material recovery targets⁹, while electronics WEEE programs focus on component recovery and hazardous material management.

Geographic Coverage Analytics: Monitor service availability by population served and geographic area covered, often including specific demographic and accessibility mandates. Many EPR laws include coverage requirements that demand detailed geographic monitoring and reporting capabilities.

Cost-Benefit Analysis: Track collection, processing, and administrative costs per unit weight or product unit to identify optimization opportunities and benchmark performance against industry standards and regulatory expectations.

Essential Monitoring Components

Automated Reporting Systems

Multi-jurisdictional reporting management requires sophisticated systems tracking deadlines, requirement changes, and submission processes across applicable jurisdictions with automated reminder systems. Configuration flexibility accommodates different methodological requirements while maintaining comprehensive audit trails.

Report generation automation assembles reports from validated data sources, reducing manual effort and eliminating transcription errors. Pre-submission validation reviews reports for completeness, accuracy, and regulatory requirement compliance before submission, while version control maintains detailed records of report versions, data sources, and calculation methodologies.

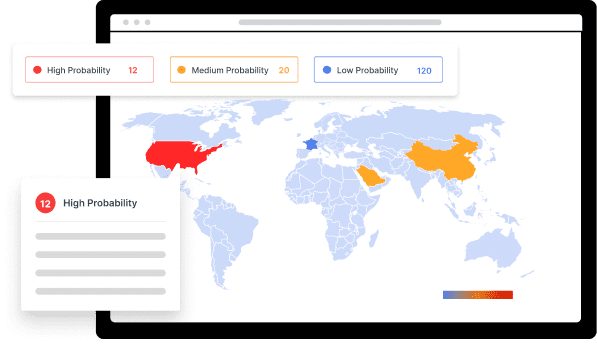

Early warning systems help organizations stay ahead of compliance deadlines and regulatory changes. Compliance and Risks’ regulatory monitoring platform provides automated alerts for upcoming obligations and regulatory changes, ensuring companies never miss critical compliance requirements while adapting to evolving regulatory landscapes¹⁰.

Logistics Tracking and Chain of Custody

EPR regulations increasingly require detailed documentation of material flows from collection through final disposition, making logistics tracking critical for compliance and operational optimization.

- Collection Point Monitoring: Geographic coverage analysis tracks service coverage by population density, demographic segments, and accessibility requirements. Collection volume tracking monitors volumes by location, time period, and material type to identify trends and optimize service schedules.

- Transportation Oversight: Route optimization tracking monitors collection routes for efficiency and cost optimization while ensuring regulatory coverage requirements. Chain of custody documentation maintains detailed records of material transfers between collection points, transportation providers, and processing facilities.

- Processing Verification: Facility certification monitoring verifies that processing facilities maintain required certifications and permits, with automated alerts for certification expirations. Material recovery tracking documents percentage of collected materials successfully recovered through recycling, reuse, or energy recovery.

Service Provider Performance Management

Monitor contractor performance across reliability, data reporting quality, customer service, and cost metrics. Performance benchmarking compares service providers across multiple dimensions identifying top performers and improvement opportunities while supporting contract negotiations and risk management.

Risk management components monitor service provider financial stability, regulatory compliance, and operational capacity to identify potential service disruptions before they impact program performance. This proactive approach prevents compliance gaps and maintains program continuity.

Technology Implementation Strategies

Organizations face three primary approaches for implementing EPR monitoring capabilities: building internal systems, purchasing software solutions, or partnering with specialized service providers. Each approach offers distinct advantages requiring careful evaluation against organizational capabilities and program complexity.

Internal Development Analysis

- Advantages: Complete customization to specific requirements, full control over system updates and modifications, seamless integration with existing enterprise systems, and elimination of ongoing licensing costs after initial development.

- Limitations: Substantial upfront development costs often exceeding $500,000 for comprehensive systems, ongoing maintenance requiring dedicated IT resources, regulatory expertise gaps requiring external consultation, limited scalability for multi-jurisdictional requirements, and resource constraints for system updates when regulations change.

- Optimal Applications: Large organizations with substantial IT resources, simple single-jurisdiction requirements, or highly specialized operational needs that standard solutions cannot accommodate effectively.

Software Solution Procurement

- Advantages: Faster implementation timelines typically ranging from 3-6 months, built-in regulatory expertise developed through multiple client implementations, automatic updates for regulatory changes eliminating internal maintenance burden, proven best practices incorporation, and lower upfront costs than internal development.

- Limitations: Reduced customization flexibility requiring process adaptation, ongoing licensing costs that can compound over time, potential integration challenges with legacy enterprise systems, and vendor dependence for system updates and maintenance.

- Optimal Applications: Mid-size to large organizations with multiple jurisdiction requirements, complex reporting needs across product categories, or limited internal IT resources for system development and ongoing maintenance.

Specialized Service Provider Partnerships

- Advantages: Complete outsourcing of compliance management reducing internal resource requirements, access to specialized regulatory and operational expertise, comprehensive service packages typically including both technology and operational components, and minimal internal resource requirements for ongoing management.

- Limitations: Reduced direct control over critical business processes, potentially higher long-term costs compared to internal solutions, limited internal capability development that may create strategic dependencies, and reliance on external providers for business-critical functions.

- Optimal Applications: Smaller organizations with limited internal resources, companies seeking to minimize EPR program management overhead, or organizations preferring to focus internal resources on core business activities while outsourcing compliance management.

Hybrid Implementation Approaches

Many successful EPR programs combine multiple approaches optimizing cost, capability, and risk management across program components. Common hybrid models include using software solutions for data management and regulatory reporting while partnering with service providers for collection and processing operations.

This approach leverages technology for data integrity and reporting automation while accessing specialized operational expertise for physical program management. Organizations can maintain strategic control over compliance while optimizing operational efficiency and cost structures.

Performance Optimization Through Data Analytics

EPR monitoring systems generate substantial data that drives program improvements beyond basic compliance requirements. Organizations leveraging this data strategically often achieve cost reductions of 15-25% while improving performance metrics and stakeholder satisfaction.

Collection Rate Enhancement

- Location Performance Analysis: Analyze collection data by geographic area, demographic segments, and collection point types to identify underperforming locations and optimization opportunities. This analysis reveals patterns in consumer behavior, service accessibility, and operational efficiency that inform strategic improvements.

- Service Frequency Optimization: Use collection volume data and utilization metrics to optimize service schedules, reducing costs while maintaining service quality and regulatory compliance. Data-driven scheduling can reduce collection costs by 20-30% while improving service reliability.

- Consumer Behavior Analytics: Track collection patterns to identify outreach opportunities, service gaps, and behavioral factors influencing program participation. Understanding demographic and geographic participation patterns enables targeted education and service improvements.

Cost Management and Revenue Optimization

- Cost Center Analysis: Track costs by program component to identify expensive operational aspects and target optimization efforts effectively. Detailed cost analysis often reveals opportunities for vendor renegotiation, process improvements, or service consolidation.

- Revenue Maximization: Optimize material recovery revenues through processor selection, contract negotiation, and material quality improvements. Enhanced material sorting and quality control can increase recovery revenues by 10-20% while meeting regulatory requirements.

- Budget Forecasting: Use historical cost and performance data to create accurate budget forecasts and identify potential cost savings opportunities. Predictive analytics help organizations anticipate regulatory changes and their financial implications.

Common Implementation Pitfalls

EPR monitoring implementations face predictable challenges that can compromise compliance effectiveness or operational efficiency. Understanding these pitfalls and preventive measures significantly improves implementation success rates.

Data Quality Challenges

- The Problem: Inconsistent data collection processes, format variations across sources, and inadequate validation procedures create inaccurate reporting and compliance risks. Poor data quality represents the primary cause of EPR compliance failures, triggering regulatory penalties and operational inefficiencies.

- Prevention Strategies: Establish standardized data collection protocols from project initiation with comprehensive documentation and training. Implement real-time validation checks that flag inconsistencies before data enters systems. Create regular data quality auditing processes with stakeholder feedback loops ensuring continuous improvement.

Regulatory Change Management

- The Problem: EPR regulations change frequently across jurisdictions, and system configurations that become outdated create compliance gaps or reporting errors. Organizations often discover regulatory changes too late to implement necessary system modifications, creating compliance risks.

- Prevention Strategies: Implement comprehensive regulatory monitoring processes that track requirement changes across all applicable jurisdictions. Design systems with configuration flexibility accommodating regulatory variations without requiring fundamental system modifications. Establish relationships with regulatory experts providing early warning of requirement changes.

Service Provider Coordination Failures

- The Problem: Poor coordination with collection contractors, processors, and other service providers results in incomplete data, service gaps, and compliance vulnerabilities. Fragmented communication and unclear expectations create operational risks and regulatory exposure.

- Prevention Strategies: Establish clear data sharing agreements with performance metrics and accountability measures. Implement regular performance review processes with documented improvement plans. Create backup service provider relationships for critical functions ensuring program continuity during disruptions.

Integration and System Compatibility Issues

- The Problem: Inadequate integration between monitoring systems and existing enterprise systems creates manual processes, data inconsistencies, and operational inefficiencies. Poor integration planning often leads to costly system modifications and delayed implementations.

- Prevention Strategies: Conduct thorough integration planning before implementation with detailed technical specifications and testing protocols. Establish data governance protocols ensuring consistency across integrated systems. Create comprehensive testing procedures for all integration points with rollback capabilities for problematic implementations.

Getting Started: Your Implementation Roadmap

Successful EPR monitoring implementation requires phased deployment building capability progressively while maintaining compliance throughout the transition. Organizations attempting comprehensive system deployments often encounter significant challenges compromising compliance or creating operational disruptions.

Phase 1: Foundation Building (Months 1-3)

- Data Architecture Development: Establish core data collection and storage capabilities focusing on the most critical data elements for regulatory compliance. This includes identifying data sources, establishing collection protocols, and implementing basic validation procedures.

- Stakeholder Engagement: Secure commitment and participation from internal teams, service providers, and technology vendors necessary for program success. This phase includes contract negotiations, service level agreement development, and change management planning.

- Baseline Establishment: Document current performance levels, cost structures, and operational processes to provide improvement measurement benchmarks. Baseline documentation supports ROI calculation and performance optimization initiatives.

Phase 2: Core Monitoring Deployment (Months 4-6)

- System Integration: Connect primary data sources and establish automated data collection for the most critical monitoring requirements. Focus on high-impact, low-risk integrations that provide immediate compliance benefits while building toward comprehensive capability.

- Initial Reporting Capability: Deploy basic reporting functionality for the most immediate regulatory requirements while building toward comprehensive multi-jurisdictional capability. Implement automated validation and submission processes for primary compliance obligations.

- Process Documentation: Create standard operating procedures for system use, data management, and compliance processes. Comprehensive documentation supports training, quality control, and regulatory audit preparation.

Phase 3: Advanced Functionality (Months 7-9)

- Performance Analytics: Add analytical capabilities for program optimization and performance tracking. Implement dashboards and reporting tools that support operational decision-making and continuous improvement initiatives.

- Multi-Jurisdictional Expansion: Extend system capabilities to accommodate additional jurisdictions and regulatory requirements. Configure reporting templates and calculation engines for secondary compliance obligations.

- Automation Enhancement: Increase automation levels for routine processes while maintaining oversight and quality control. Implement exception reporting and automated alert systems for proactive compliance management.

Phase 4: Optimization and Excellence (Months 10-12)

- Advanced Analytics: Deploy predictive analytics, trend analysis, and optimization algorithms driving continuous improvement. Implement performance benchmarking and best practice identification capabilities.

- Stakeholder Portal Development: Create interfaces for service providers and internal stakeholders to access relevant data and contribute to system effectiveness. Self-service capabilities reduce administrative overhead while improving data quality.

- Best Practice Integration: Incorporate lessons learned and industry best practices identified during initial deployment phases. Document optimization opportunities and implement systematic improvement processes.

ROI and Success Metrics

Most organizations see operational efficiency improvements within 6-12 months, with cost savings through optimization typically emerging in months 12-18. The ROI calculation should include risk mitigation value from avoided penalties and improved compliance positioning, which often justifies investment costs independent of operational improvements.

Key success metrics include compliance rate improvements, cost per unit reductions, data quality enhancements, and stakeholder satisfaction increases. Organizations typically achieve 15-25% cost reductions while improving regulatory compliance and operational performance.

Ready to transform your EPR monitoring from compliance burden to strategic advantage? Compliance and Risks’ regulatory experts and technology specialists help design monitoring systems that scale with program requirements while reducing operational overhead. Our regulatory monitoring platform provides automated alerts and comprehensive compliance support, ensuring organizations stay ahead of evolving EPR requirements across global markets.

Contact our team to discuss how strategic monitoring frameworks protect against compliance risks while unlocking optimization opportunities that drive operational excellence and competitive advantage.

References

- ¹ UK packaging producer-responsibility audit data, Environmental Agency 2024

- ² South Korea: Promotion of Saving and Recycling Resources Act, No. 4538, 1992

- ³ Japan: Promotion of Sorted Collection and Recycling of Containers and Packaging Law No. 112, 1995

- ⁴ South Africa: Extended Producer Responsibility Regulations, Notice No. 1184, 2020

- ⁵ Washington Recycling Reform Act EPR provisions

- ⁶ EU Packaging and Packaging Waste Regulation, entered into force February 11, 2025

- ⁷ Oregon Recycling Modernization Act enforcement provisions

- ⁸ EU PPWR national producer register requirements

- ⁹ EU Battery Regulation comprehensive requirements¹⁰ Compliance and Risks regulatory monitoring platform

Stay Ahead Of Regulatory Changes in EPR Take-Back Programs

Want to stay ahead of regulatory developments in EPR Take-Back Programs?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.