Material Traceability Systems for EPR Compliance

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Extended Producer Responsibility regulations continue expanding across global markets, creating urgent compliance requirements for manufacturers who must demonstrate detailed material knowledge throughout their product lifecycles. While EPR frameworks vary significantly by jurisdiction, one constant remains: the need for comprehensive material traceability that transforms regulatory burden into competitive advantage.

This guide provides a proven framework for implementing material traceability systems that ensure current EPR compliance while positioning your organization for emerging requirements like Digital Product Passports. You’ll discover actionable strategies, technology solutions, and supplier management techniques that convert compliance costs into operational advantages.

Table of Contents

- The Current EPR Compliance Landscape

- Why Material Traceability Is Essential for EPR Success

- The 5-Step EPR Traceability Implementation Framework

- Technology Solutions: Software vs. Blockchain for Traceability

- Digital Product Passports: Preparing for the Next Wave

- Building Your Business Case: ROI Beyond Compliance

- FAQ: Common EPR Traceability Challenges

The Current EPR Compliance Landscape

Extended Producer Responsibility regulations have reached critical implementation phases across multiple jurisdictions in 2025. Seven U.S. states now have active EPR programs for packaging: California, Colorado, Maine, Minnesota, Oregon, Maryland, and Washington, with Maryland and Washington becoming the sixth and seventh states to pass EPR legislation in 2025¹.

The compliance reality proves far more complex than initial legislation suggested. Oregon’s producers faced their initial reporting deadline of March 31, 2025, with extensions granted until April 30, 2025, for missed submissions². Colorado’s Circular Action Alliance (CAA) required producer registration by July 1, 2025, with companies prohibited from selling covered products if not registered and participating in the program³.

Meanwhile, European markets face the comprehensive Packaging and Packaging Waste Regulation (PPWR), which entered into force on February 11, 2025, with general application beginning August 12, 2026⁴.

Current Compliance Challenges Include

- Data Fragmentation: Each regulation demands different data points—California regulation requires detailed plastic packaging composition, while the EU PPWR mandates comprehensive supply chain transparency including facility certifications, collecting facility certificates, impact assessments and environmental impact assessments.

- Implementation Timelines: Colorado and Oregon producers must be CAA members by July 1, 2025, with legislation including House Bill 22-1355 for Colorado and Senate Bill 582 for Oregon. California continues redrafting its SB 54 regulations with revised drafts released May 16, 2025⁵.

- Technology Infrastructure: The rapid expansion from 5 to 7 active state programs in 2025 alone demonstrates the acceleration requiring scalable traceability systems rather than jurisdiction-specific solutions.

Why Material Traceability Is Essential for EPR Success

Material traceability provides the foundation for sustainable EPR compliance because it captures the granular data visibility that regulations increasingly demand. Without comprehensive traceability, companies face mounting compliance risks as enforcement mechanisms strengthen and regulatory scope expands.

The Three Pillars of EPR-Ready Traceability

- Complete Material Documentation: Effective traceability extends beyond traditional bill-of-materials tracking to include sustainability metadata, recycled content percentages, and environmental impact metrics that regulators now routinely audit.

- Real-Time Supply Chain Visibility: EPR compliance requires ongoing monitoring as regulations evolve. The blockchain for supply chain traceability market demonstrates this urgency, valued at $3.55 billion in 2025 and projected to exceed $55.31 billion by 2035, expanding at 31.6% CAGR⁶.

- Verifiable Data Integrity: Regulators demand audit trails demonstrating how material data was collected, verified, and maintained. The global blockchain for supply chain traceability market reflects this need, projected to reach $44.3 billion by 2034 from $2.89 billion in 2024, growing at 31.4% CAGR⁷.

This growth directly correlates with regulatory compliance requirements as companies recognize that comprehensive traceability systems position them advantageously for both current EPR mandates and future regulatory expansion.

The 5-Step EPR Traceability Implementation Framework

Step 1: Map Your Value Chain and Identify Data Gaps

Begin with comprehensive inventory of all materials, components, and suppliers in your value chain. This mapping reveals both current data capabilities and critical gaps requiring attention for compliance.

Start with tier-one suppliers providing materials directly to your operations. Document their data collection capabilities, certification standards, and willingness to participate in traceability initiatives. Many organizations discover that critical suppliers lack systems needed to provide required compliance data.

Extend mapping to tier-two and tier-three suppliers. While direct relationships may not exist, EPR regulations often require complete supply chain transparency. Prioritize missing information based on regulatory deadlines and enforcement risk.

Step 2: Establish Data Standards and Collection Protocols

Successful EPR compliance requires standardized data formats accommodating multiple regulatory requirements while scaling across supply chains. The EU Battery Regulation provides guidance, requiring ISO/IEC 15459 unique product identifiers starting February 2027 for industrial and EV batteries over 2 kWh⁸.

Develop comprehensive data collection templates capturing essential EPR information: material composition percentages, recycled content ratios, supplier facility locations, environmental certifications, and end-of-life processing instructions.

Establish data quality standards defining acceptable tolerance levels. Material composition might require 1% precision, while supplier location data might accept city-level accuracy.

Step 3: Choose Your Technology Infrastructure

Technology selection significantly impacts both implementation success and long-term compliance efficiency. Two primary approaches dominate: centralized software platforms and blockchain-based networks.

- Centralized Software Platforms offer rapid implementation with familiar user experiences, excelling at data aggregation and reporting automation. These systems integrate well with existing enterprise resource planning systems and provide comprehensive dashboards simplifying compliance monitoring.

- Blockchain Networks address data integrity concerns through immutable records and distributed consensus mechanisms. Multiple parties can independently verify data submissions without requiring direct access to sensitive supplier information, particularly valuable for verifying recycled content claims⁹.

Step 4: Implement Supplier Onboarding and Data Verification

Supplier participation determines traceability system success. Effective onboarding balances compliance requirements with suppliers’ operational capabilities and business concerns.

Segment suppliers based on data readiness and compliance importance. Tier-one suppliers providing materials subject to specific EPR regulations require immediate attention, while lower-risk suppliers can follow extended implementation timelines.

Provide technical support for suppliers lacking sophisticated data management capabilities, including data collection training, template customization, and temporary staff assistance during initial implementation.

Step 5: Automate Reporting and Continuous Monitoring

Transform traceability data into regulatory compliance through automated reporting and proactive monitoring systems. Modern platforms simultaneously generate reports for multiple jurisdictions, adjusting presentations to meet each regulation’s specific requirements.

Implement exception monitoring alerting compliance teams when materials or suppliers fall outside acceptable parameters. These systems flag issues like expired certifications, missing recycled content documentation, or suppliers approaching compliance deadlines.

Technology Solutions: Software vs. Blockchain for Traceability

Centralized Software Platforms: Speed and Integration

Centralized platforms excel where rapid implementation and comprehensive data integration take priority, typically offering deployment timelines measured in weeks rather than months for companies facing immediate compliance deadlines.

Integration capabilities provide their strongest advantage, seamlessly connecting with existing ERP systems, procurement platforms, and quality management software. This eliminates data silos that complicate compliance reporting while reducing manual effort required to maintain current information.

However, centralized systems create potential vulnerabilities around data control and verification, with suppliers sometimes expressing concern about sharing sensitive information through platforms controlled by customers or competitors.

Blockchain Networks: Trust and Verification

Blockchain technology addresses trust and verification challenges by creating tamper-proof records that no single party can alter, providing data integrity that sophisticated EPR compliance increasingly demands¹⁰.

Smart contracts automate compliance verification processes, automatically flagging materials not meeting minimum requirements or alerting stakeholders when supplier certifications approach expiration. This automation reduces manual monitoring while ensuring consistent compliance standards.

Blockchain implementation requires more technical expertise and longer deployment timelines compared to centralized platforms, typically needing 6-12 months for full implementation¹¹.

Making the Right Choice

The optimal technology choice depends on specific compliance requirements, supplier ecosystem, and implementation timeline. Companies in highly regulated industries with complex global supply chains often find blockchain’s verification capabilities worth additional implementation complexity.

Organizations with more straightforward value chains or immediate compliance needs frequently benefit from centralized platforms’ speed and integration capabilities.

Digital Product Passports: Preparing for the Next Wave

Digital Product Passports represent the next evolution of product transparency requirements. The EU Battery Regulation requires Battery Passports starting February 18, 2027, for industrial, light transport, and EV batteries ≥2 kWh, with expansion to textiles, electronics, and other product categories under the Ecodesign for Sustainable Products Regulation (ESPR)¹².

Understanding Digital Product Passport Requirements

Digital Product Passports require manufacturers to create comprehensive digital records for each individual product, containing detailed information about materials, manufacturing processes, sustainability metrics, and end-of-life instructions, with each product receiving a unique identifier conforming to ISO/IEC 15459 standards¹³.

Data requirements extend beyond traditional EPR mandates to include information about product durability, repairability, and upgrade possibilities, with regulations requiring machine-readable data formats enabling automated processing by regulatory authorities, recycling facilities, and consumers¹⁴.

Building DPP Readiness Through EPR Compliance

Organizations implementing comprehensive EPR traceability systems create the foundation for successful DPP compliance. Material documentation, supplier data verification, and technology infrastructure developed for EPR directly support DPP requirements.

Supplier data collection protocols established for EPR compliance easily expand to capture DPP-specific information. Suppliers already providing material composition data can enhance submissions to include manufacturing process details, durability testing results, and repair instructions.

Strategic Advantages of Early DPP Preparation

Companies preparing for Digital Product Passports while implementing EPR compliance gain significant competitive advantages in markets increasingly focused on sustainability transparency. Consumer-facing brands particularly benefit through transparency that helps differentiate sustainable products while building trust through verifiable sustainability claims.

Supply chain advantages emerge as suppliers develop capabilities supporting both EPR and DPP requirements. Organizations leading this development often secure preferential access to sustainability-focused suppliers and influence industry standards development.

Building Your Business Case: ROI Beyond Compliance

Supply Chain Risk Mitigation and Resilience

Material traceability systems provide unprecedented visibility into supply chain vulnerabilities that can disrupt operations or create compliance risks. This visibility proved particularly valuable during recent supply chain disruptions when companies with comprehensive supplier visibility adapted faster than competitors with supply chain blind spots.

The financial impact extends beyond avoided disruption costs to include improved customer retention and market share protection. Companies maintaining consistent product availability during crises often capture market share from less prepared competitors.

Enhanced Sustainability Credentials and Customer Value

Consumers and business customers increasingly prioritize sustainability in purchasing decisions, creating market premiums for products with verifiable sustainability credentials. Material traceability systems provide documentation needed to substantiate sustainability claims and command these premiums.

B2B customers particularly value suppliers providing detailed sustainability data for their own reporting and compliance requirements. Companies with comprehensive material traceability often secure preferred supplier status and pricing premiums.

Operational Efficiency and Process Optimization

Comprehensive material traceability often reveals operational inefficiencies and optimization opportunities generating substantial cost savings. Detailed data collection required for EPR compliance frequently uncovers redundant processes, excessive material waste, or supplier performance issues.

Inventory optimization emerges as traceability systems provide more accurate demand forecasting and material flow analysis, often reducing inventory carrying costs while improving product availability.

Frequently Asked Questions

- What data is required for current EPR compliance? EPR requirements vary significantly by regulation and product category. The EU PPWR requires 100% recyclable packaging by 2030 based on Design-for-Recycling criteria, while also introducing strict PFAS limits (25 ppb for individual PFAS, 250 ppb for PFAS groups) effective August 2026¹⁵. Packaging material information also needs to be supplied via labelling, as well as the need to supply packaging information and documentation under Article 16. U.S. state programs focus on material composition, recycled content ratios, and supplier facility locations.

- How do I handle suppliers resistant to providing traceability data? Supplier resistance often stems from competitive information concerns or administrative burden rather than deliberate non-cooperation. In the EU, it is a legal requirement under Article 16 of the PPWR. Address concerns by explaining regulatory context and emphasizing how traceability participation enhances suppliers’ market position with other customers facing similar mandates.

- Can existing ERP systems handle EPR traceability requirements? Most traditional ERP systems lack detailed material tracking and regulatory reporting capabilities EPR compliance demands. However, modern traceability platforms integrate seamlessly with existing systems using APIs to synchronize relevant data without requiring complete replacement.

- What’s the ROI timeline for material traceability investments? Most organizations see initial returns within 12-18 months through improved supply chain visibility, reduced compliance risks, and operational efficiency gains. Comprehensive ROI typically develops over 2-3 years as companies leverage traceability data for supplier optimization and sustainability marketing initiatives.

- How do I choose between software platforms and blockchain solutions? The choice depends on industry context, supplier ecosystem, and verification requirements. Electronics manufacturers with complex supply chains often benefit from blockchain’s verification capabilities, while packaging companies with straightforward value chains frequently prefer centralized platforms for implementation speed.

Material traceability systems transform EPR compliance from regulatory burden into competitive advantage. Companies investing in comprehensive traceability today position themselves advantageously for both current mandates and future regulatory evolution, while capturing operational efficiencies that justify investments independent of compliance requirements.

Ready to transform your EPR compliance challenge into competitive advantage? Contact our regulatory compliance experts to discover how comprehensive material traceability can streamline your operations while ensuring regulatory success across global markets.

References

- ¹ A Snapshot of Extended Producer Responsibility in 2025 – Bergeson & Campbell, P.C.

- ² 2025 EPR Packaging Update—New Laws, Deadlines & State Trends

- ³ A Snapshot of Extended Producer Responsibility in 2025 – The Acta Group

- ⁴ Packaging waste – Environment – European Commission

- ⁵ State Extended Producer Responsibility Laws: Tips For Cos., Law360

- ⁶ Blockchain for Supply Chain Traceability Market | Size, Trends & Forecast to 2035

- ⁷ Blockchain for Supply Chain Traceability Market Size | CAGR of 31%

- ⁸ Digital Product Passports (DPPs) required by EU legislation across sectors

- ⁹ Blockchain for Supply Chain Traceability Market | Size, Trends & Forecast to 2035

- ¹⁰ Blockchain for Provenance and Traceability in 2025

- ¹¹ Blockchain for Provenance and Traceability in 2025

- ¹² EU battery passport regulation requirements

- ¹³ EU Battery Passport Regulation Standards & Requirements

- ¹⁴ Digital Product Passports: what you need to know to be ready for regulatory compliance in 2025¹⁵ EU Packaging and Packaging Waste Regulation (PPWR) 2025

Next Steps for GHS Supply Chain Compliance

Implementing effective GHS supply chain compliance requires systematic planning, stakeholder coordination, and ongoing management to ensure both regulatory compliance and operational efficiency. Organizations serious about building robust compliance programs should consider a phased approach that addresses immediate requirements while building long-term capability.

Immediate Assessment and Implementation

Begin with a comprehensive assessment of current compliance status, identifying gaps in information flow, documentation, or stakeholder coordination. This assessment should evaluate both internal processes and supply chain partner capabilities to understand the full scope of compliance requirements.

Priority implementation areas typically include establishing reliable supplier communication, ensuring current safety data sheet availability, and implementing basic change management processes. These foundational elements support ongoing compliance while providing a platform for more sophisticated capabilities.

Long-term Strategic Development

Sustainable GHS compliance requires strategic investment in capabilities that can adapt to changing regulatory requirements and business conditions. This includes technology infrastructure, staff expertise development, and stakeholder relationship management that support long-term success.

Organizations should consider how GHS compliance integrates with broader risk management, sustainability, and operational excellence initiatives. This integration can create synergies that improve both compliance effectiveness and business performance.

Building Competitive Advantage

Leading organizations view GHS compliance not just as a regulatory requirement but as a competitive advantage that demonstrates commitment to safety, quality, and stakeholder protection. Effective compliance programs can differentiate companies in the marketplace while reducing operational risks and costs.

The complexity of global GHS compliance creates opportunities for organizations that invest in sophisticated capabilities and stakeholder relationships. These investments can provide competitive advantages through improved efficiency, reduced risk exposure, and enhanced customer confidence.

Ready to transform your GHS supply chain compliance from a regulatory burden into a competitive advantage? The path forward requires expertise, technology, and strategic planning that aligns with your specific operational requirements and stakeholder needs. Contact our compliance specialists to explore how comprehensive regulatory intelligence and automated compliance management can streamline your supply chain communication while ensuring robust protection for workers and communities throughout your operations.

Stay Ahead Of Regulatory Changes in GHS Supply Chain Compliance

Want to stay ahead of regulatory developments in GHS Supply Chain Compliance?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

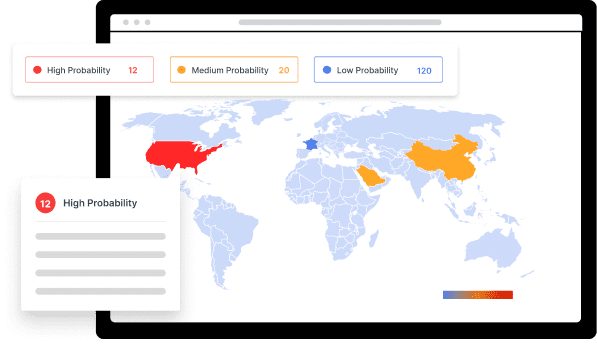

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.