The Global ESG Regulatory Landscape is Exploding: Monitor it in Real-Time

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Trying to manually track ESG regulations across multiple jurisdictions can be a daunting task. Over the last decade, global ESG rules have surged by more than 150%, turning what used to be a voluntary framework into strict compliance requirements.

The challenge goes beyond the volume of regulations: it pertains to the rapidly evolving and fragmented regulatory landscape. The EU’s Corporate Sustainability Reporting Directive, California’s climate disclosure laws, SEC climate rules, UK’s Sustainability Disclosure Requirements are major examples among countless other global regulations worldwide. The “avalanche” of ESG regulations create a complex web of requirements for many organizations. Missing even one update can expose your organization to significant financial and reputational risk.

For this reason, proactive regulatory monitoring is no longer optional – it’s a strategic edge. Instead of scrambling to catch up with changes after new regulations are announced, taking a proactive approach will help your organization manage resources more efficiently and stay on top of key compliance deadlines.

Table of Contents

- Why Manual ESG Tracking is No Longer an Option

- The Interactive Dashboard: Your Central Hub for Global ESG Oversight

- Key Global ESG Regulations Your Organization Should Monitor

- Shifting from Reactive Compliance to Proactive Horizon Scanning

- How Leading Organizations Stay Ahead of ESG Regulatory Changes

- Beyond Monitoring: Building a Robust Compliance Infrastructure

- Frequently Asked Questions

Why Manual ESG Tracking is No Longer an Option

The regulatory landscape has evolved drastically. Relying on occasional manual checks of regulatory sites – once sufficient five years ago – is no longer practical or dependable.

The Scale Challenge

Across 195 countries, regulatory bodies are simultaneously developing, revising, and implementing ESG requirements. The EU alone has introduced a dozen of major ESG-related directives and regulations since 2020, while individual US states, such as California, are enacting their own climate disclosure requirements at an accelerating pace.

The Speed Challenge

Regulatory timelines have compressed dramatically. The average window between proposal and implementation has shortened from 24 months to 12 months for major regulations. Some emergency climate measures are being fast-tracked with implementation periods as short as six months.

The Complexity Challenge

Modern ESG regulations intersect across multiple fields, ranging from environmental reporting, social impact disclosures, governance requirements and supply chain due diligence. A single regulation like the EU’s Corporate Sustainability Due Diligence Directive affects procurement, operations, reporting as well as risk management simultaneously.

The Risk Reality

The consequences of non-compliance have escalated beyond financial penalties. Depending on their jurisdictions, organizations that fail to adhere to ESG rules may face:

- Regulatory fines reaching millions of dollars

- Market access restrictions

- Supply chain disruptions

- Reputational damage affecting customer relationships and talent acquisition

- Increased scrutiny from investors and rating agencies

The Interactive Dashboard: Your Global ESG Command Center

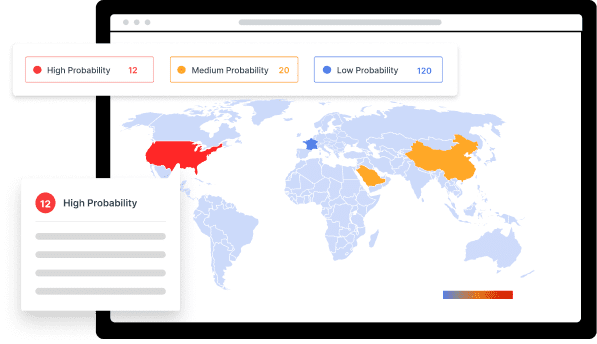

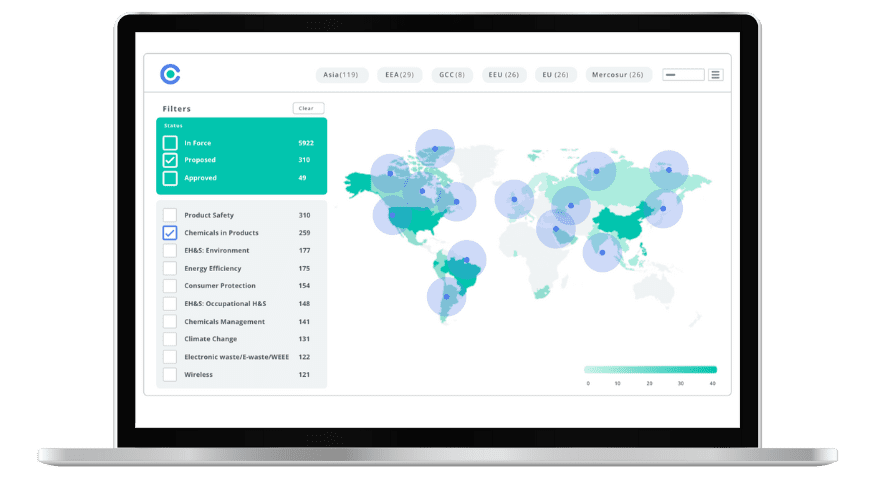

Traditional methods of regulatory monitoring – such as subscribing to countless newsletters, manually checking government websites, or depending on quarterly compliance reviews – create dangerous blind spots. By contrast, relying on a comprehensive monitoring dashboard consolidates fragmented information into clear, actionable intelligence.

Real-Time Global Coverage

A properly designed ESG monitoring system is able to track regulatory developments across all major jurisdictions simultaneously. This includes not just final regulations, but proposed rules, consultation periods, and early-stage policy discussions that could impact your organization months or years ahead.

Intelligent Filtering and Prioritization

With thousands of regulatory updates published monthly, effective monitoring requires sophisticated filtering. Advanced systems categorize changes by:

- Industry relevance and direct applicability

- Geographic scope and jurisdictional authority

- Implementation timeline and compliance deadlines

- Materiality based on your organization’s specific profile

Customized Alert Systems

Generic regulatory newsletters often bury critical updates in irrelevant information. Tailored alert systems deliver only the regulatory changes that directly impact your operations, products, or reporting requirements. C2P’s regulatory monitoring platform provides automated alerts based on your specific compliance needs.

Integration with Compliance Workflows

The most effective monitoring systems don’t just identify regulatory changes – they integrate with your existing compliance processes. This means automatic updates to compliance checklists, notification of affected stakeholders, and documentation of regulatory assessment decisions.

Key Global ESG Regulations and Standards You Must Monitor

Understanding the regulatory landscape requires tracking both current requirements and emerging developments across major jurisdictions.

Global Standards

ISSB Sustainability Disclosure Standards: IFR S1 and IFRS S2

IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures serve as a comprehensive global baseline of sustainability disclosures for the capital markets. Both standards were approved on 26 June 2023 and became effective for annual reporting periods beginning on or after 1 January 2024. Earlier application is nonetheless permitted as long as IFRS S1 and S2 are applied simultaneously.

IFRS S1 requires both public and private companies to disclose information about the “sustainability-related risks and opportunities” that may affect the entity’s cash flow, its access to finance or cost of capital over the short, medium and long-term.

IFRS S2 sets out specific climate-related disclosures and is designed to be used in conjunction with IFRS S1. This information is intended to help investors make informed decisions about providing financial resources to private and public entities.

Note that IFRS S1 and IFRS S2 are voluntary standards. Companies are not obliged to apply these standards unless jurisdictional authorities specifically require them to do so.

International Standard on Sustainability Assurance (ISSA) 5000, General Requirements for Sustainability Assurance Engagements

On 12 November 2024, the International Auditing and Assurance Standards Board (IAASB) published the finalized version of the International Standard on Sustainability Assurance (ISSA 5000) – General Requirements for Sustainability Assurance Engagements.

This standard will serve as a global baseline to conduct sustainability assurance engagement over reported sustainability information, including disclosures mandated by the IFRS S1 and S2.

Taskforce on Nature-related Financial Disclosures (TNFD)

On 19 September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) issued a set of recommendations to support companies in evaluating and reporting their nature-related dependencies, impacts, risks, and opportunities.

These recommendations are supplemented with a range of tools and sector-specific guidance, including the Locate-Evaluate-Assess-Prepare (LEAP) approach. The LEAP framework offers organizations a structured, step-by-step due diligence process to help them make disclosures consistent with the TNFD recommendations.

European Union: Setting the Global Standard

EU Taxonomy Regulation

The Taxonomy Regulation (EU) 2020/852 establishes a classification system for environmentally sustainable economic activities. The Regulation requires organisations to assess and disclose, in their non-financial statements, information regarding the extent to which the organisation’s activities are associated with economic activities that qualify as environmentally sustainable. The information include for example the proportion of their turnover, capital expenditures and operational expenditures associated with environmentally sustainable activities.

The Taxonomy Disclosure, Climate and Environmental Delegated Acts were amended on 4 July 2025 as part of the Omnibus simplification package. The amendments simplify the content and presentation of information disclosed by non-financial and financial undertakings under the EU Taxonomy framework. The changes also address technical screening criteria to determine whether economic activities cause no significant harm (DNSH) to environmental objectives.

Corporate Sustainability Reporting Directive (CSRD)

The CSRD, which came into force on 5 January 2023, substantially expanded the range of organisations subject to mandatory sustainability reporting to include public interest entities, large EU companies, including parent companies of large groups, listed SMEs and foreign undertakings having subsidiaries or branches in the EU.

The Directive requires in-scope organisations to disclose information that is necessary to understand the impacts of the company on people and the environment (impact materiality) and how sustainability matters affect the company’s financial performance (financial materiality). Reporting entities must report in accordance with the European Sustainability Reporting Standards (ESRS) and include a sustainability statement in a dedicated section of the company’s management report.

The CSRD was last amended by Directive (EU) 2025/794, also known as the ‘Stop-the-Clock’ amendment, with effect from 17 April 2025. The amendment has delayed by two years the deadline for preparing and publishing the first sustainability reports for large non-listed EU companies with more than 250 employees and listed SMEs. The respective reporting deadlines have been pushed to financial years starting on or after 1st January 2027 (with first report due in 2028) for large EU companies and to financial years starting on or after 1st January 2028 (with first report due in 2029) for listed SMEs.

Learn more about EU ESG reporting standards and their implementation timelines.

Corporate Sustainability Due Diligence Directive (CSDDD)

The Corporate Sustainability Diligence Directive (EU) 2024/1760, last revised by the so-called “stock the clock” amendment (Directive (EU) 2025/794), came into force on 25 July 2024. In short, this directive requires large companies to identify, prevent and mitigate adverse human rights and environmental impacts throughout their value chains. The scope of the CSDDD and deadlines for implementing due diligence policies have been revised as part of the stop-the-clock amendment. The application of due diligence obligations for the first wave of in-scope companies has been deferred by one year (starting from 16 July 2028) for the first wave of in-scope companies (companies with more than 3000 employees and turnover > 900 million euros).

United States: State-Level Innovation

California Climate Disclosure Laws

California’s SB 253 requires companies with annual revenues exceeding US$1 billion and operating in California to disclose their Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions. Beginning in 2026, companies must report Scope 1 and Scope 2 emissions for the prior fiscal year and obtain “limited assurance” on those disclosures. Mandatory reporting of Scope 3 emissions will follow in 2027.

Originally, the bill directed the California Air Resources Board (CARB) to establish the implementing regulations by January 1, 2025. However, following the filing of a motion for preliminary injunction, the deadline for making regulations was pushed to July 2025.

SB 261 (Climate-Related Financial Risk Act) will require entities with total annual revenues over US$500 million that operate in California to publish, every two years on their website, “climate-related financial risk” information in accordance with the TCFD and ISSB standards.

SEC Climate Rules

The Securities and Exchange Commission continues developing comprehensive climate disclosure requirements for public companies, including governance processes, strategy, risk management, and metrics related to climate change. The final rules, titled “The Enhancement and Standardization of Climate-Related Disclosures for Investors” will require registrants to include specified climate-related information in their registration statements and annual reports. The final rules were scheduled to take effect on May 28, 2024. However, the SEC has decided to voluntarily postpone their effective date after the rules were challenged in court.

Developments in other US States

Following the path of California, a number of US States have attempted to introduce similar climate disclosure bills.

Colorado introduced House Bill 25-1119, known as the “Greenhouse Gas Emissions Act” on 28 January 2025. The bill – which ultimately failed to pass the 2025 legislative session- would have required companies operating in Colorado (including subsidiaries) with revenues above one billion US dollars to publicly disclose their Scope 1 and Scope 2 emissions (starting from 2028 and annually thereafter) as well as Scope 3 emissions (with partial disclosures for purchased goods, capital goods and product use) from financial year 2029.

New Jersey and Illinois also introduced similar legislation in February 2025. New Jersey Senate Bill 4117, also known as the “Climate Corporate Data Accountability Act,” would require entities doing business in the state with annual revenues in excess of one billion dollars to publish data about their annual GHG emissions and to report to the Department of Environmental Protection (DEP). Illinois House Bill 3673 (“Climate Corporate Accountability Act”) will require US businesses doing business in Illinois with over one billion US dollars in annual revenue to disclose their greenhouse gas emissions through a phased reporting timeline beginning in 2027. The disclosures must be made in accordance with SEC climate disclosure rules, which are to be adopted by the Secretary of State by 1 July 2026. This bill failed to pass before the legislature was adjourned in May 2025.

New York Senate Bill 3456 (Climate Corporate Accountability Act) was tabled on 27 January 2025 as an updated version of Senate Bill 897A which failed to pass in 2023. SB 3456 is very similar to California’s Bill 253 (Climate Accountability Act) in that it requires companies with annual revenues in excess of USD 1 billion doing business in New York State to disclose their Scope 1 and 2 GHG emissions starting in 2027 and Scope 3 emissions starting in 2028, with annual reporting thereafter.

United Kingdom: Post-Brexit Leadership

UK General Requirements for Disclosure of Sustainability-related Financial Information, Draft Standard SRS S1, June 2025

On 25 June 2025, the UK Department for Business and Trade launched a public consultation on the Exposure Drafts of the UK Sustainability Reporting Standards (UK SRS) S1 (General Requirements for Sustainability-related Financial Disclosure) and S2 (Climate-related Disclosures). The Exposure draft standards are based on the IFRS Sustainability Disclosure Standards S1 and S2 with six proposed amendments on implementation deadlines, transition reliefs and other reporting requirements. The proposed amendments include among other things, a proposal to remove the transition relief in IFRS S1 that permits delayed reporting in the first year and the inclusion of IFRS S2 relief which, on the other hand, allows companies to report only on climate-related matters during the first two annual reporting periods (climate first approach). The consultation is open until 17 September 2025.

UK Sustainability Disclosure Requirements (SDR)

The UK’s sustainability disclosure framework requires investment managers and financial advisors to provide clear information about the sustainability characteristics of their products and portfolios.

Asia and Asia-Pacific: Rapid Development

Singapore’s Climate Disclosure Requirements

The Singapore Exchange (SGX) published a new consolidated version of the Sustainability Reporting Rules on 1 January 2025. The updated rules now require listed companies to include in their financial reports for financial year 2025 (and annually thereafter) a sustainability report containing the disclosures specified in Practice Note 7.6 and 7F of the SGX Rulebook. Listed companies must prepare their reports in line with IFRS S1 and S2 standards, including assessment of material ESG factors and the policies, practices and performance in relation to the factors and the targets in relation to the factors identified. For baseline climate-related disclosures, companies are required to disclose information on climate risks and opportunities in accordance with IFRS S2, with the exception of Scope 3 GHG emissions. In doing so, they must also apply the climate-related provisions set out in IFRS S1.

Hong Kong’s ESG Reporting Requirements

Enhanced ESG reporting requirements for listed companies are established under HKFRS S1 and HKFRS S2. These standards set out enhanced mandatory sustainability and climate disclosure requirements which are fully aligned with the IFRS Sustainability Disclosure Standards standards, IFRS S1 and S2. HKFRS 1 and HKFRS came into force on 1 August 2025. HKFRS S1 and S2 will be rolled out gradually, with large publicly accountable entities required to comply by 2028.

Japan’s SSBJ Standards

In March 2025, Japan introduced its first sustainability reporting framework, known as the SSBJ Standards. These are composed of three Sustainability Disclosure Standards:

- Universal Sustainability Disclosure Standard – Application of the Sustainability Disclosure Standards (“Application Standard”)

- Theme-based Sustainability Disclosure Standard No. 1 – General Disclosures (“General Standard”)

- Theme-based Sustainability Disclosure Standard No. 2 – Climate-related Disclosures (“Climate Standard”)

Similarly, these standards closely align with the IFRS Sustainability Disclosure Standards. The SSBJ Standards do not specify which companies will be subject to mandatory reporting nor do they contain any specific compliance deadlines. These details are expected to be clarified through future laws and regulations.

Malaysia’s National Sustainability Reporting Framework (NSRF)

Malaysia’s National Sustainability Reporting Framework (NSRF) was released on 24 September 2024 by the Securities Commission Malaysia. The framework integrates the IFRS Sustainability Disclosure Standards. It applies to listed issuers on Bursa Malaysia’s Main and ACE Markets, as well as to large non-listed companies (NLCos) with annual revenues of RM2 billion or more. The framework will be implemented through a phased/developmental approach that takes into account companies’ varying levels of readiness to adopt the ISSB Standards and the maturity of their sustainability reporting practices.

Nepal: Development of National Sustainability Reporting Standards

A consultation was launched on 16 July 2025 by the Accounting Standards Board Nepal (ASBN) to support the development of Nepal Sustainability Reporting Standards (NSRS). According to ASBN, the future NSRS will largely align with the requirements of IFRS S1 and IFRS S2.

Australia

The Australian Sustainability Reporting Standards were officially adopted in September 2024. The reporting standards essentially comprise ASSB S1 on General Requirements for Disclosure of Climate-related Financial Information and ASSB S2 on Climate-related Financial Disclosures. Both standards were developed using IFRS S1 and S2 as their baseline. Unlike IFRS S2, however, the scope of AASB S1 is restricted to climate-related financial disclosures. By contrast, AASB S2 constitutes the only mandatory sustainability reporting standard under the Corporations Act. Consistent with IFRS S2, AASB S2 requires entities to disclose information on climate-related risks and opportunities that could reasonably be expected to influence cash flows, access to finance, or cost of capital over the short, medium, or long term. The standard also mirrors IFRS S2 in structure, covering the same core content areas: governance, strategy, risk management, and metrics and targets.

The Australian Accounting Standards Board is considering amending ASSB S2 to introduce additional reliefs for specific greenhouse gas emissions disclosures. This includes GHG associated with derivatives, investment banking and insurance underwriting, application of the Global Industry Classification Standard; use of Greenhouse Gas Protocol measures and the use of global warming potential value.

South America

Mexico: Application of Standards IFRS S1 and S2 on Sustainability and Climate Disclosures, Resolution, January 2025

Sustainability and climate reporting requirements for securities market participants were introduced through a Resolution amending the General Provisions applicable to Issuers of Securities and other Market Participants. Under this Resolution, issuers submitting financial reports pursuant to the Securities Market Law are required to disclose sustainability and climate-related information in line with the IFRS Sustainability Disclosure Standards. The information must be reported for the first time in 2026 for the financial year 2025.

From Reactive Reporting to Proactive Horizon Scanning

The shift from compliance-driven reporting to strategic regulatory intelligence represents a fundamental change in how organizations approach ESG management.

Traditional Reactive Approach

Most organizations operate reactively, responding to regulatory requirements only after they’re finalized. This approach creates several problems:

- Insufficient preparation time for complex reporting requirements

- Higher implementation costs due to rushed compliance efforts

- Limited ability to influence regulatory development through consultation processes

- Missed opportunities to gain competitive advantage through early adoption

Proactive Horizon Scanning

Leading organizations implement systematic horizon scanning to identify regulatory trends 12-24 months before implementation. This approach enables:

Strategic Planning Integration

Early regulatory intelligence allows organizations to integrate compliance requirements into strategic planning cycles. Instead of treating regulatory compliance as an operational burden, it becomes part of strategic decision-making.

Resource Optimization

Advance knowledge of regulatory requirements enables efficient resource allocation. Organizations can build necessary capabilities gradually rather than scrambling to meet sudden deadlines.

Stakeholder Engagement

Early awareness of regulatory developments creates opportunities to participate in consultation processes, potentially influencing final requirements to better align with business realities.

Competitive Positioning

Organizations that anticipate regulatory changes can position themselves advantageously – developing products that meet emerging requirements or building capabilities that competitors lack.

How Leading Organizations Monitor ESG Regulatory Changes

Successful ESG regulatory monitoring requires systematic processes that combine technology, expertise, and organizational integration.

Centralized Monitoring Infrastructure

Leading organizations establish dedicated regulatory monitoring functions that serve the entire enterprise. This avoids duplication of effort and ensures consistent interpretation of regulatory requirements across different business units.

Cross-Functional Coordination

Effective regulatory monitoring involves multiple stakeholders:

- Legal teams for regulatory interpretation and compliance strategy

- Operations teams for implementation feasibility assessment

- Finance teams for cost impact analysis and reporting requirements

- Communications teams for stakeholder engagement and disclosure coordination

Continuous Assessment and Adaptation

Regulatory monitoring isn’t a one-time setup – it requires continuous refinement based on:

- Changes in business operations and geographic footprint

- Evolution of regulatory priorities and enforcement patterns

- Feedback from compliance implementation experiences

- Stakeholder expectations and industry best practices

Documentation and Audit Trail

Comprehensive regulatory monitoring includes systematic documentation of:

- Regulatory assessment decisions and rationales

- Stakeholder communications and consultations

- Implementation timelines and milestone achievements

- Compliance evidence and supporting documentation

Beyond Monitoring: Building Comprehensive Compliance Infrastructure

While regulatory monitoring provides critical intelligence, it represents just the first step in building robust ESG compliance capabilities.

Requirements Management

Once regulatory changes are identified, organizations need systematic processes to:

- Extract specific requirements from complex regulatory texts

- Map requirements to existing policies and procedures

- Identify gaps requiring new processes or capabilities

- Track implementation progress across multiple workstreams

Compliance & Risks’ Requirements Management solution helps capture, analyze and manage all requirements impacting your products and markets with live-links to regulations and standards.

Evidence Collection and Management

ESG regulations increasingly require detailed documentation and evidence of compliance efforts. This includes:

- Data collection systems for quantitative metrics

- Process documentation for qualitative assessments

- Stakeholder engagement records and outcomes

- Third-party verification and assurance arrangements

Integrated Reporting Preparation

Modern ESG reporting requirements demand integration across multiple frameworks and standards. Organizations need capabilities to:

- Consolidate data from multiple sources and systems

- Ensure consistency across different reporting requirements

- Manage disclosure review and approval processes

- Coordinate external assurance and verification activities

Continuous Improvement

ESG compliance capabilities must evolve continuously based on:

- Regulatory feedback and enforcement actions

- Stakeholder expectations and industry benchmarks

- Internal process efficiency and effectiveness metrics

- Technological advances and automation opportunities

The most effective approach combines regulatory monitoring with comprehensive compliance infrastructure, creating an integrated system that transforms regulatory requirements from operational burden to strategic advantage.

Regulatory monitoring technology has reached a maturity point where manual tracking is not just inefficient – it’s a strategic liability. Organizations that continue relying on fragmented, reactive approaches to regulatory compliance expose themselves to unnecessary risks and miss opportunities to build competitive advantages through proactive compliance leadership.

The solution lies in combining comprehensive monitoring coverage with intelligent prioritization, seamless workflow integration, and continuous capability development. This approach transforms regulatory compliance from a defensive necessity into a source of strategic insight and operational excellence.

Frequently Asked Questions

- Q: How often do ESG regulations change globally?

Major jurisdictions introduce or significantly modify ESG regulations approximately every 6-8 weeks. However, the pace varies by region, with the EU leading in frequency of new requirements, followed by individual US states and Asia-Pacific countries. Minor updates, clarifications, and guidance documents are published even more frequently. - Q: What’s the typical implementation timeline for new ESG regulations?

Implementation timelines have shortened significantly in recent years. Major regulations typically provide 12-18 months for implementation, while emergency measures or amendments may have timelines as short as 6 months. However, complex requirements like scope 3 emissions reporting often include phased implementation over 2-3 years. - Q: How do I prioritize which regulations to focus on first?

Prioritization should be based on four key factors: (i) direct legal applicability to your organization; (ii) implementation timeline urgency; (iii) potential financial and reputational impact of non-compliance; and (iv) strategic importance to your stakeholders. Organizations should also consider their current capability gaps and resource constraints when setting implementation priorities. - Q: Can automated systems replace human expertise in regulatory monitoring?

While automation significantly improves coverage and efficiency, human expertise remains essential for regulatory interpretation, materiality assessment, and strategic decision-making. The most effective systems combine comprehensive automated monitoring with expert analysis and customized interpretation. Compliance & Risks’ team of subject matter experts provides this crucial human expertise alongside advanced monitoring technology. - Q: How far in advance should we start preparing for new regulations?

Best practice is to begin preparation as soon as proposed regulations are published for consultation, typically 18-24 months before implementation. This timeline allows for capability development, system implementation, stakeholder engagement, and iterative improvement based on final regulatory requirements. - Q: What happens if we miss a regulatory deadline?

Consequences differ across jurisdictions and the severity of regulations but often involve fines, corrective requirements, stricter oversight, or operational restrictions. More significantly, failing to comply can harm stakeholder trust and reduce competitiveness. - Q: How do we ensure regulatory monitoring covers all relevant jurisdictions?

Comprehensive coverage requires mapping your organization’s operational footprint, customer base, supply chain locations, and regulatory nexus points. This includes not just physical presence but also revenue sources, data processing activities, and financial market participation that may trigger regulatory obligations. - Q: Should we build internal regulatory monitoring capabilities or use external services?

Most organizations benefit from a hybrid approach – using external services for comprehensive coverage and expert interpretation while building internal capabilities for strategic assessment, implementation planning, and stakeholder coordination. The optimal balance depends on your organization’s size, complexity, and regulatory risk profile.

Ready to transform your regulatory monitoring from reactive scrambling to proactive strategic advantage? Discover how comprehensive regulatory intelligence through C2P can position your organization ahead of compliance deadlines while reducing operational complexity. Experience firsthand how modern monitoring systems provide the clarity and confidence you need to navigate the evolving ESG landscape successfully.

Stay Ahead Of Regulatory Changes in Sustainability

Want to stay ahead of regulatory developments in sustainability?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.