The Real Cost of Non-Compliance: How Market Access Risk Can Derail Your Revenue for 18+ Months

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Organizations invest years and substantial capital in research and development to bring products to market. Teams refine products, prepare marketing strategies, and establish launch timelines across the enterprise. Then regulatory correspondence arrives.

The FDA issues a “Refuse to Receive” notification. A European Notified Body questions clinical evidence for CE mark approval under the Medical Device Regulation. The carefully planned launch timeline extends from weeks to months, potentially exceeding a year. Competitors gain unexpected market advantages during this delay.

This represents the operational reality of market access risks stemming from non-compliance. The challenge extends beyond financial penalties or administrative complications to encompass catastrophic losses in time, market opportunity, and revenue generation.

Many organizations conceptualize compliance risk primarily through the lens of regulatory penalties – moderate fines or warning letters. This perspective significantly underestimates the actual threat: complete market exclusion rather than financial penalties.

This article provides strategic analysis for leadership teams requiring comprehensive understanding of the commercial consequences of compliance failure. We examine how these risks manifest across US and EU jurisdictions, evaluate emerging threats that many organizations have not adequately prepared for, and present a framework for transforming compliance from defensive obligation into competitive advantage.

Table of Contents

- The Two Faces of Market Access Denial: US Fines vs. EU Lockouts

- US Market Access Risk: The 182-Day Delay That Costs Millions

- EU Market Access Risk: The Catastrophe of a Withdrawn CE Mark

- The Emerging Threat Most Teams Aren’t Ready For: AI & Data Integrity

- Your Proactive Defense: A 5-Step Framework for Securing Market Access

- Key Takeaways: Understanding Market Access Risk

- Frequently Asked Questions

- From Reactive Compliance to Strategic Command

The Two Faces of Market Access Denial: US Fines vs. EU Lockouts

Global compliance management requires understanding fundamental differences between major market regulatory philosophies. The United States and European Union, representing the world’s two largest markets, implement distinctly different enforcement approaches. Understanding these differences proves critical for accurate risk assessment.

The US regulatory model employs primarily punitive enforcement. The FDA permits market entry but imposes severe consequences for violations, including civil money penalties, injunctions, and criminal prosecution for executives in egregious cases. The risk manifests primarily as financial and legal liability after products reach the market.

The EU operates as a strict gatekeeper, particularly under regulations like the Medical Device Regulation (MDR). Organizations must demonstrate comprehensive compliance before market placement. Non-compliance results not in fines but in market access denial. Without CE mark certification, products cannot enter the European market under any circumstances.

Industry observers frequently focus on high-profile FDA penalties due to their headline appeal. However, from a strategic business perspective, the critical question becomes: which poses greater risk – predictable financial penalties or indefinite exclusion from the world’s second-largest economy? The genuine cost lies not in penalties but in lost revenue from inaccessible markets.

US Market Access Risk: The 182-Day Delay That Costs Millions

The FDA’s Refuse to Receive (RTR) letter represents one of the most financially consequential documents in regulated product development, yet discussions rarely address its commercial implications comprehensively.

RTR notifications are not simple rejections but declarations that submissions contain such significant deficiencies that formal FDA review cannot commence. These determinations can stem from various issues including Good Manufacturing Practice violations, inadequate impurity limits in pharmaceuticals, misbranding, or insufficient performance data for medical devices.

While statutory penalties for these violations may appear manageable, the actual cost manifests through time delays.

Research data reveals that RTR letters for generic drug submissions result in median resubmission delays of 182 days. This represents six months of intensive remediation efforts simply to return to the initial review stage. Median figures only tell part of the story – these initial delays can extend total approval timelines by 16 to 18 months.

Consider the financial implications for a new product with projected annual revenue of $50 million. A 16-month delay does not merely postpone revenue – it fundamentally alters market dynamics.

A 16-month delay eliminates approximately $67 million in revenue opportunity. Competitors gain 16 months to establish market dominance or launch competing products. First-mover advantages disappear entirely. Investor and stakeholder confidence deteriorates significantly.

This represents the hidden cost structure of US non-compliance. The risk is not a $20,000 labeling penalty but a $67 million opportunity cost triggered by that labeling deficiency causing RTR. Organizations must shift focus from penalty avoidance to delay prevention. The latter carries substantially higher financial consequences. Achieving this requires robust product compliance strategies that anticipate regulatory scrutiny well before submission.

EU Market Access Risk: The Catastrophe of a Withdrawn CE Mark

While the US system creates costly delays, the EU system under the Medical Device Regulation functions as a formidable market barrier. Entry requirements have intensified, and organizations failing to maintain compliance face market expulsion.

The EU MDR has substantially elevated requirements, demanding more rigorous clinical evidence, comprehensive technical documentation, and proactive post-market surveillance. The transition has proven so challenging that significant numbers of medical devices face potential European market withdrawal. Many manufacturers choose voluntary product withdrawal rather than pursue costly, complex recertification processes.

Consider a real-world case study analyzed by Munich Re. A manufacturer of implantable medical devices experienced CE certificate suspension and eventual withdrawal due to Quality Management System breakdown. The issue was not product failure but inadequate documentation and process controls. Their QMS could not provide objective evidence required by the Notified Body during audit.

The consequences were immediate and severe. Total market withdrawal occurred with all products immediately removed from the EU market. Brand reputation with distributors, hospitals, and patients eroded instantly. CE mark suspension frequently triggers scrutiny from other regulatory bodies globally who rely on that certification as evidence of compliance.

Unlike FDA RTR scenarios, no expedited resubmission pathway exists. Re-establishing a failed QMS and regaining CE mark certification can require years, if achievable at all. The entire European revenue stream for affected product lines is eliminated indefinitely.

This highlights the fundamental shift in EU compliance philosophy. Single-instance compliance no longer suffices. Organizations must demonstrate continuous compliance. This requires corporate sustainability and regulatory vigilance capabilities that many organizations lack structurally.

The Emerging Threat Most Teams Aren’t Ready For: AI & Data Integrity

While many companies continue addressing RTR and MDR challenges, two additional risk categories are emerging: artificial intelligence regulation and fundamental data integrity requirements.

When AI Meets Medical Devices: A New Compliance Minefield

Software as a Medical Device (SaMD) is expanding rapidly, with AI-powered diagnostic tools leading this growth. However, this innovation introduces complex new regulatory risk layers.

Regulators now scrutinize not only devices but the underlying algorithms. The EU AI Act imposes stringent requirements supplementing EU MDR obligations.

Consider the compliance implications. Algorithmic bias presents significant risk – if AI diagnostic tools train on non-diverse datasets, accuracy may vary across populations. Under the EU AI Act, this constitutes major compliance failure regarding fairness and robustness requirements. Data quality has become a regulatory concern following the principle of “Garbage In, Garbage Out.” Organizations must prove the quality, relevance, and governance of data used for AI model training. Explainability requirements demand that organizations explain to regulators how AI systems reach specific decisions. “Black box” algorithms face intensive scrutiny.

Failure in any area could invalidate CE marks under MDR and create EU AI Act violations. This is not a future consideration – companies planning 2025-2026 product roadmaps must develop these compliance frameworks currently.

The Domino Effect of a Single Data Error: The UDI/GMDN Trap

While AI represents complex, high-level risk, equally dangerous threats exist at the opposite spectrum: fundamental data management. Specifically, Unique Device Identification (UDI) and Global Medical Device Nomenclature (GMDN) codes.

These codes form the foundation of modern device tracking, supply chain management, and post-market surveillance. Simple typographical errors or GMDN code misclassifications may appear as minor administrative mistakes. They are not.

A single data error can trigger cascading failure. The UDI record in regulatory databases such as FDA’s GUDID or Europe’s EUDAMED becomes flagged as invalid. Shipments arriving at ports of entry face customs officer system flags indicating mismatches between physical UDI labels and official databases. Containers are detained indefinitely. Even if shipments clear customs, hospital inventory systems scanning devices with invalid UDI codes reject products because they cannot track them in their systems – a critical patient safety requirement. When recalls are issued, corrupt UDI data prevents effective tracking and retrieval of affected devices, creating massive patient safety risks and regulatory penalties.

One minor data entry error halts entire supply chains, invalidates products for customers, and creates substantial public health risks. This represents a logistical reality stemming from failure to treat compliance data with appropriate rigor.

Your Proactive Defense: A 5-Step Framework for Securing Market Access

Understanding these risks need not lead to organizational paralysis. Catastrophic failures are almost always preventable. They occur when compliance functions as final-stage, reactive checklist processes rather than proactive, integrated business functions.

The following framework enables regulatory leaders to transition from defensive postures to command and control positions. This approach supports justification of necessary investments in personnel, processes, and technology to executive leadership.

Step 1: Conduct a Global Compliance Audit

Organizations cannot address invisible issues. Begin by mapping every product against every market where sales occur. Extend beyond major regulations to include national standards, labeling requirements, and substance restrictions. The objective is creating a single source of truth for the organization’s regulatory footprint.

Step 2: Prioritize Risks by Commercial Impact

Not all compliance gaps warrant equal treatment. Labeling errors on low-volume products in minor markets differ fundamentally from QMS flaws threatening CE marks for flagship devices. Apply “cost of delay” and “market withdrawal” scenarios to rank risks. This transforms discussions from “compliance” to “revenue protection.”

Step 3: Stress-Test Your Data & Documentation

Assume technical files and QMS will face audit immediately. Assess readiness. Assign “red team” personnel to actively identify inconsistencies. Pay particular attention to data traceability. Can the organization prove source and validity of every claim in clinical evaluation reports? Can UDI tracking occur from factory floor to end-user without gaps?

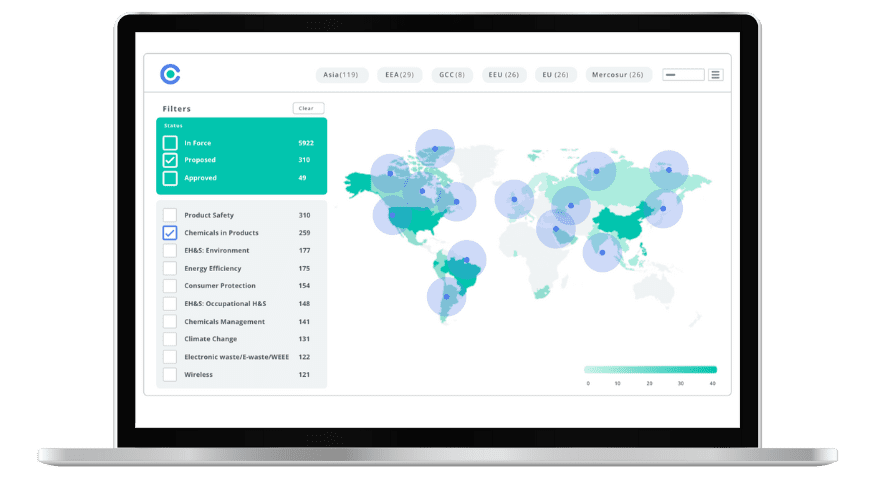

Step 4: Centralize Your Regulatory Intelligence

Organizations still relying on manual searches, email newsletters, and ad-hoc consultant updates for regulatory change tracking are falling behind. Global regulation pace and complexity demand centralized platforms. These systems should not only alert organizations to changes but also assess impact on specific product portfolios. Effective compliance management requires a single, authoritative intelligence source.

Step 5: Translate Compliance Metrics into Business KPIs

Make investment cases by employing business language. Rather than discussing “closing CAPAs,” frame conversations around “reducing risk of 182-day launch delays.” Instead of “updating technical files,” discuss “securing 100% of European market revenue.” When compliance is positioned as a direct enabler of speed-to-market and revenue assurance, it transforms from cost center to strategic partner.

Key Takeaways: Understanding Market Access Risk

What is market access risk in regulatory compliance? Market access risk refers to the potential for regulatory non-compliance to prevent or delay product entry into target markets, resulting in substantial revenue loss and competitive disadvantage that often exceeds direct penalty costs by orders of magnitude.

How long can regulatory delays impact product launches? FDA Refuse to Receive letters create median delays of 182 days for resubmission alone, with total approval timelines extending 16-18 months. EU CE mark withdrawals can eliminate market access indefinitely, potentially requiring years for remediation.

Why is EU compliance more challenging than US compliance? The EU employs a gatekeeper model requiring demonstrated compliance before market entry, while the US uses a punitive model allowing market entry with penalties for violations. EU non-compliance results in complete market denial rather than financial penalties.

How do small data errors create major compliance problems? Single errors in UDI or GMDN codes can invalidate regulatory database records, trigger customs holds, cause hospital rejections, and compromise recall effectiveness, creating cascading failures across the entire supply chain and patient safety systems.

Frequently Asked Questions

- Q: What is the single biggest market access risk companies underestimate?

The cascading effect of minor errors represents the most underestimated risk. Most leadership teams prepare for significant, obvious product failures. They do not prepare adequately for complete European market access revocation due to inadequate QMS documentation maintenance, or for shipment detention at customs due to UDI data mismatches. These incremental failures pose the largest unmanaged risk category. - Q: Our company has a dedicated regulatory team. Isn’t that enough?

Skilled teams are essential, but organizational leaders must evaluate the tools provided to these teams. In today’s regulatory landscape, asking regulatory teams to manage global compliance using spreadsheets and email resembles asking finance teams to operate without accounting software. The volume, velocity, and complexity of regulatory change have exceeded manual method capabilities. Teams require centralized platforms to function effectively and strategically rather than purely reactively. - Q: We operate in a niche industry. Do these broad risks really apply to us?

These risk mechanisms apply universally across industries. While specific regulations differ, risk mechanisms remain consistent. Whether manufacturing industrial machinery, consumer electronics, or medical devices, organizations face market entry requirement risks such as CE marking or UL certification, data integrity challenges including part numbers and substance declarations, and post-market obligations. Proactive compliance principles and commercial costs of delays transcend industry boundaries. - Q: How can we justify the investment in compliance technology to our executive team?

Frame compliance technology investments through business impact metrics. Quantify the cost of 182-day launch delays using projected product revenue. Calculate European market revenue protected by robust QMS systems. Present compliance platforms as revenue protection and speed-to-market enablers rather than cost centers. When executive teams understand that compliance technology investments prevent multimillion-dollar revenue losses, approval becomes significantly easier.

From Reactive Compliance to Strategic Command

The distinction between market leaders and cautionary tales often reduces to their fundamental approach to compliance.

One perspective treats compliance as a tax – a cost requiring minimization, a hurdle cleared at the latest possible moment. The alternative perspective recognizes compliance as a strategic asset – a mechanism for developing safer products, entering markets with greater speed and predictability, and creating durable competitive advantages.

The risk of losing 18 months of revenue on new product launches is not a regulatory problem but a business catastrophe. Prevention requires more than skilled teams. It demands fundamental strategic reorientation and appropriate technology to transform global regulatory complexity into clear, manageable, actionable plans.

When organizations integrate regulations management, requirements management, and evidence management into centralized platforms covering over 30,000 global regulations and standards across 195 countries, they establish more than operational efficiency. They create the foundation for predictable market access, accelerated time-to-market, and sustainable competitive advantage in increasingly regulated global markets. This transformation positions compliance not as an obstacle to overcome but as a strategic capability that directly enables revenue growth and market leadership.

Experience the Future of ESG Compliance

The Compliance & Risks Sustainability Platform is available now with a 30-day free trial. Experience firsthand how AI-driven, human-verified intelligence transforms regulatory complexity into strategic clarity.

👉 Start your free trial today and see how your team can lead the future of ESG compliance.

The future of compliance is predictive, verifiable, and strategic. The only question is: Will you be leading it, or catching up to it?

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.