The Volatility Tax: Why Your Compliance Risk Score is Already Out of Date

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

A notification arrives. It represents a regulatory alert from a new agency, in a new language, addressing technology the organization is only beginning to understand. In that moment, the entire compliance framework, meticulously updated throughout the previous quarter, becomes historical documentation. It is obsolete.

This is not a hypothetical scenario but the daily reality for compliance leadership. Organizations are no longer simply managing risk – they are paying a hidden “volatility tax” on every manual process, every siloed department, and every static spreadsheet maintained.

The cost of that tax is escalating rapidly.

In the first half of 2025 alone, regulatory penalties for global financial institutions surged 417%. This represents an increase to $1.23 billion in six months. The regulatory landscape has fundamentally changed. Regulators are pursuing fewer cases but imposing substantially higher penalties, with U.S. penalties increasing 83% to $5.44 billion driven by high-impact enforcement actions.

The fundamental truth is that the traditional model of periodic risk assessments is broken. It resembles using a paper map to navigate a city where streets rearrange nightly. Organizations experiencing this friction are seeking better approaches – systems that do not merely react to change but anticipate it.

This article is not another high-level analysis explaining that regulatory volatility is problematic. Organizations are experiencing it directly. Instead, this provides a technical blueprint for resolution. We examine how to transition from reactive crisis management to proactive, continuous compliance models built on dynamic risk intelligence.

Table of Contents

- The New Math of Non-Compliance

- Decoding the Sources of Volatility

- The Antidote to Volatility: Dynamic Risk Scoring Explained

- Building Your Architecture for Continuous Compliance

- Key Takeaways: Your Shift to Proactive Compliance

- Frequently Asked Questions

- From Fear to Foresight: The Next Step

The New Math of Non-Compliance

For years, compliance costs were viewed as necessary business expenses. However, research now demonstrates that non-compliance costs are 2.71 times greater than maintaining proper compliance. This represents a straightforward calculation with devastating consequences.

The core problem is not insufficient effort but reliance on outdated tools. Recent surveys found that 47% of U.S. compliance teams cite manual workflows as their biggest obstacle to maintaining pace. Organizations are attempting to compete in high-speed environments with inadequate infrastructure.

Regulatory volatility encompasses three combined factors. Frequency represents the sheer volume of new and updated regulations. Speed reflects the shrinking timeline between rule announcement and enforcement dates. Ambiguity stems from vaguely worded regulations creating uncertainty and requiring constant monitoring for clarification through court rulings and enforcement actions.

When these forces are analyzed collectively, legacy system failures become evident. The risk environment is no longer linear but exponential.

This introduces the concept of a “volatility tax” – the premium organizations pay in time, resources, and risk exposure for every day they operate with static compliance views.

Decoding the Sources of Volatility

Managing this new risk landscape requires understanding where disruptions originate. Risk triggers no longer stem solely from predictable agency rulemakings. They are faster, more interconnected, and emerging from multiple sources simultaneously.

High-Velocity Regulatory Silos: Where Risk Overlaps

Certain domains are evolving at unprecedented pace, and critically, they are interconnecting. Changes in one area instantly elevate risk profiles in others.

Artificial Intelligence represents just the beginning with the EU AI Act. With potential fines reaching €35 million or 7% of global turnover, it represents significant enforcement. However, deeper analysis reveals that new requirements for data governance in AI models do not create isolated “AI risk.” They immediately trigger data privacy risk, cybersecurity risk, and third-party vendor risk. AI-related privacy incidents already surged 56.4% in 2024. When departments operate in silos, these connections remain invisible until problems emerge.

Data Privacy in the post-GDPR world represents a patchwork of evolving state and national laws. Compliance status changes continuously. This constant evolution affects everything from marketing operations to product development.

ESG and Sustainability regulations like the Corporate Sustainability Reporting Directive are transforming voluntary initiatives into hard legal obligations. Supply chain due diligence, carbon emissions data, and labor practices are now under regulatory microscopes.

The biggest mistake organizations make is treating these as separate issues. They are interconnected risk networks. Modern compliance programs do not merely track individual nodes – they map connections between them.

From Geopolitics to Compliance Tasks: Closing the Intelligence Gap

Consider the last major geopolitical event – new trade tariffs, sanctions packages, sudden political shifts. How long did it take for teams to translate headlines into concrete action sets? How many teams required consultation?

This represents the intelligence gap. Traditional news feeds and high-level consulting firm briefings provide useful context but do not deliver actionable compliance intelligence. They indicate that storms are approaching without specifying which organizational vulnerabilities require immediate attention.

The information sources are expanding. As industry reports note, significant regulatory shifts can now originate from court decisions or legal filings, well before official rules are written.

Closing this gap requires new listening capabilities. Organizations must monitor wider source ranges – from official gazettes and regulatory dockets to specialized risk indicators like the BlackRock Geopolitical Risk Indicator – and use technology to immediately map external triggers to specific internal controls.

The Antidote to Volatility: Dynamic Risk Scoring Explained

The problem is clear: the world changes too rapidly for static, annual risk assessments. What is the solution?

It requires a fundamental methodological shift from periodic snapshots to live, streaming views of risk posture. This is Dynamic Risk Scoring.

This is not what most GRC platforms deliver. Many function as little more than digital filing cabinets – places to store policies and track audit tasks. A DRS system functions as an active intelligence engine.

A static risk model relies on historical data and subjective interviews. Scores are assigned and remain unchanged until next year’s review. Dynamic models, however, update in near real-time based on constant new information feeds.

Consider this framework: Dynamic Risk Score equals Baseline Risk plus Regulatory Volatility Adjustment plus Real-Time KRI Deviation.

Baseline Risk represents initial assessment – the inherent risk of specific processes or assets. Regulatory Volatility Adjustment represents the transformative element. When new regulations are proposed, AI-powered intelligence platforms ingest the text. Natural Language Processing identifies key obligations, dates, and applicability. The system then automatically maps these to products, business units, and controls, adjusting risk scores of every affected item instantly. Real-Time KRI Deviation integrates with internal Key Risk Indicators. When controls fail internal tests or thresholds are breached, risk scores adjust automatically.

This is not theoretical. This is how organizations close the gap between regulatory events occurring globally and their ability to respond. Instead of frantic, manual scrambling to determine impact, systems indicate instantly: “This new data residency law in Vietnam impacts these three product lines and increases risk scores on these seven data processing controls.”

Organizations move from discovering what happened yesterday to knowing what they need to do tomorrow.

Building Your Architecture for Continuous Compliance

Adopting Dynamic Risk Scoring extends beyond implementing new software. It requires building new operational architecture designed for speed and clarity. The core principle involves breaking down functional silos that create blind spots. Surveys found that only 39% of compliance functions are fully integrated. This represents massive vulnerability.

Centralized intelligence platforms become the “single source of truth,” connecting Legal, Compliance, InfoSec, Audit, and Product teams. When everyone accesses the same real-time risk data, conversations shift from “Whose problem is this?” to “How do we solve this together?”

A simple three-step framework for implementation follows.

- Step 1: Ingest & Centralize. The first step involves automating regulatory intelligence ingestion. This means replacing manual tracking with systems that pull from thousands of global sources, from government bodies to standards organizations, in real-time.

- Step 2: Map & Score. This represents the dynamic model core. Platforms map every piece of regulatory intelligence to specific obligations, policies, and controls. This is where initial risk scoring occurs, creating baselines.

- Step 3: Automate & Monitor. With the foundation established, organizations can automate workflows. New regulations can automatically trigger assessments, assign tasks, and require compliance evidence. Systems then continuously monitor for changes, both internal and external, to keep risk scores live and accurate.

The ultimate success metric here is “Time to Compliance” – the duration between new regulation publication and the organization achieving provable, audit-ready compliance states. In a world of volatility, this is the only metric that truly matters.

Key Takeaways: Your Shift to Proactive Compliance

- What is regulatory volatility? It is the combination of increasing frequency, speed, and ambiguity of new regulations, which makes traditional, static compliance methods ineffective and risky.

- Why are manual workflows failing? Manual processes are too slow and siloed to keep up. With 47% of U.S. teams citing this as a key obstacle, automation is no longer optional for managing high-velocity change.

- How does Dynamic Risk Scoring work? Unlike static annual assessments, DRS uses AI-powered intelligence platforms to continuously ingest new regulations, map them to internal controls, and update risk scores in near real-time, providing live views of compliance posture.

- What is the primary benefit of dynamic compliance? Drastically reducing “Time to Compliance” minimizes risk exposure and transforms compliance from reactive cost center into proactive strategic advantage.

Frequently Asked Questions

- Q: Our current GRC system tracks regulations. Isn’t that enough?

Most traditional GRC platforms are systems of record, not systems of intelligence. They can store regulations but often lack sophisticated AI engines needed to interpret regulatory text, automatically map it to hundreds of specific controls, and dynamically adjust risk scores in real-time. They indicate that new rules exist without precisely explaining how they affect the organization and what to do next, instantly. - Q: This sounds complex and expensive to implement. How do we justify the investment?

The justification exists in the numbers. Non-compliance costs are 2.71 times higher than maintaining compliance, and single high-impact fines can reach tens of millions. Investment in intelligence platforms should be weighed against immense financial and reputational costs of breaches caused by missed regulatory changes. Modern SaaS platforms are also designed for faster, more seamless integration than legacy enterprise software. - Q: How can we trust an AI to interpret complex legal and regulatory text?

This is not about replacing human experts but augmenting them. AI functions as extremely powerful and tireless support. It handles heavy lifting – sifting through tens of thousands of documents, identifying changes, and flagging potential impacts – at scales no human team could achieve. This frees legal and compliance experts to focus on highest-value work: strategic analysis, interpretation of nuance, and final validation. - Q: How do we measure success with dynamic risk scoring?

The primary metric is “Time to Compliance” – how quickly the organization can move from regulatory change announcement to provable, audit-ready compliance state. Secondary metrics include reduction in manual hours spent on regulatory tracking, increase in early identification of high-impact regulations, and decrease in compliance-related incidents or near-misses. These metrics demonstrate both efficiency gains and risk reduction.

From Fear to Foresight: The Next Step

The era of predictable, slow-moving regulation has concluded. The volatility tax is real, and companies still relying on manual processes and static risk models are paying it daily.

Surviving and thriving in this environment is possible. It requires shifts in mindset and technology – from reacting to headlines to building systems of continuous, proactive intelligence. By embracing dynamic approaches, organizations can transform compliance from a source of fear into a source of foresight and competitive advantage.

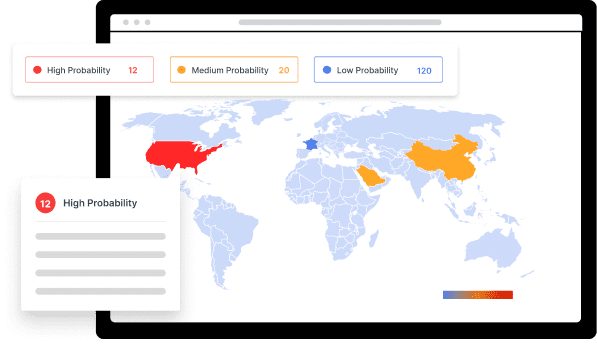

When organizations integrate regulations management, requirements management, and evidence management into centralized platforms tracking over 100,000 global regulations and standards across 195 countries, they establish more than operational efficiency. They create the foundation for transforming regulatory volatility from existential threat into strategic opportunity. This enables organizations to reduce time to compliance, minimize exposure to escalating penalties, and position compliance capabilities as business enablers that accelerate market entry and protect revenue streams in an increasingly unpredictable regulatory landscape.

Schedule a C2P demo and let our experts show you how to build a more resilient compliance framework.

Experience the Future of ESG Compliance

The Compliance & Risks Sustainability Platform is available now with a 30-day free trial. Experience firsthand how AI-driven, human-verified intelligence transforms regulatory complexity into strategic clarity.

👉 Start your free trial today and see how your team can lead the future of ESG compliance.

The future of compliance is predictive, verifiable, and strategic. The only question is: Will you be leading it, or catching up to it?

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.