UK Projects Itself As A Future Sustainable Finance Leader

This blog was originally posted on 15th July, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY SIDDHANT SHAHANE, REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

Introduction

During London Climate and Innovation Forum 2025, the UK Energy Secretary Ed Miliband announced initiatives to help large companies create climate transition plans.

As per the UK Government, the country consistently leads the world in sustainable finance, and impressively, 70% of Financial Times Stock Exchange (FTSE 100) companies have already voluntarily put in place many essential components of a transition plan.

In late June 2025, the government launched consultations on:

- Climate-related transition plan requirements and;

- New UK Sustainability Reporting Standards based on the International Sustainability Standards Board standards to provide clear, comparable information for investors on sustainability related financial risks and opportunities to enable them to make informed investment decisions.

These consultations form part of the first phase of consultations to modernise the UK’s framework for corporate reporting that is fit for the long term.

The UK’s National Contact Point for OECD Guidelines on Responsible Business Conduct (RBC) is being revamped and renamed the Office for Responsible Business Conduct. It will remain part of the Department for Business and Trade (DBT), serving as a central point of contact for UK businesses, trade unions, and civil society.

What Are the Climate-Related Transition Plan Requirements?

This transition plan reinforces the UK Government’s commitment to mandate the FTSE 100 Index companies to develop and implement credible transition plans that align with the 1.5°C goal of the Paris Agreement.

The 1.5°C goal of the Paris Agreement refers to the international commitment to limit global warming to 1.5 degrees Celsius above pre-industrial levels by the end of the century.

Transition planning means businesses set out a roadmap that outlines how they intend to adapt and transform their operations, strategies, and business models to align with their climate goals.

Transition planning has the potential to offer substantial advantages for companies, such as reducing emissions, boosting competitiveness, and lowering borrowing costs.

Developing and Disclosing a Transition Plan

- Option 1: Require entities to explain why they have not disclosed a transition plan or transition plan-related information

- Option 2: Require entities to develop and disclose transition plans

Mandating Companies to Implement Transition Plans

Under options 1 and 2, companies would be legally obligated to ensure their disclosures are reasonable and supportable at the time they’re made. This aligns with the Companies Act 2006, which makes it an offense for directors to knowingly mislead or act recklessly when approving information.

However, neither option would explicitly require companies to actually follow through on the future actions outlined in their transition plans. The UK Government is looking for feedback on whether the government should try to close this gap, or if market forces and investor pressure are enough to push companies to meet their targets.

Aligning Transition Plans to Net Zero by 2050

Currently, no UK law compels individual companies to align their activities with net zero by 2050. However, some UK companies have publicly committed to such alignment, using established tools and frameworks like the Science Based Targets initiative (SBTi), World Benchmarking Alliance, etc to support their claims.

Some options the Government may consider include:

- Introducing a requirement for entities to disclose how aligned their transition plan is with net zero by 2050;

- Introducing a requirement for entities to develop, disclose and implement a transition plan that is aligned with trajectories to meet net zero by 2050, including setting interim targets (5-10 years) aligned with 1.5°C pathways. This could include guidance for international operations and investments.

The UK Government is seeking views on options to take forward climate-related transition plan requirements in order to provide the market with credible and decision-useful information. The deadline for submitting your views is 17 September 2025 and the comments can be submitted here.

Want to get ahead of major UK and EU compliance changes in 2025 and beyond? Check out our webinar-on-demand for updates on sustainability and product compliance.

UK Sustainability Reporting Standards: What’s in the Exposure Drafts?

The UK government is seeking views on the exposure drafts of UK SRS, which are based on IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures.

The objective of UK SRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is to require an entity to disclose information about its sustainability-related risks and opportunities that are useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity.

The objective of UK SRS S2 Climate-related Disclosures is to require an entity to disclose information about its climate-related risks and opportunities that are useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity.

The government proposes 6 minor amendments to the standards for application in a UK context.

Amendment 1 – Removal of the Transition Relief in IFRS S1 that Permits Delayed Reporting in the First Year

- IFRS S1 contains a transition relief (paragraph E4) which permits reporting entities to publish disclosures made in accordance with ISSB Standards at a later time than their financial statements, for the first year of applying the ISSB Standards.

- UK entities are likely to be well placed to report climate information on the same timescale as their financial statements. Therefore, based on the UK Sustainability Disclosure Technical Advisory Committee (TAC) recommendation, the UK government has removed this relief from the draft UK SRS S1.

Amendment 2 – Extension of the Transition Relief in IFRS S1 that Permits a ‘Climate-First’ Approach

- IFRS S1 includes a transition relief (paragraph E5) which permits reporting entities to defer the disclosure of sustainability-related risks and opportunities beyond those on climate by an additional year.

- The UK Sustainability Disclosure Technical Advisory Committee (TAC) recommended extending this relief by an additional year to make it available for 2 years.

Amendment 3 – Removal of the Requirement to Use the Global Industry Classification Standard (GICS) in IFRS S2

- IFRS S1 includes a transition relief (paragraph E5) which permits reporting entities to defer the disclosure of sustainability-related risks and opportunities beyond those on climate by an additional year.

- The TAC recommended that entities should be able to use any appropriate classification standard – which could be GICS or an alternative standard that they use within existing reporting practices.

Amendment 4 – Removal of the ‘Effective Date’ clauses in IFRS S1 and IFRS S2 (with PIC Consideration)

- Both ISSB Standards currently include a statement on the effective date: “An entity shall apply this Standard for annual reporting periods beginning on or after 1 January 2024”.

- PIC concluded that the effective date should be removed from the standards, on the basis that UK SRS will be freely available for any entity to use on a voluntary basis at a time of their choosing.

Amendment 5 – References to the SASB Materials in IFRS S1 and IFRS S2

- IFRS S1 and IFRS S2 include requirements that state that entities “shall refer to and consider the applicability of” the standards published by the Sustainability Accounting Standards Board (SASB) and the ‘Industry-based Guidance on Implementing IFRS S2’ (which is based on the SASB Standards). For the purposes of this consultation, we refer to these as the ‘SASB materials’. The government proposes to amend “shall refer to and consider the applicability of…” to “may refer to and consider the applicability of…”, in both draft UK SRS S1 and draft UK SRS S2. This amendment is in paragraphs 55 (a) and 58 (a) in draft UK SRS S1 and paragraphs 12, 23, 32 and 37 in draft UK SRS S2.

Amendment 6 – Treatment of Transition Reliefs

- Both IFRS S1 and IFRS S2 include transition reliefs, with different lengths and objectives. The PIC discussed whether these reliefs should apply from the point of voluntary use of the standards or the point at which mandatory requirements start to take effect. The PIC agreed that it wanted to facilitate use of the reliefs for any mandatory reporting while avoiding penalising any early voluntary reporters.

- The UK Government invites your views on these proposed amendments and the comments can be submitted here until 17 September 2025.

What’s Next for the Future of the UK’s Sustainable Finance?

Along with the Climate-related transition plan requirements the UK government sees the UK SRS as the evolution of its sustainability reporting, strengthening its position as a global hub for sustainable finance.

As previously noted, the government is committed to creating a clear, effective, and balanced disclosure system that provides financial markets with useful sustainability data, thereby encouraging investment in UK businesses. To achieve this, the UK Government wants to ensure reporting entities have the guidance they need to apply the UK SRS correctly and they are seeking feedback on whether additional guidance beyond what’s already available would be beneficial.

Looking to stay ahead of the evolving sustainability landscape? Discover how to Navigate the Digital Product Passport and understand your compliance obligations.

Stay Ahead Of Regulatory Changes in Sustainable Finance

Want to stay ahead of regulatory developments such as the future of sustainable finance in the UK?

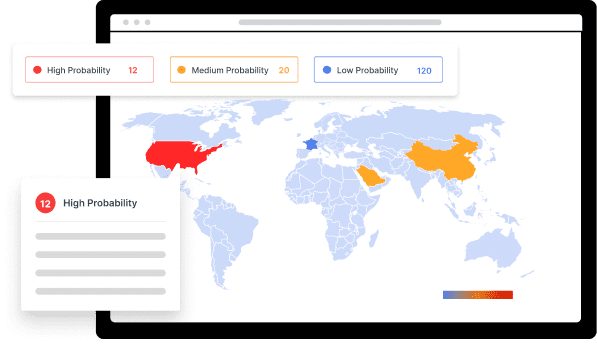

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Chemicals Quarterly – Q2 2025 Regulatory Update

Your Q2 2025 update on key regulatory changes affecting chemicals in products worldwide.