US Labor & Employment: 2025 Legislative Update – Part Two

This blog was originally posted on 7th October, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY CORINE LAURIJSEN, SENIOR REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

Every year, hundreds of Labor & Employment related bills are proposed in the US at Federal and State level. And every year, only a small percentage makes it to the finish line.

This blog gives you an overview of new state laws that have been enacted in 2025. They have been organized under non-compete agreements, reasonable accommodations, wages, and workplace protections.

This blog follows on from our blog US Labor & Employment: 2025 Legislative Update – Part One, that discussed child labor, discrimination in employment, employer & employee rights, labor related definitions, and paid and unpaid leave.

What Changed for Non-Compete Agreements?

Florida

Enacted House Bill 1219, known as the “Contracts Honoring Opportunity, Investment, Confidentiality, and Economic Growth (CHOICE) Act,” took effect on July 1, 2025. It expands the enforceability of non-compete agreements in Florida, adding two new types of restrictive covenants: covered garden leave agreements and covered non-compete agreements.

The law applies to “covered employees,” defined as those who earn or are expected to earn a salary greater than twice the annual mean wage of the county where the employer has its principal place of business.

To be enforceable, the agreements must meet specific criteria: the employer must advise the employee in writing of their right to seek legal counsel at least seven days before the agreement is signed, and the agreement must include an acknowledgment that the employee will receive confidential information or customer relationships.

Virginia

Enacted Senate Bill 1218, effective July 1, 2025, expands the existing prohibitions on non-competition agreements. It broadens the definition of “low-wage employee” with whom employers are prohibited from entering into non-compete agreements to any employee who is classified as “non-exempt” under the federal Fair Labor Standards Act (FLSA), regardless of their salary.

Employers in Virginia must post a copy of the amended law or a summary approved by the Virginia Department of Labor and Industry in a conspicuous place where other employee notices are displayed. Failure to do so can result in civil penalties.

Wyoming

Enacted Senate File 107, effective on July 1, 2025, reforms the use and enforceability of non-compete agreements in the state. It generally declares any covenant not to compete that restricts a person’s ability to receive compensation for “skilled or unskilled labor” to be void and unenforceable.

Non-compete agreements can still be enforced when they are part of a contract for the purchase or sale of a business or its assets, to protect a business’s legitimate trade secrets, to recover certain costs from employees who leave within a specified timeframe, and for executive and management personnel and officers and employees who constitute professional staff to executive and management personnel.

Which States Added Reasonable Accommodation Protections?

Illinois

Enacted Senate Bill 1159 entered into force on September 25, 2025, and establishes that an employee may file a written claim with the Arizona Department of Labor for unpaid wages against an employer if the amount does not exceed $12,000. This is an increase from the previous limit of $5,000. The claim must be filed within one year of the wages becoming due.

Rhode Island

Enacted Senate Bill 361 was signed into law on June 24, 2025, and became effective upon passage. It expands the workplace accommodation protections under the state’s Fair Employment Practices Act to include menopause and menopause-related medical conditions.

The new law requires employers to provide written notice of these rights to employees. This notice must be given to new employees at the start of their employment, to existing employees within a specified timeframe, and to any employee who notifies the employer of their condition.

Where Were Wage Provisions Amended?

Arizona

Enacted House Bill 1643 entered into force on August 3, 2025, and amends Arkansas Code § 11-3-204(a)(1). It allows a current or former employer to disclose a substantiated allegation of sexual abuse or sexual harassment by a current or former employee or the resignation of a former employee during an investigation of an allegation of sexual abuse or sexual harassment to a prospective employer of the current or former employee.

Colorado

Enacted House Bill 25-1001 took effect on August 6, 2025, and broadens the definition of an “employer” to include individuals who own or control at least 25% of a business, unless they can prove they have fully delegated day-to-day operations. This change creates personal liability for certain business owners in wage and hour disputes.

Employers who willfully misclassify employees as independent contractors now face substantial fines, ranging from $5,000 to $50,000 per affected employee, depending on the severity and whether the violation is a repeat offense or is not remedied in a timely manner. The new law also expands protections against retaliation for employees who engage in protected activities, such as raising concerns about wage and hour compliance. It creates a presumption of retaliation if an adverse action occurs within 90 days of a protected activity and makes it an explicit violation to use an employee’s immigration status to discriminate or retaliate against them.

Employers are also prohibited from making payroll deductions that would cause a worker’s pay to fall below the applicable minimum wage.

Georgia

Enacted Senate Bill 55 took effect on July 1, 2025, and eliminates the payment of subminimum wages to individuals with disabilities, ensuring they receive equal pay alongside their non-disabled peers. It repeals state provisions allowing wage exemptions for persons with disabilities, prohibits employers from using U.S. Department of Labor certificates under 29 U.S.C. § 214(c) to pay below the federal minimum wage, and establishes a phase-out schedule.

Illinois

Enacted House Bill 2488 took effect upon enactment on June 30, 2025, and amends the equal pay registration certificate application requirements of the Illinois’ Equal Pay Act by eliminating references to a federal program in the Equal Pay Act to ensure that federal changes do not undermine the state requirement that private employers with 100 or more employees report on employee wages by gender and race or ethnicity.

Maine

Legislative Document 598 became law without the governor’s signature on September 24, 2025. It requires employers to pay an employee a minimum amount when they report for a scheduled shift at the employer’s request and the shift is then canceled or reduced.

An employer is exempt from this requirement if they make a “documented good faith effort” to notify the employee not to report to work and the employee still reports. This exception also applies if the employer is unable to provide notification for reasons beyond their control.

The law does not apply if the employee is unable or not required to work due to adverse weather conditions, a natural disaster or civil emergency, or an illness, medical condition, or workplace injury of the employee.

The law applies to employers that employ at least 10 employees in the usual and regular course of business for more than 120 days in a calendar year.

Oregon

Enacted Senate Bill 906 will take effect on January 1, 2026, requiring employers to provide a written explanation of the earnings and deductions that appear on an employee’s itemized wage statement. This must be given to all employees at the time of hire.

The law provides employers with some flexibility in how they comply with the new requirements. Information can be provided in a location that is easily accessible to employees, such as a company intranet, a shared electronic file, a physical document posted in a central location, or via email. The information does not need to be written in complete sentences, as long as it is sufficiently detailed to explain the codes and rates.

Rhode Island

Enacted House Bill 5029 became effective on June 24, 2025, and sets a two-step increase for the state’s minimum wage:

- Effective January 1, 2026, the minimum wage will increase to $16.00 per hour.

- Effective January 1, 2027, the minimum wage will increase to $17.00 per hour.

Rhode Island enacted House Bill 5679 takes effect on January 1, 2026, and requires employers to provide a written notice to new employees at the start of their employment. This notice, which has been described as a “mini-handbook,” must be in English and contain detailed information about their employment, including pay information, benefits, employment status, deductions, pay schedule and employer details. Employers are required to keep a signed copy of the notice to confirm the employee’s receipt.

Explore 2025 developments in US product compliance with our webinar US Product Compliance 2025: Key Federal & State Changes to Watch.

Which New Workplace Protections Have Been Enacted?

Illinois

Enacted Senate Bill 212 will take effect on January 1, 2026, and provides that an employer may not retaliate against an employee or deprive the employee of employer-issued equipment because the employee used such equipment to record domestic violence, sexual violence, gender violence, or any other crime of violence committed against the employee or a family or household member.

An employer must grant an employee access to any photographs, voice or video recordings, sound recordings, or other digital documents or communications stored on an employer-issued device that relate to such acts of violence.

The provisions do not prevent an employer from complying with an investigation, court order, or subpoena for a device, information, data, or documents, and do not relieve an employee of their obligation to comply with the employer’s reasonable policies or to perform the essential functions of their job.

Washington State

Enacted Senate Bill 5101 takes effect on January 1, 2026, and amends existing state law to include “hate crime” alongside domestic violence, sexual assault, and stalking as reasons for which an employee can take reasonable leave from work. The legislation also requires employers to provide reasonable safety accommodations to employees who are victims of hate crimes, unless doing so would cause an undue hardship on the business. These accommodations may include a transfer, reassignment, or modified work schedule.

The new law explicitly prohibits employers from discriminating against employees who are victims of hate crimes. It also protects an employee’s right to request or use leave and safety accommodations without fear of retaliation.

Employers are required to maintain the confidentiality of any information provided by an employee regarding their status as a victim of a hate crime, to the extent permitted by law.

Enacted Senate Bill 5104, effective since July 1, 2025, is aimed at protecting employees from workplace coercion related to their immigration status or the immigration status of a family member. It introduces new prohibitions and penalties to prevent employers from using an employee’s immigration status as a tool for exploitation.

Enacted Senate Bill 5525, also known as the “Securing Timely Notification and Benefits for Laid-Off Employees Act,” became effective on July 27, 2025, and creates a state-level “mini-WARN Act,” which expands upon the federal Worker Adjustment and Retraining Notification (WARN) Act.

The new law applies to employers with 50 or more full-time employees in Washington, which is a lower threshold than the federal WARN Act that applies to employers with 100 or more employees. It requires covered employers to provide at least 60 days of written notice to the Washington State Employment Security Department (ESD) and affected employees (or their bargaining representatives) before a business closing or a mass layoff.

The act provides protection to employees on Washington Paid Family and Medical Leave (PFML). The law prohibits employers from including employees who are actively taking PFML in a mass layoff.

Conclusion

This second update again shows a variety of labor & employment legislative changes at state level that employers need to be aware of.

As US Congress and states like California and New York are still in session, you can expect a third update from us at the beginning of 2026, after closure of the 2025 legislative year.

Want to stay ahead of these US sustainability regulatory developments? Watch our expert webinar, ESG Regulatory Developments in the US, on demand now!

Stay Ahead Of Regulatory Changes in US Labor & Employment

Want to stay ahead of regulatory developments in US Labor & Employment?

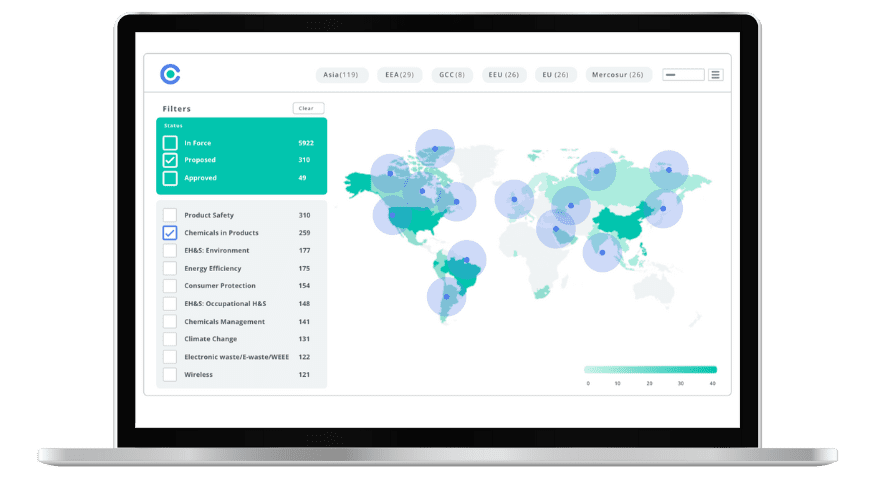

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.