Where Are the EU’s Sustainability Simplification Efforts Headed? A 2025 Recap and Forward Look

This blog was originally posted on 23rd July, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY HANNAH JANKNECHT, REGULATORY COMPLIANCE SPECIALIST, AND CÉLIA LE LIÈVRE, SENIOR REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

While a real political summer break nearly seems to be a thing of the past, the European Parliament is currently in its summer recess, with plenary sessions scheduled to resume in early September. As such, now is a good time to review the EU’s progress in simplifying sustainability rules and to explore what’s next on the horizon.

Given the extensive debate around the Omnibus packages in recent months, and the multitude of sometimes well-intentioned, sometimes misguided suggestions for simplifying sustainability rules, the proposals for the first and second Omnibus simplification packages in February 2025 already feel like a distant memory.

Since then, amendments to the reporting timelines (known as the ‘Stop-the-Clock’ amendment) were fast-tracked and adopted in April 2025. In June 2025, the Council delivered its opinion on the ‘Content Proposal’. Additionally, the Commission introduced two further Omnibus Packages in May 2025: Omnibus III, addressing the Common Agricultural Policy, and Omnibus IV, covering batteries due diligence, GDPR, the creation of a new ‘mid-caps’ company category, and the move towards “Digital by Default” product compliance.

These developments highlight that the scope of the simplification efforts now extend well beyond corporate sustainability.

And just this week, the EU Commission published a call for yet another omnibus simplification package (‘Environmental Omnibus’), seeking input on the simplification of circular economy, industrial emissions and waste management measures.

The Original Omnibus: What Does the Future Hold for the CSRD, CSDDD, Taxonomy and CBAM?

‘Stop-the-Clock’ Amendment and ‘Content Proposal’

As of July 2025, the only part of the Omnibus that has entered into force is the “stop-the-clock” amendment, which delays certain sustainability reporting deadlines under the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). This includes a two-year CSRD delay for large non-listed companies (wave 2) and small and medium-sized listed companies (wave 3), as well as a one-year delay for the first group of companies under the CSDDD. In addition, member states got one additional year to transpose the CSDDD into national law, with the new deadline set to 26 July 2027. This delay aims to prevent wave 2 and wave 3 companies from incurring unnecessary expenses, since, according to the ‘Content Proposal’, these two groups will no longer be required to report under the CSRD.

The ‘Content Proposal’ is currently still under negotiation in the Council and Parliament.

The Council adopted its position on 23 June 2025, which goes much further than what the EU Commission proposed in February:

- Setting the CSRD scope at 1,000 employees and net turnover of 450 million Euro;

- Setting the CSDDD scope at 5,000 employees and 1.5 billion Euro net turnover;

- Reverting the CSDDD back to a risk-based approach, but still limited to ‘tier 1’ and only extended in case of objective and verifiable information suggesting adverse impacts beyond direct business partners;

- Climate Transition plans to be postponed by two years;

- CSDDD Implementation postponed by another year to 26 July 2028.

Meanwhile, the European Parliament’s Committee on Legal Affairs (JURI) published its Omnibus report in June, which recommends even stricter roll-backs for both directives. According to the report, the CSRD, CSDDD, and Taxonomy should share a unified threshold of €450 million in net turnover and 3,000 employees globally. It also calls for extending the harmonization clause to prevent ‘gold plating’ by Member States and for the removal of the requirement to adopt climate transition plans altogether. These recommendations have faced strong opposition, particularly from the S&D, Renew, and Greens/EFA groups, who submitted their amendments at the end of June.

JURI shadow negotiations began on 15 July, and both JURI and the full plenary are expected to vote on the draft in October 2025. Given the sheer number of proposed amendments, more than 800 in total, and the significant disagreement especially over the scope of the directives, with proposals ranging from 250 to 10,000 employees, the question is whether a compromise can be reached at all.

European Sustainability Reporting Standards 2.0.

The Commission’s proposal to revise the CSRD also includes overhauling the European Sustainability Reporting Standards (ESRS). The European Financial Advisory Group (EFRAG) has been tasked with preparing ESRS Version 2, and EFRAG’s technical expert group published first unofficial drafts in July. The drafts outline plans to reduce the current ESRS by approximately 66%, which is significantly higher than the 50% previously discussed. The following core changes are envisaged:

- Drastic reduction of ‘shall’ data points (in excess of 50%). This will be achieved by eliminating the least relevant data points, and using a principle-based and narrative-based approach. Some more granular data points are furthermore moved to non-binding guidance documents.

- Elimination of all ‘may’ data points (277 data points in IG 3). Only a handful may potentially be maintained for less mature disclosures.

A public consultation on the exposure drafts is planned to take place from the end of July until the end of September 2025 (60 days instead of the 30-45 days previously planned). EFRAG’s deadline to deliver the drafts to the EU Commission has been extended from 31 October to 30 November 2025.

‘Quick-Fix’ Delegated Act

While the first Omnibus package contains measures for wave 2 and wave 3 companies, it does not provide any reporting reliefs for wave 1 companies. Wave 1 companies are large public companies with more than 500 employees, banks and insurance providers. These companies are already required to report under the CSRD in 2025 for the financial year 2024.

The EU Commission announced plans to introduce reliefs for these companies in May, and adopted a Delegated Act, also known as ‘Quick-Fix Delegated Act’, in July 2025. The Act extends the option for wave 1 companies to omit information on the anticipated financial effects of certain sustainability‑related risks for financial years 2025 and 2026. In addition, wave 1 companies with more than 750 employees will be able to avail of the same phase‑in provisions that are currently only applicable to companies with up to 750 employees. This concerns data points from ESRS E4 (biodiversity and ecosystems), ESRS S1 (own workforce), ESRS S2 (workers in the value chain), ESRS S3 (affected communities) and ESRS S4 (consumers and end-users).

If companies decide to make use of those exemptions for a complete topical standard, and the topic is considered material to the company, they are subject to a safeguarding provision, which requires the publication of certain summarized information.

A summary of the changes can be accessed here.

The Delegated Act will now be sent to the Parliament and Council, who have the opportunity to object to the Act.

Taxonomy Delegated Act

Another objective of Omnibus I was to simplify the Taxonomy reporting rules. To this end, the Commission adopted a delegated act to reduce the taxonomy reporting obligations for financial and non-financial companies on 4 July 2025. This includes a simplification of reporting templates and the ‘do no significant harm’ principle for pollution prevention and control related to the use and presence of chemicals, as well as the option not to assess Taxonomy-eligibility and alignment for economic activities that are not considered material to the business. For non-financial companies, activities are considered non-material if they account for less than 10% of a company’s total revenue, capital expenditure (CapEx) or operational expenditure (OpEx).

The Act has now been sent to the Council and Parliament, who have 4 months to scrutinize and potentially object to the Act. If no objections are made, the changes will apply from 1 January 2026, covering the financial year 2025.

Carbon Border Adjustment Mechanism (CBAM)

The first Omnibus package furthermore introduced significant changes to the Carbon Border Adjustment Mechanism (CBAM). In particular, it proposes to exempt small CBAM importers from their CBAM obligations by introducing a new “de minimis” mass threshold of 50 tons of imported goods per importer per year (cumulatively). The mass-based threshold would replace the value-based threshold of 150 Euros for shipment of negligible values.

This essentially means that companies and individuals who do not exceed the above annual mass threshold would not be required to declare their embedded emissions and to purchase CBAM certificates. Small importers would simply need to indicate that they are “occasional CBAM importer” when lodging a customs declaration. Whilst these changes may be seen as a U-turn, the Commission has ensured that the revised threshold would still retain 99% of embedded emissions in imported CBAM goods.

Additional simplifications are proposed for importers above the mass threshold. These include inter alia:

- An extension of the deadline for submitting CBAM declarations and surrendering CBAM certificates (via the CBAM registry) to 31 August of the year following the year of import;

- A reduction of the ratio of embedded emissions that purchased CBAM certificates shall correspond to (at the end of each quarter) to 50% (instead of 80%) of the emissions embedded in the goods imported since the start of the year;

- Possibility for authorized CBAM declarants to claim a carbon price paid in a third country other than the country of origin to reduce the number of CBAM certificates to be surrendered;

- Embedded emissions declared in the CBAM declaration must be verified by an accredited verifier; in this respect, Omnibus proposes that only embedded emissions determined on the basis of actual emissions shall be verified;

- Removal of non-calcined kaolinic clays from the scope of CBAM;

- Simplifications of emissions calculation methods to facilitate reporting obligations;

- Authorization of CBAM declarants would be simplified by removing the mandatory consultation procedure between the competent authorities and the EU Commission;

- Addition of electricity to the list of CBAM goods for which only direct emissions should be taken into account in the calculation of the embedded emissions;

- Obligation to purchase certificates would be delayed to the first quarter of 2027 (Member States should start selling CBAM certificates from 1 February 2027).

Whilst a provisional agreement was reached between the Council and Parliament on 18 June 2025, the amendment still requires formal endorsement and adoption by both institutions – which is expected by September 2025.

The measures proposed here are part of a more general review of CBAM taking place this year. The EU Commission is currently seeking public comments to revise the scope of the CBAM to target additional downstream goods. This initiative, launched on 1st July 2025, proposes to cover products further down the value chain of CBAM basic goods and to introduce additional anti-circumvention measures. CBAM currently covers primary goods including cement, iron and steel, aluminum, fertilizers, electricity, hydrogen and a limited number of downstream products listed in Annex I. While the type of downstream products to be added has not been unveiled, the Commission announced that their selection would rely on criteria similar to those that guided the initial scope of CBAM, namely: the risk of carbon leakage, the relevance of embedded emissions and the technical feasibility. At first glance, we can reasonably expect that the revised scope will help tackle circumvention practices by preventing manufacturers from processing their CBAM goods into downstream products to avoid their CBAM obligations.

The Commission is due to present a comprehensive CBAM review report by the end of this year. An official draft proposal could be released by the end of 2025. In the meantime, interested parties may submit their comments on the revised scope by 26 August 2025.

For further insights into sustainability developments across the globe, check out our recent webinars on Asia’s ESG & Sustainability Landscape: Compliance Essentials for 2025 and ESG Regulatory Developments in the US.

Omnibus IV: What Are the Changes to the Batteries Due Diligence Obligations?

While the CSDDD mandates due diligence across all sectors, it is not the only EU law asking companies to implement supply chain due diligence measures.

The EU Batteries and Waste Batteries Regulation (EU) 2023/1542, one of the most comprehensive EU product regulations to date, requires companies placing batteries and battery-containing products on the EU market to introduce a due diligence policy specifically for batteries, covering cobalt, natural graphite, lithium, nickel and their chemical compounds. The policy must address social and environmental risks associated with the manufacturing of batteries, and it must be verified by a third-party notified body. The EU Commission is obligated to adopt guidelines regarding the risks to be covered in the policy in line with international instruments such as the UN Guiding Principles on Business and Human Rights and OECD Guidelines for Multinational Enterprises.

While the due diligence requirements were originally supposed to become applicable from 18 August 2025, the Commission’s Omnibus IV delayed the application of the requirements. A Commission Delegated Act, adopted on 18 July 2025, made the following changes to Batteries Due Diligence:

- Application of the batteries due diligence obligations postponed by two years, until 18 August 2027

- Publication of the due diligence guidelines postponed by one year, until 26 July 2026

Under the current EU Batteries and Waste Batteries Regulation (EUBW), small and medium-sized companies are exempt from the due diligence obligations. A second amendment to the Batteries Regulation, also proposed as part of Omnibus IV, suggests introducing a new company classification, so-called mid-caps, which should then also be excluded from the due diligence obligations. This would concern companies with a net turnover of less than EUR 150 million. Additionally, companies in scope of the due diligence obligations should only be required to review and report their policy every three years instead of once a year. As of July 2025, this proposal has not yet been adopted by the Commission.

Critical Voices

While the CSRD, CSDDD, CBAM, and the EU Taxonomy have become focal points of political debate and controversy in recent months, the European Ombudswoman has initiated an inquiry into whether the European Commission may have failed to comply with its own ‘Better Regulation Principles.’ These principles mandate that the Commission must conduct its decision-making with openness and transparency, providing citizens and stakeholders meaningful opportunities to participate through public consultations and calls for evidence. A complaint from civil society organizations alleges the Commission bypassed public consultation, failed impact and climate consistency assessments, and conducted rushed internal procedures.

At a more technical level, #WeAreEurope conducted a survey with 1062 companies spread across different countries, sectors, company size, and maturity levels and found high levels of support for the Corporate Sustainability Reporting Directive (CSRD). Notably, only 17% of respondents expressed dissatisfaction with the 2022 version of the CSRD, and only 25% fully supported the ‘Omnibus’ Proposal, while 51% stated that major changes to the Omnibus Proposal will be needed during the legislative process, which underlines the need for a public consultation in this highly controversial matter.

Last but not least, a paper published by a group of academics just last week analyzes the impact of the proposed changes to the CSRD scope criteria and proposes a new two-tiered system as an alternative solution. This system would require companies in tier one (with either 500-1000 employees [Scenario A] or 500-5000 [Scenario B] employees) to only report core ESRS information without auditing, while companies in tier two (above 1000 or 5000 employees) report according to the simplified ESRS including limited assurance. While this solution aims to achieve a reasonable compromise between the costs and benefits of sustainability reporting, it also underscores the need to return to a balanced debate founded on evidence and actual conversations with those impacted by the final rules.

Call for Evidence for an ‘Environmental Omnibus’: The Simplification Saga Continues

On 22 July, the EU Commission launched a Call for Evidence for yet another omnibus simplification package, seeking input on the simplification of circular economy, industrial emissions and waste management measures.

The Commission aims to identify areas where administrative obligations can be streamlined, e.g. by removing double-reporting obligations and promoting further digitalisation of reporting. At the same time, the changes are not intended to affect the environmental objectives of the respective law.

The paper already identifies some potential areas for reduction, based on stakeholder workshops and surveys conducted in recent months:

- Potential discontinuation of the SCIP (substances of concern in products) database under the Waste Framework Directive

- Harmonization of EPR reporting rules

- Reduction of permitting challenges

The call for evidence is open until 10 September, with draft legislation likely to be published in Q4 of 2025.

Stay Ahead Of Regulatory Changes in EU Sustainability Simplification Efforts

Want to stay ahead of regulatory developments in product safety related to e-commerce and non-EU imports?

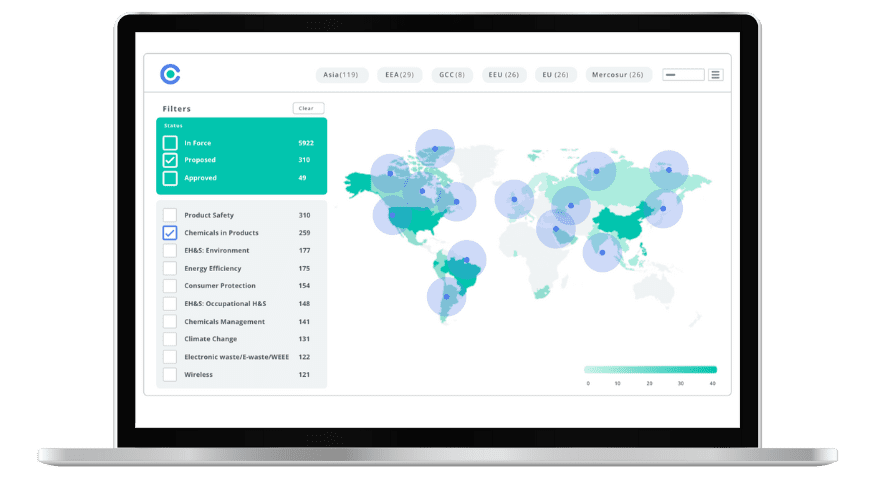

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

US Product Compliance 2025: Key Federal & State Changes to Watch

Explore recent developments in US product compliance – with a particular focus on state-level legislation and trends to watch in 2025.