Material Compliance in ESG Programs: The Complete Guide to Sustainable Product Compliance

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Modern businesses face an unprecedented challenge: navigating the complex intersection where product compliance meets ESG reporting. Material compliance is no longer simply about avoiding regulatory violations—it’s become a strategic driver of company value, consumer appeal, and long-term business viability. This comprehensive guide reveals how forward-thinking organizations are transforming their approach to regulated substances and material restrictions into competitive advantages that strengthen their ESG performance.

Table of Contents

- Why Material Compliance is Your ESG Power Play

- The Regulatory Landscape Decoded

- From Silos to Synergy: Integration Framework

- Sustainable by Design: Practical Guidance

- Solving the Top 3 Technical Challenges

- Building Your Roadmap to Success

- Frequently Asked Questions

Why Material Compliance is Your ESG Power Play

The financial case for integrating material compliance with ESG programs has never been stronger. Research shows that a 10% increase in focus on material ESG issues correlates with a 1.4% increase in company value, while consumers demonstrate their commitment by paying a 9.7% premium for sustainable products.

These statistics reflect a fundamental shift in how markets value corporate responsibility. ESG-related products now account for 56% of sales growth across industries, transforming what was once viewed as a cost center into a revenue driver.

The Hidden Value of Integration

When companies treat material compliance and ESG reporting as separate functions, they miss critical opportunities to:

- Enhance Brand Credibility: Transparent reporting on material safety and sustainability builds consumer trust faster than marketing claims alone. Companies with robust material compliance programs can make credible toxic-free product claims that resonate with environmentally conscious consumers.

- Streamline Operations: Integrating data collection for REACH, RoHS, and California Prop 65 compliance with ESG reporting eliminates duplicate efforts and reduces administrative overhead.

- Attract Investment: ESG-focused investors increasingly scrutinize material compliance records as indicators of operational excellence and risk management capabilities.

- Future-Proof Business Models: Proactive material compliance positions companies ahead of evolving regulations while supporting circular economy initiatives that drive long-term sustainability.

The Regulatory Landscape Decoded

Understanding the regulatory environment requires recognizing how individual compliance requirements connect to broader sustainability objectives. Each major regulation serves specific purposes but collectively they’re driving the market toward safer, more sustainable products.

Core Chemical Restrictions

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) represents the EU’s comprehensive approach to chemical safety. Beyond compliance, REACH data provides valuable inputs for ESG reporting on product safety and environmental impact. Companies leveraging REACH data strategically can demonstrate proactive risk management while supporting their sustainability narratives.

- RoHS (Restriction of Hazardous Substances) focuses on electronic products but its principles extend to broader sustainable design concepts. Organizations that excel at RoHS compliance often develop capabilities that support circular economy objectives, including design for disassembly and material recovery.

- California Prop 65 requires disclosure of chemicals causing cancer, birth defects, or reproductive harm. While geographically specific, Prop 65 compliance often drives global product reformulation decisions that align with ESG goals around human health and safety.

The Game-Changer: ESPR and Digital Product Passports

The EU’s Ecodesign for Sustainable Products Regulation (ESPR) fundamentally changes how companies must think about material information. The mandated Digital Product Passport (DPP) requires detailed data on material content, environmental footprint, and reparability—essentially codifying the integration between compliance and sustainability reporting.

This regulation transforms material compliance from a defensive necessity into a competitive differentiator. Companies with sophisticated material tracking and reporting capabilities will meet DPP requirements more efficiently while gaining market advantages through superior transparency.

From Silos to Synergy: Integration Framework

Most organizations maintain separate systems and processes for compliance and ESG reporting, creating inefficiencies and missed opportunities. Successful integration requires a systematic approach that connects these functions at the data, process, and strategic levels.

Step 1: Centralize Your Compliance Data

- Audit Existing Data Sources: Map where material compliance information currently lives—supplier databases, laboratory reports, certification documents, and internal testing records. Many organizations discover they possess more valuable data than they realize, but it remains trapped in disconnected systems.

- Establish Data Standards: Create consistent formats for material declarations, test reports, and compliance documentation. This standardization enables automated processing and ensures compatibility with ESG reporting requirements.

- Implement Centralized Management: Deploy systems that aggregate material compliance data from multiple sources while maintaining traceability to original documentation. This centralization reduces manual effort while improving data quality and accessibility.

Step 2: Map Data Points to ESG Frameworks

- Connect to GRI Standards: Align material safety data with Global Reporting Initiative indicators, particularly those addressing product safety (416-1), customer privacy (418-1), and environmental compliance (307-1).

- Support SASB Requirements: Map chemical content and restriction compliance to Sustainability Accounting Standards Board metrics relevant to your industry, enabling consistent sustainability reporting.

- Enable CDP Reporting: Use material compliance data to support Carbon Disclosure Project submissions, particularly regarding supply chain impacts and product lifecycle assessments.

Step 3: Automate Data Collection from Supply Chain

- Standardize Supplier Communications: Develop templates and protocols that capture both compliance requirements and ESG-relevant information in single requests, reducing supplier burden while improving response rates.

- Implement Progressive Disclosure: Start with basic compliance requirements and gradually expand to comprehensive material declarations that support both regulatory and sustainability objectives.

- Create Feedback Loops: Establish processes that validate supplier data accuracy while providing feedback that helps suppliers improve their own compliance and sustainability practices.

Sustainable by Design: Practical Guidance

Transforming material compliance from reactive to proactive requires embedding sustainability considerations into product development processes. This shift enables companies to exceed regulatory requirements while creating market differentiation through superior environmental performance.

Material Selection Excellence

- Develop Restriction Hierarchies: Create tiered approaches that eliminate problematic substances before regulations require it, positioning products ahead of regulatory curves while supporting marketing claims about safety and sustainability.

- Prioritize Bio-Based Alternatives: Evaluate renewable material options that reduce environmental impact while meeting performance requirements. Document these decisions to support ESG reporting on renewable material usage.

- Consider End-of-Life Impact: Select materials that support circular economy objectives, including recyclability, biodegradability, and compatibility with existing waste management systems.

Lifecycle Assessment Integration

- Map Environmental Impact: Use material compliance data as inputs for comprehensive lifecycle assessments that quantify environmental benefits of material choices.

- Quantify Benefits: Translate material restrictions and sustainable substitutions into measurable Environmental, Social, and Governance impacts that support reporting and marketing objectives.

- Track Performance Over Time: Monitor how material choices affect overall product environmental performance, creating data that supports continuous improvement initiatives and sustainability claims.

Solving the Top 3 Technical Challenges

Organizations consistently encounter similar obstacles when integrating material compliance with ESG programs. Addressing these challenges systematically prevents common pitfalls while accelerating implementation success.

Challenge 1: Data Fragmentation and Quality

- The Problem: Material compliance data often exists in multiple formats across different systems, making consolidation difficult and error-prone. Inconsistent supplier reporting formats compound these challenges.

- The Solution: Implement data governance frameworks that establish clear ownership, quality standards, and integration protocols. Start with high-impact product families and gradually expand coverage while refining processes. Use validation rules and automated checks to identify and correct data quality issues before they affect reporting.

Challenge 2: Supplier Engagement and Data Collection

- The Problem: Suppliers struggle to provide consistent, comprehensive material information due to competing requests from multiple customers and limited internal capabilities.

- The Solution: Develop tiered supplier engagement strategies that match requirements to supplier capabilities. Provide training and tools that help suppliers improve their data collection and reporting processes. Create incentive structures that reward accurate, timely reporting while supporting supplier development in compliance and sustainability.

Challenge 3: Resource Allocation and Expertise

- The Problem: Organizations lack sufficient personnel with expertise spanning both regulatory compliance and ESG reporting, leading to knowledge gaps and inefficient resource utilization.

- The Solution: Invest in cross-functional training that develops hybrid skills while establishing clear collaboration protocols between compliance and sustainability teams. Consider strategic partnerships or technology solutions that supplement internal capabilities during transition periods. Focus internal expertise on high-value decision-making while automating routine data collection and processing tasks.

Building Your Roadmap to Success

Successful integration of material compliance and ESG programs requires phased implementation that builds capabilities systematically while delivering early wins that demonstrate value.

Phase 1: Foundation Building (Months 1-3)

- Assess Current State: Complete comprehensive audits of existing data, systems, and processes for both material compliance and ESG reporting. Identify gaps, overlaps, and integration opportunities that can drive immediate improvements.

- Define Integration Strategy: Establish clear objectives that align material compliance improvements with ESG goals. Create cross-functional teams with representatives from compliance, sustainability, procurement, and IT to ensure comprehensive planning and buy-in.

- Select Priority Products: Focus initial efforts on product categories with the highest regulatory risk, sustainability impact, or strategic importance. This targeted approach enables faster results while building expertise that can be scaled across the organization.

Phase 2: System Integration (Months 4-8)

- Implement Data Infrastructure: Deploy integrated systems that capture, validate, and distribute material compliance information for both regulatory and sustainability reporting purposes. Ensure compatibility with existing business systems while planning for future scalability.

- Standardize Processes: Create unified workflows that eliminate duplicate efforts between compliance and ESG teams. Establish clear roles, responsibilities, and approval processes that maintain compliance integrity while supporting sustainability objectives.

- Pilot Program Launch: Begin full integration with selected product lines, suppliers, and reporting frameworks. Use pilot results to refine processes, validate technology choices, and demonstrate value to stakeholders.

Phase 3: Scale and Optimize (Months 9-18)

- Expand Coverage: Roll out integrated processes across all relevant product categories and supplier relationships. Use lessons learned from pilot programs to accelerate implementation while maintaining quality standards.

- Advanced Analytics: Implement reporting and analytics capabilities that transform integrated data into actionable insights for product development, supplier management, and strategic planning.

- Continuous Improvement: Establish feedback mechanisms that capture performance metrics, stakeholder feedback, and regulatory changes. Use this information to continuously refine and enhance integration capabilities.

Frequently Asked Questions

- Q: How does material compliance data specifically support ESG reporting frameworks like GRI and SASB?

Material compliance data provides concrete evidence for multiple ESG indicators. For example, REACH compliance data supports GRI 416-1 (product safety assessments), while RoHS compliance demonstrates adherence to environmental regulations under GRI 307-1. SASB frameworks in sectors like technology and consumer goods specifically call for disclosure of restricted substances management, making material compliance data essential for complete sustainability reporting. - Q: What are the cost implications of integrating material compliance with ESG programs?

While initial integration requires investment in systems and training, organizations typically see net cost reductions within 18-24 months. Benefits include eliminated duplicate data collection efforts, reduced compliance risks through better data quality, and improved supplier efficiency. The strategic value of enhanced ESG performance often justifies integration costs through improved access to capital and premium pricing opportunities. - Q: How can companies prepare for the EU Digital Product Passport requirements?

Start by mapping current material information against DPP requirements for your product categories. Implement systems that can capture and maintain detailed material composition data throughout product lifecycles. Establish supplier relationships and data collection processes that can provide the granular information DPP will require. Consider DPP compliance as an opportunity to differentiate products through superior transparency rather than just a regulatory burden. - Q: What role does supplier engagement play in successful integration?

Supplier engagement is critical because material information originates throughout the supply chain. Successful companies provide clear requirements, training resources, and feedback mechanisms that help suppliers improve their data quality and sustainability practices. Creating win-win relationships where suppliers see value in providing comprehensive material information leads to better compliance outcomes and stronger sustainability partnerships. - Q: How do upcoming global ESG regulations affect material compliance integration strategies?

Global regulatory convergence around sustainability reporting creates opportunities for companies with integrated approaches. Organizations that can efficiently collect and report material compliance data for multiple jurisdictions will have significant competitive advantages. Stay informed about regulatory developments in key markets and design systems that can adapt to evolving requirements without major restructuring.

The ESG compliance landscape will continue evolving rapidly, making systematic readiness assessment and continuous improvement essential for organizational success. This framework provides the foundation for building resilient, compliant, and competitive ESG programs that create lasting value for all stakeholders.

Stay Ahead Of Regulatory Changes in Corporate Sustainability

Want to stay ahead of regulatory developments in sustainability?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

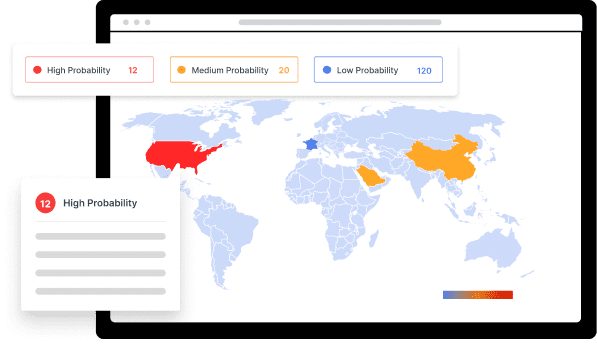

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.