The Complete Guide to Right-to-Repair and EPR Integration in the US: Building a Unified Circular Economy Strategy

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

The regulatory landscape is rapidly evolving – and for the first time, two critical streams of legislation are converging in ways that smart manufacturers can leverage for competitive advantage. California’s SB 244, New York’s Digital Fair Repair Act, and Massachusetts’ automotive-focused law aren’t just compliance checkboxes. They’re the first signals of a fundamental shift toward circular economy mandates that integrate seamlessly with Extended Producer Responsibility (EPR) frameworks.

For compliance officers and sustainability strategists managing multi-state operations, this convergence presents both challenge and opportunity. Instead of treating right-to-repair laws as isolated state requirements, forward-thinking companies are building unified strategies that address repair obligations while strengthening their EPR compliance infrastructure.

This guide synthesizes the fragmented regulatory landscape into actionable strategies, showing you how to transform compliance burdens into business advantages through integrated circular economy planning.

Table of Contents

- Understanding the Regulatory Convergence

- State-by-State Analysis: CA, NY, and MA Laws

- The EPR Connection: Why Repair Infrastructure Matters

- Building Your Integration Strategy

- Repairability Indices and Design Innovation

- Spare Parts Access: Supply Chain Transformation

- Compliance Case Studies by Product Type

- Implementation Timeline and Best Practices

- Future Outlook: National and Global Trends

- Frequently Asked Questions

Understanding the Regulatory Convergence

The intersection of right-to-repair and EPR legislation isn’t coincidental – it reflects a coordinated policy approach toward comprehensive product stewardship. While right-to-repair laws focus on extending product lifespans through accessible repair, EPR frameworks hold producers accountable for end-of-life management.

This convergence creates a unique opportunity for manufacturers who recognize that the infrastructure built to comply with repair mandates – spare parts logistics, documentation systems, authorized service networks – directly supports EPR objectives like product take-back programs and material recovery initiatives.

Consider the strategic implications: California’s SB 244 requires manufacturers to maintain spare parts availability for 3-7 years after the last date a product model or type was manufactured, depending on product price points. This same supply chain infrastructure can serve dual purposes, facilitating both consumer repairs and manufacturer-led refurbishment programs that extend EPR compliance.

The most successful companies are already viewing these requirements through an integrated lens, building systems that satisfy immediate compliance needs while creating foundations for broader circular economy initiatives.

State-by-State Analysis: CA, NY, and MA Laws

California SB 244: Consumer Electronics Mandate

Effective July 1, 2024, California’s law establishes the right-to-repair framework for consumer electronics and appliances. Key provisions include:

Coverage Scope: All electronic and appliance products sold in California with digital displays or electronic controls, including smartphones, laptops, home appliances, and consumer electronics.

Parts Availability Timeline:

- Products priced $50-$99.99: 3 years after the last date a product model or type was manufactured

- Products priced $100+: 7 years after the last date a product model or type was manufactured

Documentation Requirements: Manufacturers must provide repair manuals, diagnostic tools, and parts availability information.

Service Network Standards: Independent repair providers must have access to the same parts, tools, and documentation available to authorized service centers.

New York Digital Fair Repair Act: The Penalty Pioneer

New York’s legislation, effective December 28, 2023, broke new ground with its enforcement mechanisms and penalty structure.

Enforcement Framework: Up to $500 per violation.

Digital Equipment Focus: Specifically targets “digital electronic equipment” including computers, phones and tablets.

Service Manual Standards: Detailed requirements for documentation quality, including step-by-step repair procedures.

Independent Provider Access: Explicit rights for non-authorized repair shops to access manufacturer resources.

Massachusetts: The Automotive Data Pioneer

Massachusetts took a different approach, focusing primarily on automotive telematics and diagnostic data access based on the 2020 Massachusetts Right to Repair ballot initiative (expanding the 2013 automotive R2R law).

Vehicle Coverage: All model year 2022+ vehicles sold in Massachusetts must provide standardized diagnostic data access.

Platform Requirements: Manufacturers must create “inter-operable, standardized and open access platforms” for independent repair shops.

Data Security Protocol: Specific cybersecurity and consumer privacy protections for diagnostic data sharing.

Enforcement Status: Implementation has faced litigation delays as manufacturers challenge data-sharing mandates, though the Massachusetts Attorney General’s office moved forward with enforcement as of March 2025.

Comparative Analysis Table

| State | Effective Date | Primary Focus | Parts Timeline | Penalties | Unique Features |

|---|---|---|---|---|---|

| California | July 1, 2024 | Consumer electronics, appliances | 3-7 years after the last date a product model or type was manufactured | Chapter 8.6 (Section 42488.3) of Part 3 of Division 30 of the Public Resources Code contains the penalties related to SB 244 | |

| New York | Dec 28, 2023 | Digital electronic equipment | Reasonable terms | Up to $500/violation | |

| Massachusetts | Ongoing (litigation delays) | Automotive telematics | N/A (data focus) | Varies | Data platform requirements |

The EPR Connection: Why Repair Infrastructure Matters

Electronics EPR is currently active in at least 12 U.S. states (including Connecticut, Maine, Minnesota, New York, Oregon, Vermont, Washington, Illinois, New Jersey, Rhode Island, Michigan, and Maryland). Meanwhile, packaging EPR laws are expanding in California, Colorado, Maine, Minnesota, Maryland, Oregon, and Washington. The infrastructure investments required for right-to-repair compliance directly strengthen EPR program effectiveness.

Shared Infrastructure Benefits

Logistics Networks: The distribution systems built to deliver spare parts to repair providers can double as collection points for end-of-life products under EPR take-back requirements.

Documentation Systems: Repair manuals and parts catalogs provide the detailed product information needed for effective material recovery planning and recycling optimization.

Service Provider Relationships: Authorized and independent repair networks can serve as EPR collection partners, creating convenient consumer drop-off locations.

Data Collection Capabilities: Repair tracking systems generate valuable data on product failure modes, helping inform both design for repairability and design for recyclability initiatives.

Cost Optimization Through Integration

Companies that integrate their right-to-repair and EPR strategies typically see case study averages of:

- 25-40% reduction in combined program administrative costs

- Improved material recovery rates through repair-first cascading

- Enhanced brand positioning around sustainability leadership

- Reduced regulatory risk through comprehensive compliance frameworks

Building Your Integration Strategy

Phase 1: Infrastructure Assessment and Unification

Begin by auditing existing repair and EPR infrastructure to identify integration opportunities:

Supply Chain Analysis: Map current spare parts distribution against EPR collection networks to identify overlap opportunities and gap areas.

Documentation Audit: Assess whether existing repair manuals and parts catalogs provide sufficient detail for both customer repair and recycling partner material recovery.

Service Network Evaluation: Review authorized service centers and independent repair providers for potential EPR collection partnership opportunities.

Data System Integration: Evaluate whether current tracking systems can capture both repair metrics and EPR compliance data through unified reporting frameworks.

Phase 2: Regulatory Compliance Harmonization

Create unified processes that address multiple regulatory requirements simultaneously:

Cross-State Documentation: Develop repair manuals that meet the highest standard among applicable states, ensuring consistent quality while minimizing administrative burden.

Parts Availability Matrix: Build spare parts inventory systems that satisfy the longest availability requirements while optimizing inventory investment.

Training Program Integration: Combine right-to-repair training for service providers with EPR collection and handling procedures.

Reporting System Consolidation: Design data collection systems that feed both right-to-repair compliance tracking and EPR reporting requirements.

Phase 3: Circular Economy Business Model Development

Transform compliance infrastructure into revenue-generating circular economy initiatives:

Certified Refurbishment Programs: Use repair capabilities and parts inventory to develop factory-certified refurbished product lines.

Repair-as-a-Service Models: Expand from compliance-driven repair access to proactive maintenance and upgrade services.

Material Recovery Optimization: Leverage repair data to improve product design for both repairability and recyclability.

Customer Engagement Platform: Create unified customer portals that provide repair resources, facilitate EPR collection, and promote circular economy initiatives.

Repairability Indices and Design Innovation

Repairability indices are becoming critical tools for both compliance demonstration and market differentiation. These scoring systems evaluate how easily products can be repaired by independent service providers and consumers.

Industry Standard Frameworks

iFixit Repairability Score: The most widely recognized consumer-facing index, scoring products from 1-10 based on factors like documentation availability, parts accessibility, and tool requirements.

AFNOR Standard (France): Government-mandated scoring system required for certain electronics in France since 2021, focusing on spare parts availability, repairability documentation, and design characteristics.

EU Ecodesign Requirements: The Ecodesign for Sustainable Products Regulation (ESPR), published in 2024, requires repairability and durability scoring across multiple product categories starting between 2026-2030.

Strategic Integration Opportunities

Companies leading in repairability index performance often see:

- Reduced compliance costs through improved product design

- Enhanced brand reputation among sustainability-conscious consumers

- Lower warranty and service costs through easier repairs

- Improved EPR performance through higher material recovery rates

Design Innovation Drivers

Modular Architecture: Products designed with replaceable modules reduce both repair costs and end-of-life material recovery complexity.

Standardized Components: Using industry-standard parts and fasteners reduces inventory requirements while improving repair accessibility.

Documentation Integration: Building repair instructions into product design (QR codes, embedded guides) satisfies regulatory requirements while improving user experience.

Tool Optimization: Designing for common tools reduces barriers to independent repair while controlling service quality.

Spare Parts Access: Supply Chain Transformation

The evolution from traditional OEM-controlled parts distribution to open access models requires fundamental supply chain reconfiguration. Successful companies are treating this transformation as an opportunity to build more resilient, efficient logistics networks.

Distribution Network Redesign

Multi-Channel Strategy: Develop systems that serve authorized dealers, independent repair shops, and direct consumer sales through unified inventory management.

Regional Hub Optimization: Strategic warehouse placement to meet state-specific delivery requirements while minimizing inventory investment.

Digital Parts Catalogs: Comprehensive online systems that provide real-time availability, compatibility information, and ordering capabilities for all authorized users.

Inventory Forecasting Enhancement: Leverage repair data analytics to optimize parts stocking levels and reduce carrying costs.

Quality Control and Authentication

Parts Verification Systems: Implement tracking and authentication measures to prevent counterfeit parts from entering the supply chain.

Installation Guidance: Provide technical support and installation documentation to ensure proper parts usage across all service channels.

Warranty Integration: Design warranty systems that protect consumers regardless of whether repairs are performed by authorized or independent providers using genuine parts.

Performance Monitoring: Track repair success rates and customer satisfaction across different service channels to identify improvement opportunities.

Cost Management Strategies

Bulk Procurement Advantages: Leverage increased parts volume to negotiate better supplier terms while maintaining required availability timelines.

Refurbishment Programs: Develop systems to recondition and resell returned parts, reducing waste while improving profitability.

Cross-Product Standardization: Design new products to use common components where possible, reducing overall parts inventory requirements.

Dynamic Pricing Models: Implement pricing strategies that balance accessibility requirements with cost recovery needs.

Compliance Case Studies by Product Type

Consumer Electronics: Smartphone Manufacturers

Challenge: Meeting California’s 7-year parts availability requirement for devices with rapid technology evolution cycles.

Solution Approach: Leading manufacturers are developing “repairability tiers” where core components (screens, batteries, charging ports) remain available for the full compliance period, while advanced features may have shorter support windows.

Results: Companies implementing this approach report 30% reduction in compliance costs while maintaining customer satisfaction scores above 85% for repair experiences.

EPR Integration: The same parts distribution network serves both repair requirements and trade-in program logistics, improving overall program efficiency.

Home Appliances: Major Appliance Brands

Challenge: Balancing California’s price-based availability timeline (7 years for products over $100) with complex mechanical component sourcing.

Solution Approach: Proactive parts inventory management using predictive analytics to optimize stocking levels based on historical failure patterns and regional demand variations.

Results: Participating companies achieved 95%+ parts availability within required timeframes while reducing inventory carrying costs by 20%.

EPR Integration: Service networks doubling as collection points have increased EPR program participation rates by 40% in pilot regions.

Professional Equipment: Commercial Electronics

Challenge: New York’s penalty structure ($500 per violation) creates significant risk exposure.

Solution Approach: Comprehensive service partner training programs combined with detailed documentation systems that exceed regulatory requirements.

Results: Zero compliance violations in the first 18 months post-implementation, with service partner satisfaction scores improving by 25%.

EPR Integration: Customers increasingly requesting integrated repair/end-of-life services, creating new revenue opportunities.

Implementation Timeline and Best Practices

12-Month Strategic Implementation Framework

Months 1-3: Assessment and Planning

- Complete regulatory compliance gap analysis across all applicable states

- Audit existing repair infrastructure and EPR program capabilities

- Develop integrated strategy document with executive stakeholder buy-in

- Begin legal review of documentation and warranty policy updates

Months 4-6: Infrastructure Development

- Implement unified parts distribution system upgrades

- Develop comprehensive repair documentation meeting highest regulatory standards

- Launch service provider training programs for new requirements

- Begin data system integration for unified compliance reporting

Months 7-9: Pilot Program Launch

- Execute limited-scope pilot in one regulated state

- Test integrated repair/EPR processes with select service partners

- Gather customer feedback on documentation and parts availability

- Refine processes based on initial compliance experience

Months 10-12: Full Deployment and Optimization

- Roll out complete program across all regulated states

- Launch customer-facing repair resource portals

- Begin performance monitoring and continuous improvement processes

- Develop business case for expanded circular economy initiatives

Critical Success Factors

Executive Sponsorship: Ensure leadership understands the strategic opportunity beyond compliance requirements.

Cross-Functional Integration: Break down silos between compliance, sustainability, customer service, and supply chain teams.

Data-Driven Decision Making: Implement robust metrics and monitoring systems from program inception.

Stakeholder Communication: Maintain regular dialogue with service partners, customers, and regulatory agencies throughout implementation.

Continuous Improvement: Build feedback mechanisms that allow for ongoing program optimization based on real-world experience.

Future Outlook: National and Global Trends

Federal Legislation Momentum

Multiple federal right-to-repair bills are under consideration in Congress.

Impact Assessment: Companies with robust multi-state compliance systems will be well-positioned to adapt quickly to federal standards.

International Harmonization

European Union Leadership: The EU’s Right to Repair Directive and repairability index requirements are becoming global benchmarks, with the directive entering into force July 30, 2024.

Global Supply Chain Implications: Multinational manufacturers are increasingly adopting EU standards globally to achieve supply chain efficiency.

Trade Policy Integration: Right-to-repair requirements are being integrated into international trade discussions, potentially creating cross-border regulatory harmonization.

Technology Evolution Drivers

Digital Documentation: QR codes and augmented reality repair guides are becoming standard features in new product designs.

Parts on Demand: 3D printing and local manufacturing capabilities are reducing traditional parts inventory requirements.

Predictive Maintenance: IoT sensors and AI analytics are enabling proactive repair recommendations, extending product lifecycles.

Blockchain Authentication: Emerging technologies for parts authenticity verification are improving supply chain security.

Circular Economy Business Model Innovation

Product-as-a-Service: Companies are shifting from product sales to service models that inherently prioritize repairability and lifecycle extension.

Modular Design Standards: Industry consortiums are developing common standards for modular product architecture to improve repair ecosystems.

Material Passports: Digital documentation systems that track materials throughout product lifecycles are improving both repair and recycling outcomes.

Frequently Asked Questions

- Q: How do right-to-repair laws interact with existing warranty obligations?

Right-to-repair laws generally don’t void existing warranty protections. Manufacturers cannot deny warranty coverage solely because a consumer or independent repair provider performed repairs using genuine parts and proper procedures. However, damage caused by improper repairs may still void warranty coverage for affected components. - Q: What are the cost implications of maintaining spare parts inventory for extended periods?

While parts inventory requirements do increase carrying costs, successful companies report that strategic inventory management, bulk procurement advantages, and integrated EPR programs often offset these expenses. Many see net cost reductions through improved operational efficiency and new revenue streams. - Q: How do these laws apply to products sold online to customers in regulated states?

Online sales into regulated states are generally subject to the same requirements as local sales. Companies selling nationwide typically find it most efficient to adopt the highest standard across all sales channels rather than managing state-specific compliance systems. - Q: Can manufacturers charge premium pricing for spare parts and repair documentation?

Pricing for spare parts and documentation must be “reasonable” under most state laws, though specific pricing guidelines vary. Courts generally interpret this to mean prices comparable to those charged to authorized service providers, not necessarily at-cost pricing. - Q: What happens if a manufacturer discontinues a product line before the required parts availability period ends?

It will also depend on the specific requirements of the jurisdiction. For example, in CA, “Nothing in this section shall be construed to require a manufacturer to sell service parts if the service parts are no longer provided by the manufacturer or made available to an authorized repair provider.” There are situations where lack of availability means that compliance is not required. - Q: How do these requirements apply to products with integrated security features or proprietary software?

Most laws include provisions for legitimate security and safety concerns. Manufacturers can restrict access to security-sensitive components while still providing access to user-serviceable parts. However, these exceptions are narrowly interpreted and must be clearly justified. It will also depend on the specific requirements of the jurisdiction. - Q: How can companies demonstrate compliance with right-to-repair laws?

Compliance demonstration typically involves maintaining detailed records of parts availability, documentation provision, and service provider access. Many companies develop compliance dashboards that track key metrics and generate reports for regulatory agencies when requested. It will also depend on the specific requirements of the jurisdiction.

The convergence of right-to-repair and EPR regulations represents more than a compliance challenge – it’s an opportunity to build competitive advantages through comprehensive circular economy strategies. Companies that integrate these requirements into unified business approaches will be best positioned for long-term success in an increasingly sustainability-focused marketplace.

Ready to develop your integrated right-to-repair and EPR strategy? The regulatory landscape will only continue evolving, and early movers consistently achieve better outcomes through proactive planning and strategic vision. Start by conducting a comprehensive assessment of your current compliance capabilities and identifying integration opportunities that can transform regulatory requirements into business advantages.

Stay Ahead Of Regulatory Changes in Sustainability

Want to stay ahead of regulatory developments in sustainability?

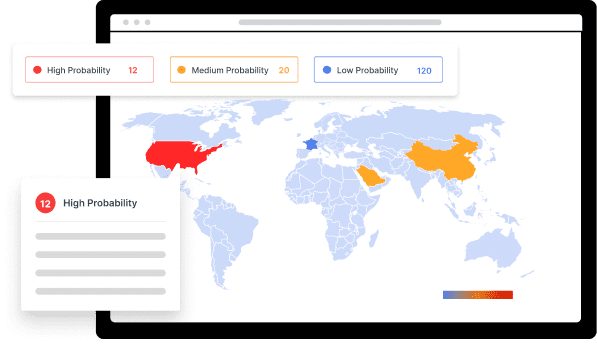

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.