The State of Play: Batteries Regulation Across Africa

This blog was originally posted on 9th October, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY ANDREW O’NEILL, REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

Battery usage is surging across Africa from small consumer electronics and automotive batteries to large lithium-ion packs for solar and electric vehicles. Ensuring their safe lifecycle management is a growing priority. African countries have begun implementing various regulations to handle all types of batteries including portable batteries, lead-acid car batteries, and advanced lithium-ion batteries but approaches vary widely.

In this blog, I compare battery regulations across all African countries, highlighting common strategies and key differences. We’ll see which nations have implemented Extended Producer Responsibility (EPR) or take-back schemes, which rely on hazardous waste laws, and where gaps remain. A summary comparison table is also provided for a quick country-by-country overview.

Comprehensive EPR and E-Waste Laws

A growing number of countries have passed laws requiring producers to be responsible for batteries at end-of-life. These often fall under broader electronic-waste (e-waste) management frameworks with clear definitions of “producer” and obligations to fund or organize battery collection and recycling. Notable examples include Nigeria, South Africa, Kenya, Ghana, Rwanda, Uganda, Cameroon, Côte d’Ivoire, Madagascar, and Zambia. Many of these laws emphasize the Extended Producer Responsibility (EPR) principle, making manufacturers, importers, and distributors financially and organizationally responsible for managing used batteries.

Hazardous Waste and Pollution Control Regulations

Some countries regulate batteries primarily as hazardous waste, focusing on safe disposal and controlling pollution from toxic battery materials (lead, mercury, cadmium, etc.). These regulations may not include formal producer take-back schemes but set requirements for licensed handling, recycling, or disposal. For example, Senegal issued a decree in 2010 to strictly regulate recycling of used lead-acid batteries and related lead pollution after severe lead poisoning incidents. Tunisia prohibits landfilling of batteries under a 1999 law that treats used batteries as dangerous waste requiring special handling, although enforcement has been a challenge . Many other countries address batteries under general environmental laws that classify them as hazardous waste, even if they lack battery-specific rules.

Limited or No Specific Regulations

A number of African countries still have no dedicated battery or e-waste laws. In these nations, used batteries are often managed informally or under basic environmental protection acts without clear guidance for producers or recyclers. Public awareness and formal collection infrastructure tend to be low. However, even where national laws are lacking, most African countries are parties to international conventions like the Basel Convention (controlling transboundary movement of hazardous waste, including used batteries) and the Bamako Convention (which prohibits import of hazardous waste into Africa) providing some baseline for managing battery waste. Additionally, under the Minamata Convention on Mercury, countries are obliged to phase out mercury-containing batteries, influencing national standards. Despite these differences, there is a clear continent-wide trend toward tighter battery regulation. By 2020, 13 African countries had some form of e-waste or battery legislation, and that number has grown.

Our guide The Future Of Batteries: Compliance and Sustainability Under The New EU Regulation covers the changing battery regulatory landscape in 2025.

South Africa

South Africa introduced mandatory EPR in 2021 via Section 18 of the National Environmental Management: Waste Act. Batteries (particularly portable batteries) are one of the product streams covered. Producers must register with the government and join or form a Producer Responsibility Organization (PRO) for batteries. Under this system, importers and manufacturers fund battery collection and recycling through fees paid to PROs, which coordinate nationwide take-back programs. Notably, South Africa’s EPR regulations currently distinguish portable batteries (sealed, handheld batteries) for the organized scheme, while automotive and industrial batteries are managed through separate hazardous waste channels. The EPR rollout in South Africa has been called an early success, covering not only batteries but also electronics, lighting and packaging.

Nigeria

In 2024 Nigeria implemented the National Environmental (Battery Control) Regulations 2024, a dedicated regulation for all battery types. This comprehensive framework addresses the entire battery lifecycle production, use, collection, transportation, storage, recycling, and disposal under the oversight of the national environmental agency (NESREA). Critically, Nigeria’s regulation enforces EPR: battery producers must take full responsibility for their products’ end-of-life and work with a Producer Responsibility Organization (the Alliance for Responsible Battery Recycling, ARBR) to ensure safe collection and recycling. This move formalized what had been voluntary efforts, creating a funded system to combat widespread informal recycling that had caused soil, air, and water pollution. Nigeria’s battery law aligns with global best practices and the country’s commitments under the Basel and Bamako Conventions.

Kenya

Kenya is a recent entrant, publishing the Sustainable Waste Management (Extended Producer Responsibility) Regulations, 2024, which take effect in 2025. These regulations list “battery and accumulators” as one of the product categories subject to EPR. Producers and importers of batteries in Kenya must register with the National Environment Management Authority (NEMA) and join an approved individual or collective EPR compliance scheme. They are required to develop 4-year EPR plans, meet collection and recycling targets, and pay fees per unit (including at import) as prescribed in the regulations. Kenya’s approach is comprehensive; it covers batteries alongside packaging, electronics, end-of-life vehicles, etc., reflecting a broad push for circular economy solutions. By May 2025, all existing producers must be registered and participating in EPR or face penalties.

Ghana

Ghana was one of the early adopters of e-waste legislation in Africa. The Hazardous and Electronic Waste Control and Management Act, 2016 (Act 917) and its 2016 regulations (LI 2250) established an advanced eco-levy on electronic equipment imports to fund recycling. While not battery-specific, this law covers any products that will become e-waste, implicitly including batteries (particularly those integrated in electronics). Importers must pay the eco-fee to Ghana’s Environmental Protection Agency, and manufacturers/distributors have take-back obligations – they are required to take back used electronics and ensure proper recycling. The fees collected go into an e-waste fund used to build recycling facilities and support formal e-waste (and battery) collection programs. Ghana’s system thus shares EPR costs across industry via the import levy and mandates participation in take-back, though operationally it functions slightly differently than a PRO model. Enforcement is backed by customs controls (no import clearance without paying the levy), making the scheme more resilient financially.

Rwanda

Rwanda has one of Africa’s most advanced e-waste management systems. A 2018 regulation on e-waste management explicitly includes batteries as a covered category of electrical and electronic waste. Rwanda’s approach has been a public-private partnership model: the government partnered with Enviroserve to establish a state-of-the-art e-waste and battery recycling facility, one of the first of its kind in Africa. While producers in Rwanda are expected to cooperate in e-waste collection (and likely an EPR framework is evolving), the notable aspect is significant government investment in recycling infrastructure and community collection programs. This centralized facility in Kigali handles batteries (from small batteries to large industrial ones) for safe material recovery. Rwanda’s success demonstrates an alternate path to EPR: direct government-led collection and recycling, which is now serving as a regional hub and model for neighboring countries.

Cameroon, Côte d’Ivoire, and Madagascar

These countries have all introduced e-waste regulations that encompass batteries.

Cameroon put in place specific regulations in 2012 to manage electronic waste, and it defines producers broadly (importers, sellers) who must take responsibility, similar to the EPR concept.

Côte d’Ivoire has e-waste management rules that include clear definitions of obligated producers and was among the first in West Africa to pilot an eco-levy or producer responsibility scheme (around 2014) for electronics and batteries.

Madagascar passed a decree in 2015 on Waste Electrical and Electronic Equipment (WEEE) – one of Africa’s earliest laws likely covering discarded batteries as part of e-waste.

Each of these laws places emphasis on identifying producers (including importers) who must register and contribute to managing the waste. The implementation status varies: for instance, Madagascar’s law is on the books, but formal collection systems are still nascent. Côte d’Ivoire and Cameroon have been working with telecom companies and NGOs to set up collection points, but challenges remain in scaling up recycling infrastructure.

Uganda

Uganda updated its environmental laws in 2019/2020 to incorporate EPR for electronics. The National Environment Act, 2019 and the Waste Management Regulations, 2020 include provisions that require producers (“product stewards”) to take back end-of-life electrical products. In fact, Uganda’s regulations make it an offense to dispose of electronic waste (including batteries) in landfills, and impose a “duty of product steward to receive electrical and electronic waste.” This means any company that imports or sells electronics must accept the waste batteries/devices from consumers for proper management. While Uganda is still developing the full implementation (collection centers, PROs, etc.), the legal framework aligns with EPR principles similar to Kenya’s and South Africa’s.

Zambia

Zambia introduced Extended Producer Responsibility Regulations in 2018 (Statutory Instrument No. 65 of 2018) which cover various waste streams. Initially, emphasis was on packaging and plastics, but the regulations also legally enabled EPR for electronic waste. In practice, EPR was not strongly enforced in the electronics sector at first. However, as of 2023 Zambia has been developing specific e-waste regulations and updating EPR requirements for electronics (including batteries). With international support, Zambia is preparing dedicated EPR guidelines for electronic equipment and working on standards for e-waste treatment. This illustrates a progression from a general EPR mandate to a focused approach on batteries and electronics, recognizing growing e-waste volumes.

Senegal

In response to a tragic mass lead poisoning in 2008 from informal battery recycling, Senegal enacted Decree No. 2010-1281 (September 2010). This decree strictly regulates the collection, transport, recycling, and disposal of used lead-acid batteries and other sources of lead, as well as the use of mercury and its compounds. It requires any person or company handling used batteries to obtain authorization, follow safety standards, and it bans certain unsafe practices. While this decree doesn’t create a producer-funded take-back system, it is a stringent command-and-control approach to prevent unchecked battery smelting and dumping. Senegal’s law is an example of a specific pollution control regulation targeting batteries to protect public health, given the acute dangers of lead and mercury exposure.

Tunisia

Tunisia’s environmental laws treat used batteries as hazardous waste that must not be mixed with ordinary trash. As early as 1999, Tunisian regulations have forbidden the disposal of batteries in general waste and mandated that they be collected for specialized treatment. Tunisia even set standards limiting heavy metals in batteries (e.g. essentially banning batteries with high mercury content) in line with European norms. However, despite these laws on paper, Tunisia struggled with implementation collection systems never fully materialized and a planned recycling facility stalled. This highlights a common challenge: legislation alone isn’t enough without enforcement and infrastructure. Still, Tunisia’s early adoption of rules (mirroring the EU battery directives) shows awareness of battery hazards. Today, the National Waste Management Agency in Tunisia is refocusing efforts on battery collection, and the country’s commitment under the Minamata Convention reinforces the ban on mercury-containing batteries.

Morocco and Algeria

These countries do not yet have dedicated battery or e-waste laws, but they manage batteries under general waste and hazardous substance laws.

Morocco’s framework law on waste management (Law 28-00) classifies certain wastes as hazardous and requires licensed handling. Used batteries, especially lead-acid batteries, fall into that category. Morocco has been considering EPR schemes (for example, for packaging and possibly electronics), but as of this writing, a formal battery/EPR law is not in force.

Algeria similarly controls hazardous waste through regulations that would cover battery disposal, but no specific EPR for batteries exists yet. Both countries, however, are part of regional and international efforts they have ratified Basel and are part of the Mediterranean network fighting pollution, which includes addressing used battery trade and disposal.

Egypt

Egypt recently overhauled its waste management legislation with Law 202 of 2020. This law introduced concepts of EPR and called for executive regulations to manage various waste streams, including electronic and electrical waste. By extension, batteries (particularly those in electronics or vehicles) are meant to be addressed. As of 2025, Egypt is in the process of issuing specific regulations or directives for e-waste and battery take-back. In the interim, batteries are regulated under hazardous waste provisions of older laws (Law 4/1994 as amended) which require permits for handling and prohibit improper disposal. Egypt has also implemented restrictions on importing very old used electronics to curb e-waste dumping. Once fully implemented, Egypt’s EPR system is expected to place responsibility on battery and electronics producers, potentially resembling EU-style compliance.

Other Sub-Saharan Countries

Many other African nations have general environmental regulations that implicitly cover batteries.

For example, Tanzania and Ethiopia classify battery waste as hazardous; any company dealing in battery scrap must follow permitting rules. Namibia and Botswana have regulations for hazardous waste management under their environmental management acts, which would include used battery acid and lead. Zimbabwe has used import/export controls (banning export of used lead-acid batteries to prevent unsafe smelting abroad) and requires local recycling facilities to be licensed.

However, these countries have not yet established producer-funded collection schemes or detailed consumer take-back rules. Often the enforcement of safe battery disposal relies on ad-hoc projects or scrap value incentives (e.g. car batteries are collected by scrap dealers for lead value).

Commonalities

Countries with EPR or e-waste laws tend to share certain features. They legally define “producer” to include importers (critical in Africa, where most batteries are imported). They often require producers to register with authorities or PROs, submit plans or reports, and pay fees to support collection/recycling. Some use fee-based systems (e.g. Ghana’s import levy, Nigeria’s PRO fees, Kenya’s scheduled fees at import). Others directly ban disposal of batteries in municipal waste (Uganda, South Africa) and set targets for collection or recycling (e.g. Kenya’s EPR schemes will have to meet government-set targets). Most of these frameworks also foresee public awareness campaigns funded by industry fees, recognizing that educating consumers to return used batteries is vital. Even where formal EPR is missing, governments often at least caution against dumping lead batteries and may have guidelines for garages and telecom companies to store and hand them to authorized recyclers. Imports of used batteries from abroad are widely restricted thanks to the Bamako Convention (almost 30 African countries have ratified it), to prevent Africa from becoming a dumping ground for foreign battery waste.

Regional Harmonization Efforts

- Given the patchwork of different national regulations, there are moves to harmonize and strengthen battery and e-waste policies at regional levels: East African Community (EAC) and Southern African Development Community (SADC) have both developed regional e-waste management guidelines. In late 2024, a joint guideline for SADC and EAC was published to help countries develop EPR frameworks for electronics, batteries, solar equipment, etc.. These guidelines encourage a standardized approach – for instance, adopting clear definitions of battery categories, setting up take-back systems, and sharing recycling facilities across borders. They also emphasize addressing logistical challenges in Africa (like long transport distances for collected batteries) by fostering regional recycling hubs.

- African Union and Pan-African Initiatives: The African Union’s Agenda 2063 and environmental action plans encourage member states to manage toxic wastes responsibly. While there isn’t an Africa-wide battery directive yet, platforms like the African Circular Economy Alliance and the African Battery Alliance (focused on battery value chain development) are indirectly influencing policies. They highlight the economic opportunity of battery recycling and second-life usage, which in turn pressures governments to update regulations to facilitate safe battery collection and repurposing.

- International Partnerships: Several countries are partnering with international organizations on battery management. For example, Nigeria and Germany have a cooperation on improving battery recycling practices. Ghana and the EU have worked together on the E-waste Program which supports formal e-waste collection centers (including batteries). Rwanda, Zambia, and Paraguay are in a project with the ITU (International Telecommunication Union) to implement national e-waste/EPR regulations, sharing lessons learned. These collaborations often result in technical guidelines and help in drafting laws that align with global standards.

- Electric Vehicle (EV) Battery Second-Life and Recycling: A forward-looking aspect of regulation is emerging around EV batteries. Countries like Kenya and South Africa are already considering standards for second-life usage of EV batteries (e.g., repurposing EV lithium-ion packs for home solar storage). Kenya’s Bureau of Standards has begun developing testing protocols to ensure used EV batteries still have sufficient capacity and are tracked through their second life. South Africa has drafted guidelines that differentiate battery refurbishment vs. repurposing, requiring facilities to be licensed and meet safety standards for handling EV batteries. While these initiatives are not yet codified into widespread law, they show the direction regulators are heading, anticipating the next wave of battery waste and setting the stage for regional alignment (possibly under the African Continental Free Trade Area, which could facilitate cross-border movement of batteries for recycling).

Comparison Table: Battery Regulations by African Country

| Country/Group | Regulatory Approach & Status | Key Features |

| Nigeria | 📜 Dedicated Battery EPR Regulation (2024) | • Comprehensive: Covers all battery types from production to recycling. • Mandatory Take-Back: Producers must use a Producer Responsibility Organization (PRO). • Strong Enforcement: Actively managed by NESREA. |

| South Africa | 📜 Mandatory EPR under Waste Act (2021) | • PRO Membership Required: Producers must join and fund a PRO. • Broad Scope: Includes portable batteries; separate rules for automotive/industrial types. • Systematic: Features a comprehensive reporting and fee structure. |

| Kenya | 📜💡 New EPR Regulations (2024) | • Explicitly Includes Batteries: Covers “batteries and accumulators.” • Eco-Fees: Levied on imports to fund the system. • Target-Based: Producers must meet set collection and recycling targets (enforcement from 2025). |

| Ghana | ♻️💰 E-waste Act with Eco-Levy (2016) | • Advance Fee Model: Importers pay a recycling fee upfront on electronics, including batteries. • Financed System: The National E-Waste Fund supports recycling infrastructure. • Clear Obligations: Mandates take-back and safe recycling for manufacturers. |

| Rwanda | ♻️ E-waste Regulation (2018) | • Integrated System: Batteries are a key category in the comprehensive e-waste law. • Public-Private Partnership: Features a high-tech recycling facility (Enviroserve). • Government Support: Strong backing for collection, awareness, and licensing. |

| Uganda | ⚠️💡 Environment Act with EPR Duty (2020) | • Legal Duty: Establishes producer responsibility for take-back, though a full PRO system is not yet in place. • Landfill Ban: Prohibits dumping of electronics and batteries. • Pilot Programs: Government and private sector are actively running collection schemes. |

| Zambia | ⚠️💡 General EPR Regs (2018) | • Framework in Place: A general EPR law exists. • In Development: Specific regulations and standards for e-waste and batteries are currently being drafted. |

| North Africa | ⚠️💡 Hazardous Waste Laws; Emerging EPR | • Egypt Leading: A new law (2020) explicitly includes EPR for batteries (implementation ongoing). • Others: Morocco, Algeria, and Tunisia classify batteries as hazardous waste and are studying EPR. |

| Cameroon, Côte d’Ivoire, Madagascar | ♻️💡 E-waste Laws with Limited Implementation | • Early Adopters: Established e-waste decrees between 2012-2015. • Implementation Gap: Laws require producer registration, but enforcement and infrastructure remain limited. |

| Senegal | ⚠️ Battery Pollution Control Decree (2010) | • Specific Focus: Strictly regulates used lead-acid batteries only. • Control, Not EPR: Bans informal recycling and requires licensing but does not assign end-of-life costs to producers. |

| Southern Africa | ⚠️ General Environmental Laws | • Hazardous Waste Management: Batteries are managed under general environmental acts, requiring permits for transport and disposal. • No EPR: While some countries have discussed EPR, no formal systems are in place. |

| Other West, Central, & East Africa | ⚠️ General Environmental Laws | • Minimal Regulation: Most other nations lack specific battery or e-waste laws. • Basic Framework: Batteries fall under general hazardous waste clauses with very limited enforcement. |

| Small Island States | 💡 Emerging Plans | • Future-Oriented: Mauritius is actively drafting EPR regulations. • Current Practice: Rely on import controls and basic hazardous waste rules, often seeking regional partnerships. |

Conclusion

African countries are at different stages in regulating batteries, but the overall trajectory is clear, more robust and responsible management of battery life-cycles. Leading nations have put in place EPR schemes and specific regulations to make producers part of the solution, ensuring batteries are collected and recycled rather than dumped. Others rely on hazardous waste laws and are catching up in implementation. A common thread is the recognition of batteries’ environmental and health impacts (especially lead and acidic electrolytes) and a willingness to draw from global best practices (many African laws echo the EU’s approach in definitions and producer responsibilities.

Africa presents a patchwork of compliance requirements: from registering with PROs in countries like Nigeria or South Africa, to paying import levies in Ghana, to simply adhering to basic disposal rules in less-regulated markets. Importantly, there is momentum toward harmonization: through regional guidelines and conventions, Africa is moving toward a more unified stance on battery management. This means future regulations may converge, simplifying compliance for pan-African operations but also raising the bar for environmental responsibility.

Want to stay ahead of these evolving regulatory developments? See how our Batteries regulatory content can help you!

Stay Ahead Of Regulatory Changes in Batteries

Want to stay ahead of regulatory developments in batteries?

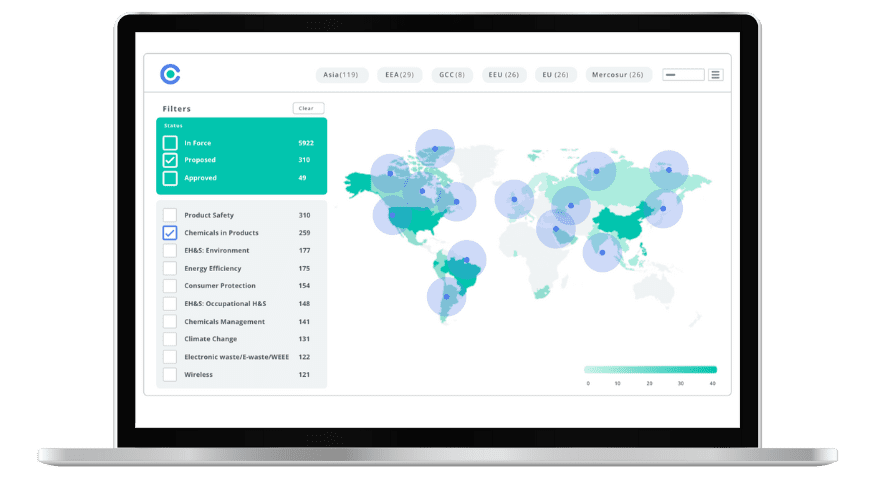

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

EU Battery Regulation: Key Compliance & Sustainability Requirements for 2025 & Beyond

Join us for an in-depth webinar as we explore the key obligations under the new EU Battery Regulation (EUBR).