Which Way for 6 GHz, Mobile or Wi-Fi?

This blog was originally posted on 9th September, 2025 and updated on 18th September, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY AARON GREEN, J.D., PH.D., SENIOR REGULATORY COMPLIANCE CONSULTANT, COMPLIANCE & RISKS

Wi-Fi 6E or 5G Mobile?

In 2020, the US FCC allocated the entire 6 GHz band of the radio spectrum to unlicensed short range devices in anticipation of the expanded use of the next generation of wi-fi and high speed local area networks.

In 2023, China reserved the same 6 GHz band for cellular International Mobile Telecommunications (IMT) to expand 5G mobile services, effectively preventing the use of wi-fi 6E equipment. Brazil initially followed the US model, but then pulled back the upper half of the 6 GHz band for IMT services.

The UK, on the other hand, has proposed allocating the lower half to wi-fi and shared use of the upper half by wi-fi and mobile. Meanwhile, Europe has allocated the lower half of the band for wi-fi, but continues to deliberate on the allocation of the upper half, with recommendations due to be issued later in 2025 or early 2026.

Momentum Behind the Split Use of the 6 GHz Band

Momentum is growing behind the split use of the 6 GHz band with the lower half (5.925-6.425 GHz) dedicated to unlicensed use and the upper half (6.425–7.125 GHz) reserved for IMT cellular networks. For example, Ukraine recently approved a plan to open the upper 6 GHz band for IMT in 2028. Hong Kong has already conducted the world’s first auction of upper 6 GHz spectrum, raising over $373 million, which illustrates another incentive for governments to allocate the band to licensed IMT services rather than unlicensed free use for wi-fi 6E equipment. Regardless of which use best serves the public interest, licensed spectrum will provide the most revenue.

The Profitability Challenge of 5G

While 5G mobile has undoubtedly improved the mobile internet user experience, the telecommunications companies who provide the service have yet to realize profits commensurate with data rates. According to telecoms.com, the biggest problem facing the telecommunications sector in 2024 was the slow pace of recovering the cost of 5G network infrastructure. According to one executive, “there have been significant investments that have happened in 5G, but that hasn’t necessarily translated into a significant lift in the revenues that telcos have been able to achieve.” In contrast, 6 GHz wi-fi can provide a significant increase in bitrates and user densities with relatively little infrastructure investment.

Global Divergence on 6 GHz

On balance it seems likely that the US and China will remain on either side of the fence while the rest of the world splits the difference. GSMA notes that there are countries in every region committed to a split 6 GHz band, with unlicensed short-range use in the lower half and licensed mobile cellular access in the upper half.

On 3 September 2025, Australia announced that it would allow low-power RLAN to use the 6425-6585 MHz band, which gives wi-fi more of the 6 GHz band while preserving most of the upper half of the band for future allocation. There was concern among stakeholders that this unique position would impede market access for the latest technology, but ACMA noted that differences between the RLAN frequency boundary of Australian arrangements compared to other international arrangements are likely to be catered for by software programming of devices to disable channels not authorised in Australia.

As technology advances, so do cybersecurity risks. Our webinar-on-demand and whitepaper keep you informed on the changing cybersecurity regulatory landscape in 2025.

Global 6 GHz Spectrum Allocation at a Glance

The following table summarizes the different strategic paths being taken by major global players, underscoring the EU’s position as an outlier.

| Region | Lower Band Status (5.925–6.425 GHz) | Upper Band Status (6.425–7.125 GHz) | Key Policy Rationale |

| European Union | Unlicensed (LPI/VLP) | Under Deliberation (Four proposals under review) | Balanced approach, managing interests of both Wi-Fi and mobile industries. |

| United States | Unlicensed (Standard Power & VLP) | Unlicensed (Standard Power & VLP) | Unlicensed innovation-first strategy to expand Wi-Fi capacity. |

| China | Under consultation, leans toward mobile | Licensed (5G) | Mobile-centric infrastructure strategy. |

| Brazil | Unlicensed (LPI/VLP) | Licensed (IMT) | Shift to a mobile-first strategy. |

| United Kingdom | Unlicensed (LPI/VLP) | Phased, Shared-Use Approach under consultation | Pragmatic “third way” to enable immediate Wi-Fi benefits while reserving future mobile access. |

Technical and Operational Considerations

The regulatory debate is influenced by the technical and operational realities of the two competing technologies. The EU’s current regulations for the lower 6 GHz band define specific technical conditions for devices. Low Power Indoor (LPI) devices are limited to a maximum mean power of 23 dBm EIRP and are restricted to indoor use. In contrast, Very Low Power (VLP) devices, designed for portable use, may operate both indoors and outdoors at a much lower power level, with a maximal mean power of 1 dBm EIRP.

Technical Distinctions Between the EU and the U.S.

A key technical distinction between the EU and the U.S. is the absence of a provision for standard power operation with Automated Frequency Coordination (AFC). AFC is a critical system that allows higher-power devices to operate outdoors by identifying and avoiding interference with incumbent licensed services, such as fixed point-to-point microwave links. The lack of this mechanism in the EU’s current framework for the lower band is a core point of contention for Wi-Fi advocates who seek the full flexibility of the technology.

The Need for Wider Channels

A central driver behind the Wi-Fi Alliance’s demand for the entire 1.2 GHz band is the need for wider channels. Modern Wi-Fi standards like Wi-Fi 6E and Wi-Fi 7 utilize channel widths of up to 160 MHz, while Wi-Fi 7 is designed to support channels up to 320 MHz. These wider channels are essential for delivering the high throughput and low latency required for applications like high-definition video streaming, virtual reality, and industrial automation. In contrast, the mobile industry argues that the future of 6G will require even wider channels, with a need for 200–400 MHz channels per operator to meet future capacity and speed requirements. This highlights that the debate is not just about raw capacity but about access to the specific bandwidth necessary to enable next-generation performance for each technology.

Private 5G Networks as an Alternative

While the debate rages on over the future of the 6 GHz band, institutions and facilities that need the consistency and security of 5G connectivity for critical applications are quietly turning to private networks in the existing CBRS (citizen’s band) and other available bands. These private networks can be implemented in combination with the wi-fi to provide the benefits of facility-wide 5G wireless coverage without having to rely on public network availability. This option is particularly useful in high-density environments like arenas where the public network is likely to be overwhelmed or critical infrastructure where security is the primary concern.

Conclusion

Ultimately, the debate circles back to the key question facing the telecommunications network industry: who is going to pay for it? Where is there sufficient demand to monetize next generation performance? Everyone is happy to have streaming HD video on demand everywhere they go, but the whole benefit of telecommunications is that they do not need to go anywhere to access the information they need.

If one path leads to an overwhelming economic advantage, that will be the outcome, but at the moment we are still waiting for the killer use-case to drive the argument one way or the other.

Want to stay ahead of these evolving regulatory developments? See how our Wireless regulatory content can help you!

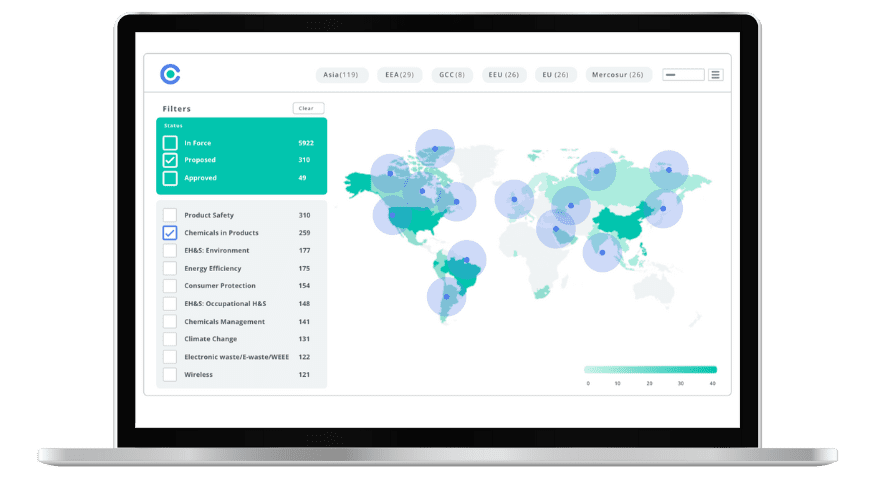

Stay Ahead Of Regulatory Changes in Wireless

Want to stay ahead of regulatory developments in Wireless?

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

EU Battery Regulation: Key Compliance & Sustainability Requirements for 2025 & Beyond

Join us for an in-depth webinar as we explore the key obligations under the new EU Battery Regulation (EUBR).