The Strategic Playbook for Medical Device Regulatory Strategy Development

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Organizations developing groundbreaking medical devices face a significant challenge: the chasm between prototype and first commercial sale, paved with regulatory complexity. Single missteps or missed deadlines can consume budgets and derail timelines entirely.

The importance of regulatory strategy is widely acknowledged. However, most guidance treats it as a bureaucratic checklist – a compliance hurdle requiring clearance. This fundamentally mischaracterizes its strategic value.

An effective medical device regulatory strategy functions not as a cost center but as a competitive instrument. It represents the blueprint dictating revenue generation speed, market share protection mechanisms, and global expansion capabilities without requiring complete compliance framework reconstruction for each jurisdiction.

This article provides a decision-making framework for leadership teams. We examine the high-stakes trade-offs organizations actually confront: go-to-market sequencing decisions regarding parallel submissions versus securing initial regional wins to fund subsequent efforts, global harmonization approaches that eliminate redundant work through unified technical dossiers serving FDA, EU, and high-growth markets like Brazil, and future-proofing strategies for AI-enabled devices navigating overlapping EU AI Act and MDR requirements.

Executing this correctly enables on-time, on-budget launches. The consequences of errors are substantial – average high-risk device approvals require 12 to 18 months, and regulatory compliance can consume up to 10% of annual revenue for some organizations. This framework positions organizations on the favorable side of these statistics.

Table of Contents

- Why Your Regulatory Strategy is a Profit Center, Not a Cost Center

- Phase 1: Architecting Your Global Go-to-Market Sequence

- Phase 2: Building Your Global Submission Engine with the IMDRF ToC

- Phase 3: Future-Proofing for AI, SaMD, and Emerging Technologies

- Your Action Plan: An 8-Step Framework for a Bulletproof Strategy

- Key Takeaways: Medical Device Regulatory Strategy Essentials

- Frequently Asked Questions

- Take Control of Your Market Access

Why Your Regulatory Strategy is a Profit Center, Not a Cost Center

A fundamental mindset shift is required. Regulatory affairs has historically been positioned as a necessary constraint – a department that decelerates progress. However, in a market projected to exceed $12.6 billion by 2030, successful organizations will be those integrating regulatory planning into core business strategy from inception.

For novel devices, regulatory milestones can consume over 50% of total development costs. This represents not merely a budget line item but a massive capital investment. Like any investment, it should be architected to generate returns.

Strategic regulatory planning drives profit through three distinct mechanisms.

It accelerates time-to-market. Selecting optimal market sequences and submission pathways enables faster revenue generation. A sequential strategy prioritizing US 510(k) pathways, for instance, might generate cash flow sooner to fund more complex EU submissions.

It creates competitive barriers. More rigorous pathways like Pre-Market Approval in the US are slower and more expensive. However, they also establish significant competitive moats. Competitors cannot simply follow with “substantially equivalent” devices – they must replicate extensive clinical data, providing valuable head starts.

It reduces redundant costs. Harmonized, global-first approaches prevent reinventing processes for each new market. Building core technical files structured for global acceptance drastically reduces personnel hours and consulting fees for regional expansion.

The objective transcends mere approval. It encompasses securing approval in optimal markets at appropriate times with defensible positions that maximize innovation’s commercial value.

Phase 1: Architecting Your Global Go-to-Market Sequence

Among the first and most critical decisions is determining initial market entry and submission sequencing. No universal correct answer exists – decisions depend entirely on funding availability, risk tolerance, and long-term business objectives.

The Three Core Sequencing Models

Most global rollout strategies fall into three categories: Sequential, Parallel, or Staggered.

Sequential submissions represent the incremental approach. Organizations focus all resources on securing approval in a single primary market, often the US via the 510(k) pathway for speed. This approach best serves startups and resource-constrained companies, minimizing upfront cash requirements and allowing first-market revenue to fund subsequent submissions. The risk involves concentration – delays or rejections from the initial regulatory body can prove catastrophic for timelines.

Parallel submissions represent the aggressive, comprehensive approach. Organizations prepare and submit applications to multiple major markets simultaneously, including US, EU, and Canada. This suits well-funded companies where speed to global market represents the absolute priority, dramatically compressing overall timelines. The risk requires massive upfront resource and personnel investments. Teams must manage multiple regulatory review cycles simultaneously, each with distinct questions and timelines. Changes requested by one agency can create domino effects across other submissions.

Staggered submissions represent the optimized hybrid model. Organizations prepare a single, harmonized core submission package. After submitting to the primary market and gaining visibility into that review process, they stagger subsequent submissions to other markets. This serves most companies effectively, balancing speed and resource management. Organizations learn from first agency questions and feedback, strengthening packages for subsequent submissions. This de-risks the process – unexpected FDA questions can be proactively addressed in EU MDR technical files before submission, preventing costly delays with Notified Bodies.

The Pathway Trade-Off: Speed vs. Defensibility

Within each market, organizations face another strategic choice: which regulatory pathway to pursue. The classic example is the US FDA’s 510(k) versus PMA.

The 510(k) pathway is faster and less expensive, based on proving “substantial equivalence” to existing market devices. It represents the path of least resistance.

PMA applies to high-risk, novel devices and requires extensive clinical data proving safety and effectiveness. It represents a lengthy, expensive, arduous process.

Why would organizations choose PMA if alternatives exist? Because it functions as a competitive weapon.

PMA approval extends beyond market clearance – it establishes standards. Subsequent companies cannot simply file 510(k) applications claiming equivalence to approved devices. They must complete the same rigorous PMA process, investing equivalent millions of dollars and years in clinical trials. Regulatory strategy has constructed multi-year competitive advantages.

This represents the trade-off strategic planning must address: organizations must determine whether they require immediate revenue (510(k)) or long-term defensible market positions (PMA).

Phase 2: Building Your Global Submission Engine with the IMDRF ToC

Once market sequences are determined, technical execution begins. Many companies waste time and capital here by creating bespoke submissions for every country – FDA submissions in one format, CE technical files in another, completely different structures for Brazil’s ANVISA.

This represents an outdated, inefficient model. The future of global regulatory affairs is harmonization.

From STED to IMDRF Table of Contents

For years, the industry standard for harmonized dossiers was the Summary Technical Documentation or STED format, developed by the Global Harmonization Task Force. However, STED has become obsolete.

The GHTF has been replaced by the International Medical Device Regulators Forum (IMDRF), which has published a more detailed and logical structure: the IMDRF Table of Contents.

This matters because major regulatory bodies are actively adopting it. Health Canada already mandates it. The EU’s MDR and IVDR align closely with its principles. While the FDA maintains its own eCopy and eSTAR structure, underlying data requirements map cleanly to the IMDRF ToC.

Adopting the IMDRF ToC as the backbone of internal technical documentation is the single most effective action for streamlining global submissions. It requires building comprehensive, modular dossiers from inception.

The Modular Dossier: A Playbook for Multi-Country Submissions

IMDRF ToC-aligned documentation should be conceptualized as a master file built from modules. Module 1 covers device description and specifications (universal). Module 2 addresses preclinical testing and biocompatibility (largely universal). Module 3 encompasses clinical evidence (largely universal). Module 4 includes labeling and instructions for use (region-specific). Module 5 contains regulatory administrative information (region-specific).

When entering new markets, organizations do not start from scratch. They leverage universal modules representing 80% of the work and create or modify region-specific modules.

Practical implementation for staggered launches proceeds as follows. For US submissions, organizations compile master dossiers and format them for FDA eSTAR templates, then submit and initiate review timelines. For EU submissions three months later, while FDA reviews proceed, organizations take identical core data and format it according to Notified Body technical file requirements, translating labels and instructions into necessary languages. By the time first substantive FDA questions arrive, organizations can incorporate that feedback into EU submissions before finalization. For Brazil submissions six months later, organizations repeat processes for ANVISA, leveraging mature core dossiers and adding Brazil-specific requirements.

This “build once, deploy many” approach transforms regulatory operations from disjointed, high-effort initiatives into smooth, predictable, scalable capabilities. It enables effective compliance management and ensures continuous audit readiness.

Phase 3: Future-Proofing for AI, SaMD, and Emerging Technologies

Devices involving software, particularly machine learning or AI, require additional strategic sophistication. Software as a Medical Device and AI-enabled devices represent the new frontier, with regulators still developing appropriate handling frameworks.

This presents opportunities for demonstrating true strategic foresight.

The Dual Compliance Challenge: Navigating the EU AI Act and MDR/IVDR

Europe exemplifies this emerging complexity. AI and ML-powered medical devices must comply not only with the EU Medical Device Regulation but likely also with the EU AI Act.

If AI systems are classified as “high-risk” under the AI Act – which many diagnostic and therapeutic AI tools will be – organizations face dual compliance burdens.

Technical documentation must satisfy two separate but overlapping rule sets. MDR requirements focus on clinical safety, performance, risk management under ISO 14971, and usability. AI Act requirements focus on data quality, transparency, human oversight, cybersecurity, and robustness.

Strategy must explicitly plan for this. How will organizations validate training datasets to meet AI Act standards? How will they document model logic to satisfy transparency requirements? How will post-market surveillance plans monitor for algorithmic drift? Addressing these questions proactively rather than reactively during Notified Body inquiries is critical.

Planning for a Living Device: Post-Market Strategy from Day One

For AI and ML devices that can learn and change over time, the concept of one-time “approval” is becoming obsolete. Regulators expect plans for entire device lifecycles.

Regulatory strategy must include robust Post-Market Surveillance and Post-Market Clinical Follow-up plans treating devices as living entities. This means planning for continuous monitoring to detect real-world performance degradation or unexpected behavior, managing updates through processes for validating and deploying algorithm changes and determining when software updates trigger new regulatory submissions, and gathering real-world evidence by proactively collecting field data to prove continued safety and potentially support expanded claims or new indications.

Building these processes into compliance management frameworks from the outset is no longer best practice – for SaMD and AI, it represents fundamental requirements.

Your Action Plan: An 8-Step Framework for a Bulletproof Strategy

Integration of these elements into tangible documentation requires systematic approach. The following eight-step framework guides regulatory strategy creation.

- Step 1: Define the Intended Use & Classification. Be precise. This single statement dictates everything that follows. Determine whether it functions as a diagnostic tool for clinicians or a monitoring application for patients. This determines classification in every market.

- Step 2: Identify Target Markets & Sequence. Using Sequential, Parallel, or Staggered models, map three-to-five-year global rollout plans. Justify choices based on commercial objectives.

- Step 3: Conduct a Gap Analysis. Analyze standards and requirements for target markets. Identify where requirements overlap (approximately 80%) and where they differ (approximately 20%). This is foundational for product compliance and harmonization efforts.

- Step 4: Select Your Regulatory Pathways & Trade-Offs. For each market, declare chosen pathways such as 510(k), De Novo, PMA, or CE Class IIa. Explicitly state business justifications, for example “Choosing 510(k) for speed to initial revenue.”

- Step 5: Map Out Your Evidence Generation Plan. Based on selected pathways, determine required preclinical, clinical, and usability testing. Create timelines and budgets for these activities.

- Step 6: Adopt a Harmonized Dossier Structure. Formally adopt the IMDRF ToC as the backbone for all technical documentation.

- Step 7: Develop Your AI/SaMD Lifecycle Plan (If Applicable). Document strategy for dual compliance such as AI Act plus MDR and outline post-market plans for monitoring and updating algorithms.

- Step 8: Establish a Regulatory Intelligence Process. Regulations are not static. Define how the organization will monitor for changes in standards and regulations in target markets to ensure strategy remains current.

This documented strategy becomes the organizational North Star, aligning research and development, clinical, quality, and commercial teams around a single, coherent success plan.

Key Takeaways: Medical Device Regulatory Strategy Essentials

What is a medical device regulatory strategy? It is a comprehensive business plan that determines market entry sequencing, regulatory pathway selection, and technical documentation approaches to accelerate time-to-market, create competitive barriers, and enable efficient global expansion for medical device innovations.

Why should regulatory strategy be developed early? Regulatory strategy should be developed parallel to initial device concepts. Early decisions about intended use and target markets have massive downstream effects on entire product development lifecycles, budgets, and timelines.

How does the IMDRF Table of Contents improve efficiency? The IMDRF ToC provides a harmonized structure for technical documentation that major regulatory bodies are adopting. By building a modular master dossier based on this structure, organizations complete 80% of work once and simply adapt region-specific modules for each market, eliminating redundant effort.

What are the key considerations for AI-enabled medical devices? AI-enabled devices face dual compliance requirements in Europe (MDR plus AI Act), requiring documentation of data quality, algorithmic transparency, and continuous post-market monitoring. Organizations must plan for device lifecycles rather than one-time approvals, including processes for managing software updates and gathering real-world evidence.

Frequently Asked Questions

- Q: How early should we start developing a medical device regulatory strategy?

Regulatory strategy should be developed parallel to initial device concepts. Early decisions about intended use and target markets have massive downstream effects on entire product development lifecycles, budgets, and timelines. Delaying strategic planning until later development stages forces costly rework and limits strategic options. - Q: What’s the single biggest mistake companies make in their regulatory strategy?

Organizations treat it as a regional, one-off project instead of a global, harmonized program. Creating US-specific submissions from scratch and then attempting to adapt them into EU technical files is incredibly inefficient and leads to inconsistencies that regulators will identify. Organizations should think globally from inception. - Q: Can our regulatory strategy change over time?

Absolutely. It should function as a living document. Organizations might plan for sequential launches but receive new funding enabling parallel approaches. Clinical trials might reveal new indications changing device classifications. Strategy should be reviewed and updated at every major project milestone. - Q: How do we handle markets that don’t follow the IMDRF structure, like China?

While markets like China’s NMPA have unique and complex requirements, core technical data – biocompatibility reports, sterilization validation, clinical data – remains consistent. By building comprehensive master dossiers based on the IMDRF ToC, organizations ensure all core evidence is prepared. They then work with local experts to reformat and supplement that data according to NMPA-specific requirements. The harmonized dossier still eliminates approximately 80% of redundant work.

Take Control of Your Market Access

Medical devices have the potential to transform patient care, but innovation alone is insufficient for reaching patients. Deliberate, forward-thinking regulatory strategy is the bridge between vision and compliant, commercially successful products.

By moving beyond simple checklists and embracing strategic frameworks, organizations can transform regulatory obligations into powerful competitive advantages. Organizations can accelerate timelines, protect markets, and scale globally with confidence and efficiency.

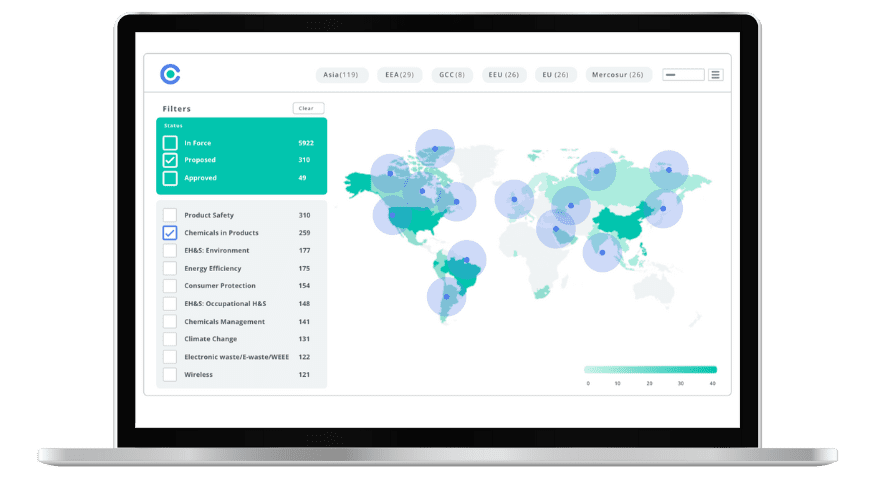

Navigating global regulatory complexities, from the IMDRF ToC to the EU AI Act, requires constant vigilance and deep expertise. When organizations integrate regulations management, requirements management, and evidence management into centralized platforms tracking over 100,000 global regulations and standards across 195 countries, they establish more than operational efficiency. They create the foundation for predictable market access, accelerated time-to-market, and sustainable competitive advantage in increasingly complex medical device markets. This transformation positions regulatory strategy not as an obstacle to overcome but as a strategic capability that directly enables revenue growth and market leadership.

Experience the Future of ESG Compliance

The Compliance & Risks Sustainability Platform is available now with a 30-day free trial. Experience firsthand how AI-driven, human-verified intelligence transforms regulatory complexity into strategic clarity.

👉 Start your free trial today and see how your team can lead the future of ESG compliance.

The future of compliance is predictive, verifiable, and strategic. The only question is: Will you be leading it, or catching up to it?

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.