Jurisdictional Change Monitoring Strategies: Building Resilient Compliance Programs Across Global Markets

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

In an era where regulatory requirements shift across the global business landscape like tectonic plates, organizations face an unprecedented challenge: staying compliant while maintaining operational agility. With regulatory events surging into the tens of thousands annually and compliance costs increasing by over 60% for major corporations in recent years, the stakes have never been higher.

This guide explores proven strategies and cutting-edge tools for tracking regulatory changes by country and region, enabling your organization to build a compliance program that transforms regulatory turbulence into competitive advantage. You’ll discover how leading organizations are moving beyond reactive compliance to establish proactive monitoring systems that prevent costly violations while accelerating market entry.

Table of Contents

- Why Traditional Monitoring Fails

- Modern Jurisdictional Monitoring Architecture

- Legal Gazette Intelligence and Dynamic Calendars

- AI-Powered Impact Assessment

- Building Collaborative Compliance Implementation

- Choosing Your Monitoring Solution

- FAQ: Common Monitoring Questions

Why Traditional Monitoring Fails

The regulatory landscape has transformed into a complex web of interconnected requirements spanning multiple jurisdictions, industries, and compliance domains. Today’s compliance teams are drowning in information while thirsting for actionable intelligence.

Regulatory complexity has intensified dramatically, with 85% of global compliance teams reporting increased difficulty managing requirements in recent years. This complexity translates directly to the bottom line – US federal regulations alone cost an estimated over $3 trillion annually, representing a significant percentage of the nation’s GDP.

Organizations relying on manual monitoring or basic alert systems face critical vulnerabilities. Time lag vulnerabilities mean manual processes typically identify regulatory changes 30-90 days after publication, creating windows of non-compliance exposure. Interpretation inconsistencies lead different teams to interpret the same regulatory change differently, causing inconsistent implementation across business units. Resource drain consumes up to 70% of compliance team time on administrative tasks rather than strategic planning. Most critically, traditional monitoring fails to identify how changes in one jurisdiction impact compliance obligations in others, creating blind spots that sophisticated regulatory authorities increasingly exploit.

The executive perspective has shifted dramatically – 64% of CEOs now view the regulatory environment as actively inhibiting value creation rather than simply adding operational costs. This reflects the reality that modern regulatory frameworks directly impact strategic business decisions, from market entry timing to product development roadmaps. Companies with advanced jurisdictional monitoring capabilities can enter new markets faster, adapt products more efficiently, and even influence regulatory development through early engagement with policymakers.

Modern Jurisdictional Monitoring Architecture

Effective jurisdictional change monitoring requires a fundamental shift from reactive information consumption to proactive intelligence synthesis. Modern systems operate on four foundational principles that transform regulatory noise into strategic clarity.

Comprehensive source integration monitors primary sources including official government publications, legal gazettes, regulatory agency feeds, and multilateral organization updates. This direct access ensures complete coverage and eliminates interpretation delays that plague secondary sources.

Contextual filtering distinguishes between regulatory changes requiring immediate action and those providing advance notice of future requirements. This intelligence prevents information overload while ensuring critical changes receive appropriate attention.

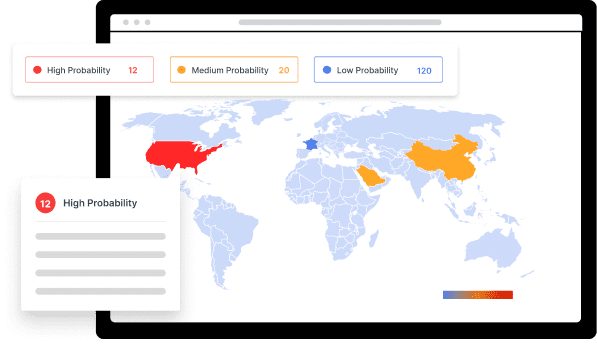

Cross-jurisdictional correlation identifies relationships between regulatory changes across different jurisdictions, enabling organizations to understand how a change in one market might impact global operations. A regulatory shift in the European Union can trigger compliance requirements across subsidiary operations in Asia-Pacific markets, supply chain partners in Latin America, and data processing activities in North America.

Predictive analysis uses historical patterns and regulatory trends to predict likely future changes, enabling proactive compliance planning rather than reactive scrambling. The most sophisticated systems analyze regulatory development patterns to forecast upcoming requirements months before official publication.

Effective monitoring requires diverse information sources. Primary government sources provide authoritative information about confirmed changes. Legal gazettes represent the definitive record but often require significant processing to extract actionable insights. Industry associations provide early warnings about proposed changes and practical interpretations. Multilateral organizations like the OECD and World Trade Organization often drive harmonization efforts that eventually cascade to individual jurisdictions.

Quality assurance ensures reliability through multi-source verification of critical changes, expert validation networks providing local context, and automated consistency checking that flags potential conflicts between related regulations.

Legal Gazette Intelligence and Dynamic Calendars

Legal gazettes represent the official record of regulatory changes in most jurisdictions, but their traditional formats often make systematic monitoring difficult. Converting these authoritative sources into actionable intelligence requires sophisticated processing capabilities.

Legal Gazette Processing

Legal gazettes vary dramatically in format, publication frequency, and content organization across jurisdictions. European Union gazettes follow structured formats with standardized section numbering, while emerging market publications may use less consistent organizational schemes.

Modern gazette monitoring employs advanced natural language processing algorithms that identify regulatory changes within gazette text, distinguishing between substantive modifications and administrative updates. These systems process multiple languages simultaneously while maintaining accuracy across different legal terminology systems.

Red-line comparison analysis automatically compares new gazette entries with existing regulatory frameworks, highlighting exactly what has changed and identifying potential conflicts with existing requirements. Impact classification categorizes gazette entries by potential business impact, urgency level, and affected business functions, enabling compliance teams to prioritize responses appropriately.

Dynamic Regulatory Calendars

Traditional compliance calendars quickly become obsolete in the face of constant regulatory change. Dynamic regulatory calendars represent a fundamental advancement, automatically adapting to new requirements while maintaining comprehensive coverage of existing obligations.

When monitoring systems detect regulation changes affecting compliance deadlines, dynamic calendars automatically adjust related entries, update dependent tasks, and notify affected stakeholders. Cascade impact analysis identifies how changes to one regulatory deadline impact related compliance activities, adjusting multiple calendar entries simultaneously.

Multi-jurisdiction coordination helps organizations operating across multiple jurisdictions manage overlapping and sometimes conflicting compliance requirements. Intelligent calendars identify these conflicts and suggest optimal resolution strategies while coordinating activities across multiple business functions. Different stakeholders require different perspectives. Executive dashboards provide C-suite leaders high-level visibility into compliance status and upcoming critical deadlines without operational detail overload. Operational views give compliance managers detailed task lists, resource assignments, and progress tracking capabilities. Audit trails provide internal and external auditors comprehensive records of compliance activities, including evidence of completion and documentation of exceptions.

AI-Powered Impact Assessment

Artificial intelligence is revolutionizing how organizations assess the impact of regulatory changes, moving beyond simple alert systems to provide sophisticated analysis of business implications and implementation requirements.

Advanced AI systems provide contextual analysis of regulatory changes within the broader context of existing requirements, identifying potential conflicts, redundancies, or gaps requiring attention. Business impact modeling considers factors like implementation costs, operational disruptions, and competitive implications. Risk prioritization automatically prioritizes regulatory changes based on business impact, implementation urgency, and resource requirements.

Red-Line Analysis

Sophisticated AI systems excel at identifying precisely what has changed in regulatory frameworks. Granular change detection identifies changes at the paragraph, sentence, or even word level, providing precise information about modifications, additions, or removals. Version comparison maintains comprehensive regulatory version histories, enabling detailed comparison between any two points in time to understand regulatory evolution patterns. Cross-reference analysis identifies how changes in one regulation impact related requirements, providing comprehensive impact analysis beyond immediate regulatory text.

Explainable AI for Compliance

The compliance domain requires AI systems that can explain their reasoning and provide auditable decision-making processes. Modern compliance AI systems provide detailed explanations of how they reached specific conclusions, including data sources, analytical methods, and logical reasoning involved. Audit trail generation automatically documents analytical processes, supporting both internal reviews and external regulatory examinations. The most effective systems integrate AI capabilities with human expertise, enabling compliance professionals to validate and refine AI-generated recommendations.

Building Collaborative Compliance Implementation

Effective regulatory compliance requires seamless coordination across multiple business functions, jurisdictions, and stakeholder groups. Modern compliance implementation platforms provide the collaboration tools and workflow management capabilities needed to transform complex regulatory requirements into coordinated organizational responses.

Regulatory compliance typically involves diverse stakeholder groups with different expertise areas and responsibilities. Legal and compliance teams interpret regulatory requirements and develop implementation strategies but require operational input to ensure practical feasibility. Business operations implements compliance measures in daily operations, requiring clear guidance on new requirements. Technology and data teams often implement technical compliance measures, particularly in data protection and cybersecurity. Executive leadership requires visibility into compliance status and strategic implications without operational detail overload.

Workflow Automation

Modern compliance implementation relies heavily on automated workflow management. Intelligent task assignment automatically assigns compliance tasks to appropriate stakeholders based on expertise areas, workload capacity, and jurisdictional requirements. Dependency management handles interdependent tasks that must be completed in specific sequences. Progress tracking provides real-time visibility into implementation status, identifying potential bottlenecks before they become critical issues.

Standardized communication protocols ensure all stakeholders understand their responsibilities, timelines, and escalation procedures. Centralized documentation maintains comprehensive repositories of compliance documentation, ensuring all stakeholders have access to current information and historical records. Regulatory correspondence management ensures appropriate stakeholders are informed and responses are coordinated effectively.

Choosing Your Monitoring Solution

Selecting the right jurisdictional change monitoring solution requires careful evaluation of organizational needs, technical capabilities, and strategic objectives. Several critical considerations will impact compliance effectiveness for years to come.

Core Platform Capabilities

The most critical factor is comprehensive coverage of regulatory sources across all relevant jurisdictions. Evaluate not just the number of jurisdictions covered, but the depth of coverage within each jurisdiction, including local and municipal regulations where relevant. Processing speed and accuracy are essential – assess how quickly systems identify changes, the accuracy of their automated processing, and their ability to distinguish between significant changes and administrative updates.

Integration capabilities ensure compliance monitoring systems connect seamlessly with existing enterprise systems, including document management platforms, workflow management tools, and reporting systems. Evaluate natural language processing quality across multiple languages, impact assessment intelligence that analyzes how regulatory changes impact specific business operations, and predictive capabilities using historical data and trend analysis.

User Experience and Vendor Selection

The effectiveness of any monitoring solution depends heavily on user adoption and practical usability. Compliance teams often work under significant time pressure, making intuitive interface design crucial for effective adoption. Different users require different information views and alert configurations – evaluate how effectively systems accommodate diverse user needs.

Vendor evaluation involves strategic considerations beyond immediate technical capabilities. Assess vendor experience in your specific industry and their track record of successful implementations. Consider vendor relationships with regulatory bodies and their reputation within the compliance community. Evaluate investment in research and development and roadmap for future capability enhancement. Regulatory monitoring represents a long-term commitment, so assess vendor financial stability and likelihood of maintaining and enhancing their platform over time.

FAQ: Common Monitoring Questions

- Q: What is the difference between regulatory change monitoring and general compliance management?

Regulatory change monitoring focuses specifically on identifying and processing new or modified regulations as they are published, while general compliance management encompasses the broader range of activities required to maintain ongoing compliance with existing regulations. Change monitoring serves as the early warning system that feeds into broader compliance management processes, requiring specialized capabilities like legal gazette processing, cross-jurisdictional correlation, and real-time alerting. - Q: How do organizations measure ROI from jurisdictional monitoring investments?

Organizations measure monitoring ROI through several key metrics. Direct cost avoidance includes penalties avoided through early compliance and operational efficiency gains from automated processing. Many organizations report reducing compliance management time by 40-60% through automated monitoring. Indirect benefits include faster market entry through proactive regulatory preparation, reduced legal consultation costs through better internal intelligence, and improved negotiating positions with regulatory bodies. - Q: What are the most common implementation challenges?

The primary implementation challenge involves data integration complexity, particularly when connecting monitoring systems with existing compliance workflows and document management platforms. Organizations often underestimate the effort required to configure systems for their specific business contexts and regulatory profiles. Change management represents another significant challenge, as compliance teams must adapt established workflows to incorporate new monitoring capabilities. Successful implementations typically require 3-6 months of adjustment period with dedicated training and support. - Q: How do different legal systems impact monitoring approach requirements?

Common law jurisdictions (like the US and UK) typically require monitoring of judicial decisions and regulatory interpretations alongside formal regulations, as precedent plays a significant role in compliance requirements. Civil law jurisdictions focus primarily on codified regulations but often have more prescriptive requirements. Mixed legal systems require hybrid approaches that account for both codified regulations and judicial precedent. - Q: What level of automation is realistic for regulatory change monitoring?

Current technology enables 80-90% automation of the initial change identification and basic processing tasks, including source monitoring, change detection, and initial categorization. However, impact assessment and implementation planning still require significant human expertise, particularly for complex or ambiguous regulatory changes. The most effective approaches combine automated processing for routine tasks with human expertise for interpretation and strategic decision-making. - Q: What integration capabilities are essential for enterprise deployments?

Enterprise deployments require robust integration with document management systems, workflow management platforms, and enterprise resource planning systems. API-based integrations enable real-time data sharing while maintaining system independence. Single sign-on capabilities and role-based access controls are essential for organizations with complex user hierarchies. Integration with existing reporting and analytics platforms enables consistent performance measurement and executive visibility.

Modern jurisdictional change monitoring represents a fundamental shift from reactive compliance to proactive regulatory intelligence. Organizations that master these capabilities will not only avoid the escalating costs and risks of non-compliance but will transform regulatory change from a business constraint into a competitive advantage. The regulatory landscape will continue evolving at an accelerating pace, making sophisticated monitoring capabilities essential for sustainable business success.

Experience the Future of ESG Compliance

The Compliance & Risks Sustainability Platform is available now with a 30-day free trial. Experience firsthand how AI-driven, human-verified intelligence transforms regulatory complexity into strategic clarity.

👉 Start your free trial today and see how your team can lead the future of ESG compliance.

The future of compliance is predictive, verifiable, and strategic. The only question is: Will you be leading it, or catching up to it?

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.