Automated Regulation Mapping for ESG KPIs: The Complete 2025 Guide to AI-Driven Compliance

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Managing ESG compliance shouldn’t feel like navigating an impossibly complex maze. Yet 57% of firms cite compliance complexity as their top challenge, while 49% report high costs as a major obstacle in meeting ESG regulations. The traditional approach—manually tracking hundreds of regulations across spreadsheets—simply doesn’t scale in today’s rapidly evolving regulatory landscape.

This comprehensive guide reveals exactly how leading organizations automate the identification and mapping of regulatory obligations to their ESG metrics, transforming what was once a resource-intensive manual process into a streamlined, intelligent system. You’ll discover the four-step framework that connects your KPIs to relevant regulations automatically, see real examples of this technology in action, and explore how an interactive mapping tool can immediately demonstrate value for your compliance program.

Table of Contents

- The Hidden Cost of Manual ESG Compliance

- What Is Automated Regulation Mapping?

- The 4-Step Framework for Automating ESG KPI Mapping

- Step 1: Centralizing Your ESG Data Sources

- Step 2: Identifying Relevant Regulatory Requirements

- Step 3: The AI Engine – Connecting KPIs to Regulations

- Step 4: Continuous Monitoring and Reporting

- Interactive ESG KPI Mapper: See It in Action

- Building the Business Case: ROI of Automated Compliance

- Beyond Mapping: Complete Compliance Strategy

- Frequently Asked Questions

The Hidden Cost of Manual ESG Compliance

The numbers tell a startling story. Organizations operating across multiple jurisdictions typically face over 400 distinct ESG-related regulatory requirements. A single sustainability manager might spend 15-20 hours per week just identifying which regulations apply to their specific KPIs, leaving little time for strategic compliance improvement.

Consider the complexity facing a multinational technology company. They must track energy usage for EU CSRD requirements, monitor hazardous material reduction for RoHS compliance, calculate reuse rates for circular economy reporting, and measure carbon emissions for TCFD disclosures—all while ensuring these metrics align with potentially overlapping regulatory frameworks across different markets.

The traditional approach involves maintaining complex spreadsheets that map each KPI to relevant regulations, but this method breaks down quickly. When the EU updates CSRD requirements or the UK modifies SECR reporting standards, compliance teams scramble to identify impacts across their entire KPI framework. By the time they’ve updated their mappings, new regulations have emerged.

This reactive approach creates what compliance experts call the “perpetual catch-up cycle”—organizations always trailing behind regulatory changes, never getting ahead of compliance requirements. The result is increased risk, higher costs, and missed opportunities to leverage ESG performance for competitive advantage.

What Is Automated Regulation Mapping?

Automated regulation mapping transforms the traditional manual process into an intelligent, AI-driven system that connects your ESG KPIs to relevant regulatory obligations in real-time. Instead of spending weeks researching which regulations apply to your energy consumption metrics, the system instantly identifies every relevant requirement across all operating jurisdictions.

The technology works by maintaining a comprehensive, continuously updated database of global regulations—covering everything from energy efficiency mandates to circular economy requirements. Advanced algorithms analyze the language and intent of these regulations, creating semantic connections between regulatory text and your specific ESG metrics.

Modern ESG automation platforms utilize over 100 pre-built API connectors to integrate data sources automatically, creating a centralized, auditable ESG data library. This approach replaces the fragmented spreadsheet systems that 40% of investors cite as the primary barrier to effective ESG data management.

The automation extends beyond simple matching. These systems understand context—recognizing that “energy consumption” in manufacturing contexts might trigger different regulatory requirements than energy usage in data centers. They account for company size thresholds, geographic scope, and industry-specific exemptions that manual processes often miss.

When regulations change, the system automatically reassesses all relevant KPIs and flags potential impacts. This proactive approach means compliance teams receive advance notice of upcoming requirements, allowing strategic planning rather than crisis response.

The 4-Step Framework for Automating ESG KPI Mapping

Leading organizations follow a systematic approach to automate their ESG regulation mapping. This framework, developed through analysis of successful implementations across multiple industries, provides a clear pathway from manual processes to intelligent automation.

Step 1: Centralizing Your ESG Data Sources

The foundation of effective automated mapping begins with data consolidation. Most organizations discover their ESG data exists across multiple systems—energy consumption tracked in facilities management software, waste reduction metrics in operational databases, and emissions data in environmental management systems.

Modern platforms address this challenge through comprehensive data integration capabilities. They connect directly to existing enterprise systems, pulling data from ERP platforms, IoT sensors, utility management systems, and third-party data providers. Rather than requiring manual data entry, these integrations create a real-time data pipeline that ensures mapping accuracy.

The centralization process reveals hidden data relationships. For instance, energy consumption data might connect to both carbon emissions reporting and energy efficiency regulatory requirements. Automated systems identify these multi-dimensional relationships, ensuring no regulatory obligation is overlooked.

Data quality becomes crucial at this stage. Automated systems implement validation rules that flag inconsistencies, missing values, or suspicious trends. This quality assurance function often discovers data issues that manual processes miss, improving overall reporting reliability.

Step 2: Identifying Relevant Regulatory Requirements

With centralized data established, the system begins intelligent regulatory identification. This process goes far beyond simple keyword matching, utilizing natural language processing to understand regulatory intent and scope.

The AI analyzes your company profile—industry classification, geographic operations, company size, and business activities—against comprehensive regulatory databases covering 195 countries and territories. This analysis considers not just current operations but planned expansions, ensuring emerging market requirements are identified proactively.

For UK operations, this might include CSRD requirements for large companies, SECR energy reporting for qualifying organizations, and TCFD climate disclosures for financial services firms. The system understands the interconnections between these frameworks, identifying overlapping requirements that can streamline reporting processes.

The technology also recognizes regulatory hierarchies and precedence. When multiple regulations address similar requirements, the system identifies the most stringent standard, ensuring compliance with the highest requirement automatically satisfies lesser obligations.

Threshold management becomes automated. The system monitors your company metrics against regulatory thresholds—employee counts, revenue levels, energy consumption volumes—and automatically flags when approaching limits that trigger new obligations.

Step 3: The AI Engine – Connecting KPIs to Regulations

The core intelligence emerges in the mapping engine, where sophisticated algorithms create precise connections between your specific KPIs and applicable regulatory requirements. This process involves multiple layers of analysis that human reviewers would find prohibitively time-consuming.

Semantic analysis examines regulatory language to understand what each requirement actually measures. When a regulation mentions “energy efficiency improvements,” the system identifies all KPIs that could demonstrate such improvements—energy consumption per unit of production, renewable energy percentages, energy intensity ratios, or efficiency upgrade investments.

Context awareness ensures mapping accuracy. The system recognizes that “hazardous materials” requirements vary significantly between electronics manufacturing (RoHS compliance) and chemical production (REACH obligations), mapping appropriate KPIs for each context.

The AI continuously learns from regulatory updates and user feedback. When compliance teams confirm or modify suggested mappings, the system incorporates this knowledge to improve future recommendations. This machine learning capability means mapping accuracy increases over time.

Cross-jurisdictional intelligence prevents compliance gaps. The system identifies situations where operations in multiple jurisdictions create overlapping or conflicting requirements, suggesting consolidated KPIs that satisfy multiple regulations simultaneously.

Step 4: Continuous Monitoring and Reporting

Automation’s greatest value emerges through continuous monitoring capabilities. Rather than periodic compliance reviews, the system provides real-time oversight of regulatory changes and their potential impacts on your KPI framework.

Regulatory tracking monitors thousands of government websites, legislative databases, and official publications for emerging requirements. When new regulations are proposed or existing ones modified, the system immediately assesses relevance to your operations and existing KPI mappings.

Impact assessment quantifies potential changes. The system doesn’t just flag new requirements—it estimates implementation timelines, identifies affected KPIs, and suggests necessary data collection modifications. This analysis enables strategic planning rather than reactive compliance.

Automated reporting generation creates audit-ready documentation that demonstrates compliance processes. The system maintains comprehensive records of how KPIs map to regulations, when mappings were established or modified, and evidence supporting compliance.

Interactive ESG KPI Mapper: See It in Action

To demonstrate the power of automated regulation mapping, modern ESG compliance platforms offer interactive tools that showcase immediate value. These mappers allow organizations to input their basic company information—industry, size, locations, and key ESG focus areas—and instantly receive a customized regulatory landscape analysis.

The interactive experience typically reveals surprising insights. A mid-sized manufacturing company might discover they’re subject to 47 different ESG regulations across their operating jurisdictions, with 23 requiring specific KPI tracking that wasn’t previously identified. The tool highlights regulatory overlaps where single KPIs can satisfy multiple requirements, immediately identifying efficiency opportunities.

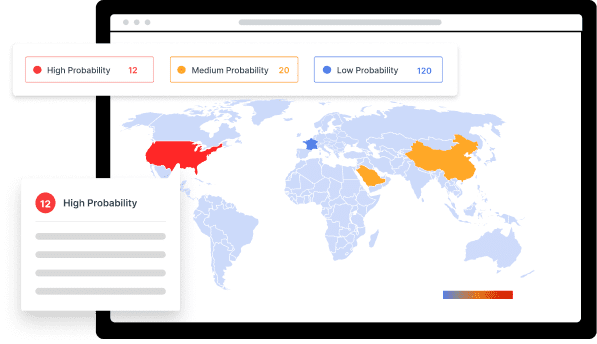

Real-time visualization capabilities display regulatory complexity through intuitive dashboards. Users can see how their KPIs connect across different regulatory frameworks, identify gaps where additional metrics might be needed, and understand the priority ranking of various compliance obligations based on penalties, deadlines, and business impact.

Building the Business Case: ROI of Automated Compliance

The financial justification for automated ESG mapping becomes clear when quantifying current manual process costs. Organizations typically underestimate the true expense of compliance management, focusing only on direct labor costs while missing opportunity costs, error-related expenses, and strategic delays.

Direct cost savings emerge immediately. A sustainability team spending 60 hours monthly on regulatory research can redirect that effort to strategic initiatives worth significantly more than compliance maintenance. When multiplied across global operations, these efficiency gains often justify automation investments within the first year.

Risk mitigation provides substantial additional value. Automated systems dramatically reduce the likelihood of missing regulatory deadlines or overlooking applicable requirements. Even a single missed compliance obligation can result in penalties, market access restrictions, or reputational damage worth far more than the technology investment.

Strategic advantages compound over time. Organizations with automated mapping capabilities can respond to new market opportunities faster, incorporate ESG performance into business development more effectively, and demonstrate compliance readiness that accelerates partnerships and customer acquisition.

Beyond Mapping: Complete Compliance Strategy

While automated regulation mapping provides the foundation, comprehensive ESG compliance strategy requires integration with broader business processes. Leading organizations use mapping insights to inform strategic decision-making, not just satisfy reporting requirements.

Supply chain integration becomes more sophisticated when regulatory mapping extends beyond direct operations. Automated systems can assess supplier ESG compliance requirements, identifying where partner performance might impact your regulatory obligations and suggesting contractual provisions that ensure alignment.

Product development acceleration occurs when regulatory mapping informs design decisions early in development cycles. Instead of discovering compliance requirements during late-stage testing, teams can incorporate regulatory considerations from initial concept development, reducing time-to-market and avoiding costly redesigns.

Investment planning improves when regulatory intelligence provides advance visibility into upcoming requirements. Organizations can budget for necessary infrastructure, technology, or process changes well before compliance deadlines, avoiding rushed implementations and premium pricing from constrained vendor availability.

Frequently Asked Questions

- Q: How accurate is automated regulation mapping compared to manual review?

Modern AI-driven mapping systems achieve 95%+ accuracy rates for regulatory identification, significantly higher than manual processes which studies show miss 20-30% of applicable requirements due to research time constraints and human oversight. The systems continuously improve through machine learning and expert verification. - Q: Can automated mapping handle complex jurisdictional overlaps?

Yes, advanced systems excel at identifying and reconciling overlapping requirements across multiple jurisdictions. They can suggest consolidated KPIs that satisfy multiple regulations simultaneously and flag potential conflicts that require expert review. - Q: What’s the typical implementation timeline for automated mapping?

Most organizations achieve initial mapping results within 2-4 weeks of system implementation. Complete integration with existing data sources and workflow customization typically requires 6-12 weeks, depending on data complexity and organizational requirements. - Q: How do these systems stay current with regulatory changes?

Automated platforms monitor thousands of regulatory sources continuously, using AI to assess relevance and impact of changes. Expert teams verify significant updates, ensuring accuracy while maintaining real-time currency that manual processes cannot match. - Q: What happens when regulations conflict across jurisdictions?

The system identifies conflicts and provides expert analysis of resolution approaches. This might include recommendations for meeting the most stringent requirement, implementing jurisdiction-specific processes, or seeking regulatory guidance for unique situations. - Q: Can the technology integrate with existing ESG reporting tools?

Modern platforms offer extensive integration capabilities, connecting with major ESG reporting tools, ERP systems, and data management platforms through APIs and standardized data formats. This ensures mapping insights enhance existing workflows rather than requiring complete system replacement.

Stay Ahead Of Regulatory Changes in Sustainability

Want to stay ahead of regulatory developments in sustainability?

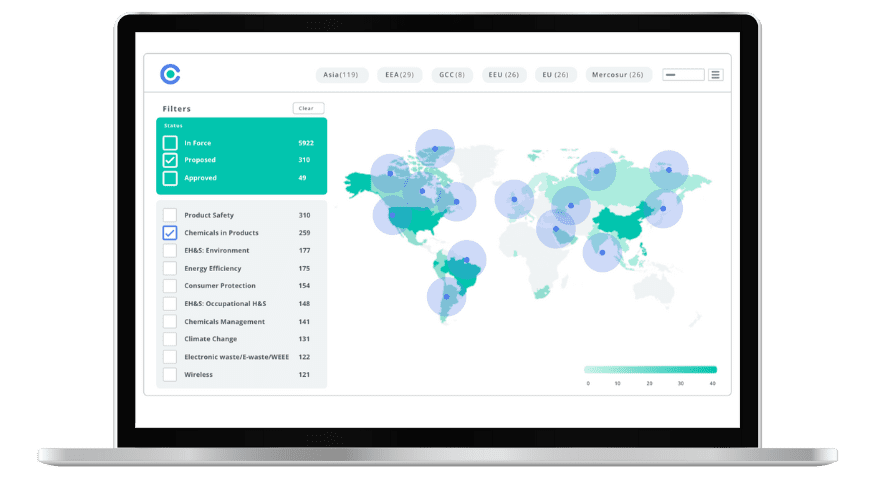

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.