Mercury-Added Products in Asia: A Compliance Guide

THIS BLOG WAS WRITTEN BY THE COMPLIANCE & RISKS MARKETING TEAM TO INFORM AND ENGAGE. HOWEVER, COMPLEX REGULATORY QUESTIONS REQUIRE SPECIALIST KNOWLEDGE. TO GET ACCURATE, EXPERT ANSWERS, PLEASE CLICK “ASK AN EXPERT.”

Asia is gradually and rapidly tightening regulations on the use of mercury-added products during the period of 2025-2027. Several countries are introducing bans, restrictions, and phase-out deadlines for them. These rules seek ways to align with international agreements such as the Minamata Convention for the reduction of mercury pollution. For companies that manufacture, import, or sell these products in the region, the regulatory landscape has become more complex—and compliance has become mandatory.

This compliance guide aims to summarize the latest regulatory changes related to mercury-added products in Asia. We explain the product categories, important deadlines, and the steps companies must take to remain compliant. We will address these issues in the following countries: China, Taiwan, Japan, Vietnam, Hong Kong, and Singapore.

Why Mercury Compliance Matters in Asia?

Mercury is a highly toxic substance that exposes the environment and public health to significant risks. For this reason, regional regulatory agencies have accelerated the phase-out and ban of mercury-added products in Asia, especially in lighting, batteries, and measuring devices. If regulations are not complied with within the established deadlines, product recalls, import bans, fines, and damage to companies’ reputations may occur. This makes it essential for manufacturers and importers to understand this context, in addition to enforcement expectations.

China: New Phase-Out Rules for Mercury-Added Products

China’s Ministry of Ecology and Environment (MEE) released a draft regulation implementing amendments to the Minamata Convention in November 2025. This draft has 12 specific mercury-added product types as targets. It also prohibits mercury catalysts in polyurethane production.

A phased ban on the production, import, and export of mercury-added products is the core requirement of the draft. It includes strict restrictions on the production of some types of batteries, cosmetics, fluorescent lamps, and measuring instruments of high precision. The use of banned products within assembled goods is also prohibited, extending compliance through the entire supply chain.

Taiwan: Total Ban on Mercury and Elimination of Mercury-Containing Fluorescent Lamps

Taiwan has proposed significant changes to the prohibited activities and permitted uses for mercury to strengthen management and phase out non-essential uses.

The Ministry of Environment seeks to completely prohibit the manufacture, import, sale and use of mercury, with the exception of specified permitted uses.

Specific deadlines are set for phasing out the manufacture of mercury-containing fluorescent lamps. The phase-out is primarily driven by the Minamata Convention, which mandates a global transition to mercury-free alternatives like LEDs. The targeted phase-out deadline for compact fluorescent lamps is December 31, 2026, while the deadline for linear and non-linear fluorescent lamps is December 31, 2026 and December 31, 2027, depending on wattage and phosphor type.

Japan: Strong Controls on Class-I-Chemicals and Mercury Products

Japan has been enforcing stringent chemical controls under the Chemical Substances Control Law (CSCL) for the past years. In 2025, the country expanded the list of Class-I chemicals and mercury products. The idea is to restrict manufacturing, import, and use without regulatory approval. Specified products containing these chemicals are being applied to import bans.

The “specified mercury-using products” list grew, and a strict phase-out schedule was also implemented. This way, products must be compliant before entering the Japanese market, or import bans corresponding to internal manufacturing bans will be applied.

Vietnam: New Chemical Information Disclosure and Dangerous Chemical Controls

Vietnam’s draft decree on products presents restrictions to 241 substances, including industrial precursors and substances under the Stockholm and Rotterdam Conventions. It also introduces controls on their information disclosure. Then, organizations producing or importing goods with these hazardous chemicals will have to follow a rigorous tracking system for their content, use, and concentration.

To follow the decree, manufacturers and importers must declare product chemical information in a specialized database. Also, they must publicly disclose composition details via labels or electronic pages. Such records should be maintained as a proof of accuracy and compliance.

Hong Kong: Mercury Control Ordinance Expansion

Amendments to the Mercury Control Ordinance were made by Hong Kong in 2025, adding 16 mercury-added products to the list. The first phase of restrictions took effect on December 31, 2025, covering products like compact fluorescent lamps, measuring devices, mercury vacuum pumps, and more.

The second phase, predicted to be in 2026, will cover additional product categories following international conventions, marking a continued expansion of mercury regulation in the special administrative region of China.

Singapore: New Controls on POPs + Mercury Product Bans

Singapore’s Ministry of Sustainability and the Environment (MSE) and National Environment Agency (NEA) strengthened hazardous substance controls in 2025. Key actions include:

- Temporary exemptions for certain POPs (Dechlorane Plus and UV-328) for specific high-reliability applications.

- New controlled chemical requirements, including HS (Hazardous Substances) licensing and permits.

- A complete ban on nine mercury-added product categories, effective August 1, 2025.

These changes require companies to verify compliance before importing, manufacturing, or handling regulated products.

Mercury-Added Products in Asia: Phase-Out Deadlines Table

| Country | Product Category | Product | Phase-Out Deadline |

| China | Fluorescent Lamps (CFLs) | CFLs over 30W | Dec 31, 2026 |

| China | Fluorescent Lamps (CFLs) | Non-integrated ballast CFLs ≤ 30W (≤ 5 mg mercury) | Dec 31, 2026 |

| China | Fluorescent Lamps (Halophosphate) | Linear lamps ≤ 40W (≤ 10 mg mercury) | Dec 31, 2026 |

| China | Fluorescent Lamps (Halophosphate) | Linear lamps > 40W | Dec 31, 2026 |

| China | Fluorescent Lamps (Halophosphate) | Non-linear fluorescent lamps (U-shaped/circular) on all wattages | Dec 31, 2026 |

| China | Fluorescent Lamps (Triband) | Linear lamps < 60W (≤ 5 mg mercury) | Dec 31, 2027 |

| China | Fluorescent Lamps (Triband) | Linear lamps ≥ 60W (≤ 5 mg mercury) | Dec 31, 2027 |

| China | Fluorescent Lamps (Triband) | Linear lamps ≥ 60W (> 5 mg mercury) | Dec 31, 2027 |

| China | Fluorescent Lamps (Triband) | Non-linear fluorescent lamps (U-shaped/circular) on all wattages | Dec 31, 2027 |

| Taiwan | Compact Fluorescent Lamps | CFLs | December 31, 2026 |

| Taiwan | Linear Fluorescent Lamps | Triband phosphor < 60W | December 31, 2027 |

| Japan | Specified mercury products | Multiple categories | Jan 1, 2026–2028 (varies) |

| Hong Kong | Mercury products | 8 initial categories (e.g., CFLs, measuring devices) | Dec 31, 2025 |

| Singapore | Mercury products | 9 product categories | Aug 1, 2025 |

How Companies Should Prepare?

To ensure compliance of mercury-added products in Asia, companies must take these proactive steps:

- Map product portfolios against local mercury restrictions and deadlines.

- Verify supplier documentation for mercury content and compliance certifications.

- Update product labeling and packaging where required.

- Prepare for import/export restrictions and ensure supply chain traceability.

- Monitor regulatory updates continuously, especially in fast-changing markets like China and Taiwan.

Mercury-added products in Asia are passing through phase-outs and restrictions really fast. So, companies must adapt quickly, since multiple countries are implementing bans and expanding control lists. In this scenario, compliance requires robust product chemical management, accurate documentation, and strong supplier oversight. If they fail to meet deadlines, it can result in market exclusion and significant regulatory penalties.

The time to act is now. Businesses acting in Asia must establish a compliance roadmap, identifying affected products and ensuring their supply chain is aligned with these evolving regulations.For more in-depth information about this theme, please go to our whitepaper Asia Product Compliance: Regulatory Trends in Major Markets in 2025, written by our subject matter experts Giselle Chia and Lynn Chiam.

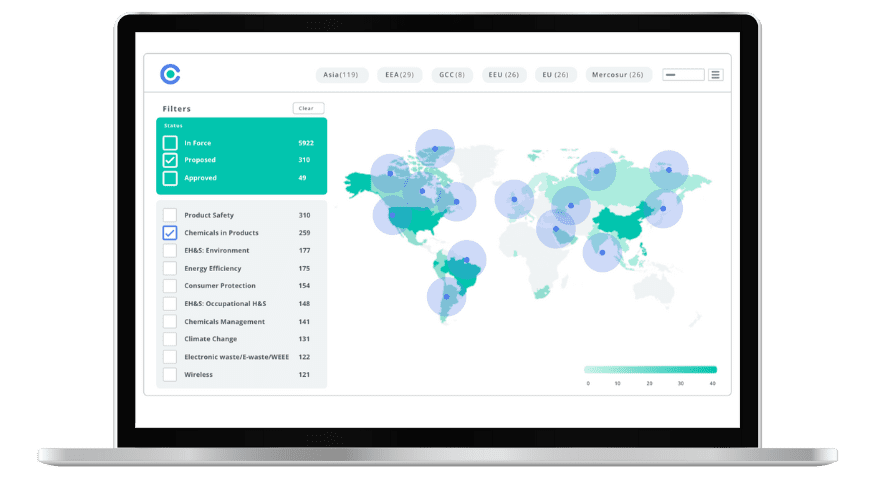

Simplify Corporate Sustainability Compliance

Six months of research, done in 60 seconds. Cut through ESG chaos and act with clarity. Try C&R Sustainability Free.