24 Stats Every Chief Compliance Officer Should Know in 2024

This blog was originally posted on 11th January, 2024. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

It’s 2024, and the weight of ever-growing, ever-evolving, regulations remain on the shoulders of each Chief Compliance Officer (CCO), and the entire compliance team. CCOs are facing a myriad of challenges and opportunities to ensure their compliance frameworks, risk mitigation processes, and technological advancements are being honed to navigate the complex global regulatory environment.

This article has been drafted to firstly aid chief compliance officers and their team grasp the key themes in their industry in 2024, and also to validate the strategies taken by modern compliance teams in choosing technology to effectively manage their compliance vs. manual processes.

Please enjoy 24 key statistics every chief compliance officer (and the entire compliance team!) should know in 2024. If you have insight or stats you think should be added to the list, reach out to us – we’re excited to collaborate with industry experts!

24 Stats Every Chief Compliance Officer Should Know

1. 35% of risk and compliance professionals are adopting technology to meet regulatory requirements. (Navex Global’s 2022 Definitive Risk & Compliance Benchmark Report)

2. According to Navex Global’s 2023 Definitive Risk & Compliance Benchmark Report, a significant 83% of risk and compliance professionals consider maintaining compliance with laws, policies, and regulations as a very important or absolutely essential consideration aspect in their decision-making processes. (Navex Global’s 2023 Definitive Risk & Compliance Benchmark Report)

3. 80% of corporate risk and compliance professionals acknowledge risk and compliance as valuable business advisory functions, with 74% recognizing their role in enabling, supporting, and enhancing business activities. (2023 Thomson Reuters Risk & Compliance Survey Report)

4. In 2023, 73% of organizational leaders agreed with the effectiveness of cyber and privacy regulations in reducing cyber risks, marking a noticeable increase from the 39% agreement recorded in 2022. (World Economic Forum’s Global Cybersecurity Outlook 2023)

5. If U.S. regulation were a separate nation, it would be the eighth-largest economy globally. (CEI Ten Thousand Commandments 2022)

6. According to the findings in the Coalfire Compliance Report of 2023, a notable 84% of professionals in the fields of security and IT regard data protection frameworks, such as GDPR and CCPA, as obligatory prerequisites for their respective industries. (Coalfire Compliance Report 2023)

7. Compliance officers are increasingly involved in areas such as implementing a demonstrably compliant culture (58%), setting risk appetite (51%), and assessing the effectiveness of corporate governance arrangements (48%). (Thomson Reuter’s Cost of Compliance Report 2023)

8. A significant 76% of risk and compliance professionals prioritize ensuring their organization builds and maintains an ethical culture of compliance in their decision-making processes. (Navex Global’s 2023 Definitive Risk & Compliance Benchmark Report)

9. As revealed in the 2023 Thomson Reuters Risk & Compliance Survey Report, risk and compliance professionals dedicate most of their time to identifying and assessing risk (56%) and monitoring compliance (52%). (2023 Thomson Reuters Risk & Compliance Survey Report)

10. According to The Institute of Internal Auditors’ 2021 North American Pulse of Internal Audit Report, the top concerns for organizations are cybersecurity (65%), IT (51%), third-party relationships (41%), compliance/regulatory (41%), and operational issues (33%). (The Institute of Internal Auditors 2021 North American Pulse of Internal Audit Report)

11. When non-compliance is indicated as a factor in a breach, it costs almost $220,000 more on average. (IBM’s Cost of a Data Breach Report 2023)

12. An average cost of USD $5.05 million was associated with organizations who have a high level of non-compliance. When compared to the average cost of a data breach, this is a 12.6%, or USD $560,000, increase. (IBM’s Cost of a Data Breach Report 2023)

13. Approximately 35% of risk executives perceive compliance and regulatory risk as the primary obstacle to their company’s growth, while an equivalent proportion identifies cyber or information risk as the main concern. (2022 PwC Pulse Survey of CROs and Risk Management Leaders)

14. A significant 61% of respondents anticipate an increase in the cost of senior compliance officers, with demand for skilled staff and knowledge (77%) and additional senior staff requirements (40%) cited as the top reasons. (Thomson Reuter’s Cost of Compliance Report 2023)

15. The 2023 Thomson Reuters Risk & Compliance Survey Report identifies a lack of knowledgeable personnel, inadequate resources, and poor company culture as the top three obstacles to a team’s confidence in addressing compliance risks. (2023 Thomson Reuters Risk & Compliance Survey Report)

16. Compliance is still manually managed using spreadsheets by 60% of GRC users. (Coalfire Compliance Report 2023)

17. 44% of organizations state their top compliance management challenges as: handling compliance assessments; undergoing control testing; implementing policy and process updates. (MetricStream State of Compliance Survey Report 2021)

18. In 2023, compliance and risk professionals identified training employees on policies (42%) and aligning policies to changing regulations (38%) as their top policy management challenges. These figures showed an improvement on 2022’s survey, with training employees on policies (48%) and aligning policies to changing regulations (40%). (Navex Global’s 2023 Definitive Risk & Compliance Benchmark Report)

19. In the year 2023, 23% of professionals in the fields of security and IT identified that their primary challenges within the compliance program revolved around staying informed and interpreting new requirements and regulations that had an impact on the organization.

20. A significant 76% of managers responsible for compliance engage in the manual scanning of regulatory websites to monitor any relevant changes and evaluate the resulting impact on the organization.

21. Outsourcing compliance functionality saw a jump in 2023, with 38% of organizations opting for this, in comparison to 30% in 2022. (Thomson Reuter’s Cost of Compliance Report 2023)

22. According to Statista, cyber incidents such as cyber crime and data breaches were identified by 34% of risk management experts as the primary risk facing international businesses. (Statista)

23. Staying on top of upcoming regulatory and legislative changes was a key strategic priority for 61% of corporate risk and compliance professionals. (2023 Thomson Reuters Risk & Compliance Survey Report)

24. Corporate risk and compliance professionals value staying updated on the latest ESG-related developments, with 77% agreeing that it is important or very important. These updates include email newsletters and other publication sources, or through industry conferences/events. (2023 Thomson Reuters Risk & Compliance Survey Report)

How Can Compliance & Risks Help with Your Compliance Priorities in 2024?

We’re in the tomorrow business, providing you with critical insights to empower your strategic vision. Compliance & Risks’ mission is to help ensure global companies have the tools to build safe, sustainable, products in a world full of change. We have spent two decades honing the digital tools, expertise and content you need to monitor, assess and prove your products’ compliance, protecting your brands and helping drive your growth, all housed on our unrivaled software platform, C2P.

In the face of a compliance landscape marked by constant regulatory expansion and change, alongside a growing emphasis on sustainability, C2P acts as a strategic enabler, allowing you to proactively plan for what lies ahead. Tailored for the modern compliance team, C2P stands out as an enterprise-ready, cloud-based platform designed to meet the evolving needs of corporate compliance, helping to ensure constant global market access.

Specifically engineered with comprehensive live-linking capabilities, C2P dynamically adapts to the ever-changing regulatory environment. This ensures a revolutionary approach to managing both global and local regulations, standards, compliance prerequisites, and evidentiary requirements.

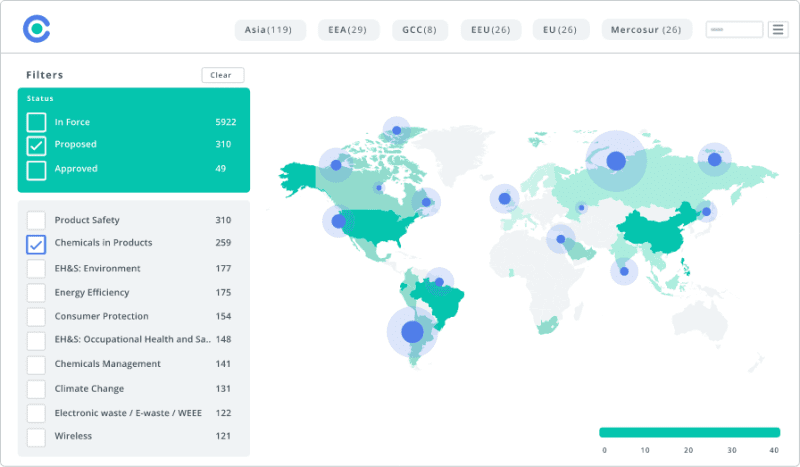

Heatmap of Global Regulations Source: C2P by Compliance & Risks

With our suite of Product Compliance & ESG Solutions, powered by the C2P, you can seamlessly research, collaborate & align with stakeholders. Witness your ESG goals and targets materialize while effortlessly showcasing compliance with evolving regulatory demands and other stakeholder mandates.

Key benefits:

- Accelerate time-to-market for products

- Enable teams with a single source for all compliance matters

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

But that’s not all – elevate your compliance journey with C2P’s customizable add-on packages. These offer specific insights into ESG and Product Compliance, with unparalleled access to global regulatory content, a dedicated team of subject matter experts, and an array of professional services meticulously designed to expedite your market access.

Please reach out to us here to learn more.