Key Priorities for a Chief Compliance Officer in 2024

This blog was originally posted on 29th November, 2023. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY VISH KARASANI, PRODUCT MARKETING MANAGER, COMPLIANCE & RISKS

2. Addressing Cybersecurity & AML Risks

3. Embracing Technology Upgrades & Innovations

4. Embracing Future-oriented Strategies

5. Regulatory Examination Preparedness

6. Collaboration & Communication

7. Hot Trends evaluated by Compliance & Risks Experts

8. What Steps can the CCO Take To Maintain Compliance Excellence

9. How Can Compliance & Risks Help You?

10. Conclusion

1. Introduction

As we step into 2024, the landscape of regulatory compliance continues to evolve, presenting both challenges and opportunities for businesses. Chief Compliance Officers (CCOs) are at the forefront, tasked with navigating an increasingly complex regulatory environment while ensuring adherence to stringent standards.

In 2024, CCOs face a myriad of challenges and opportunities to ensure robust compliance frameworks, risk mitigation, and technological advancements to navigate the complex regulatory environment.

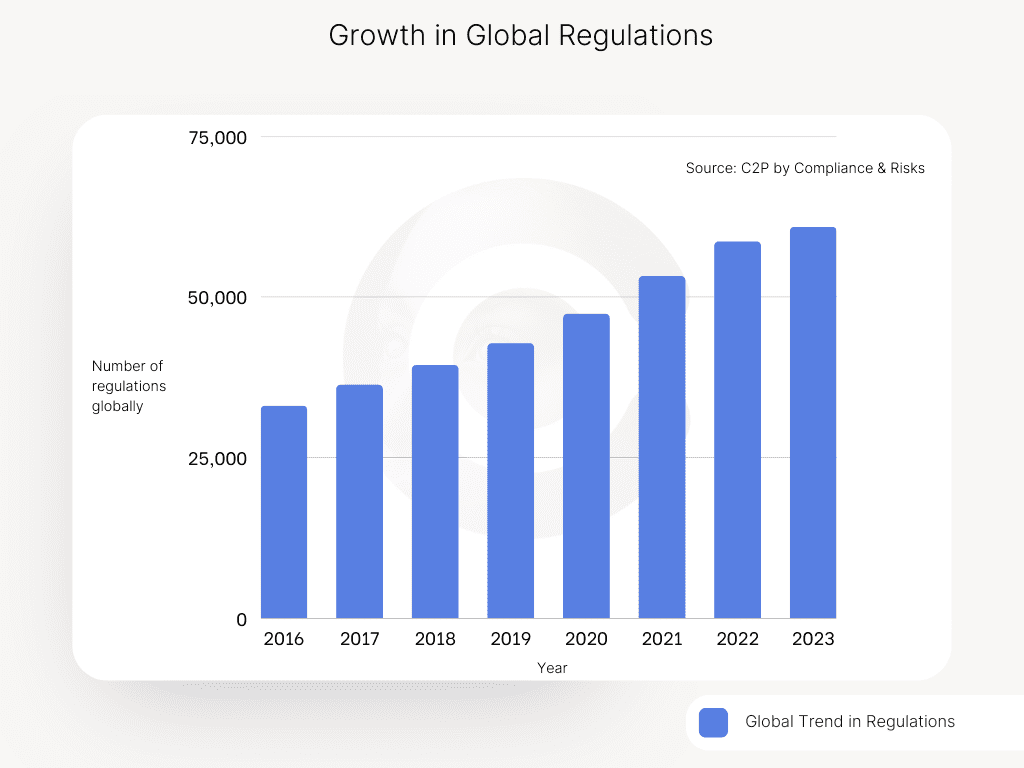

As reported on C2P Platform by Compliance & Risks, there has been an 84% growth in global regulations since 2016 (See below Image 1: Source, C2P Platform by Compliance & Risks). Product & ESG compliance is now in the limelight more than ever.

Image 1: Growth in Global Regulations, Source: C2P Platform by Compliance & Risks

In this dynamic climate, several key priorities emerge for CCOs aiming to steer their organizations toward compliance excellence and sustainable growth.

2. Addressing Cybersecurity & AML Risks

The Securities and Exchange Commission (SEC) has outlined cybersecurity and Anti-Money Laundering (AML) risks among its top examination priorities for 2024. With the evolving threat landscape, CCOs must proactively fortify their compliance programs against cyber threats and financial crimes.

Below are 3 steps to implement to mitigate these risks:

- Implement robust cybersecurity measures

- Conduct regular risk assessments

- Deploy advanced AML solutions

3. Embracing Technology Upgrades & Innovations

According to a recent survey by Gartner, CEOs and CFOs are focusing extensively on leveraging technology to drive business growth and resilience. For CCOs, this translates into an urgent need to upgrade compliance technology infrastructures. A notable article on Compliance Week emphasizes that upgrading compliance technology stands as a top priority for CCOs in 2024.

Another Gartner report states that compliance leaders anticipate technology will be one of the areas of highest spend increases this year. Source: Key Budget, Staffing and Spending Trends for Compliance in 2023.

CCOs should focus on leveraging advanced technologies such as artificial intelligence (AI), machine learning, and automation to streamline compliance processes. Investing in tech upgrades not only enhances efficiency but also improves accuracy in regulatory monitoring, stakeholder reporting & regulatory compliance.

64% of large companies (more than $1 billion in annual revenue) list enhanced evidence mapping as the top way to effectively demonstrate compliance with multiple frameworks. Source: Coalfire Compliance Report 2023)

Product Compliance & ESG Compliance solutions by Compliance & Risks are perfect examples of technology blending with compliance strategy to help enable business excellence driven by compliance.

4. Embracing Future-oriented Strategies

The Chief Compliance Officer of 2024 should have a keen overview towards the future with powerful insights into future market changes so as to plan accordingly & avoid expense and delays.

Innovation and the right partnerships will help safeguard 2024 business goals. It is important to take note that Compliance is not just an everyday and burdensome task at hand, but an opportunity to gain a competitive edge in an evermore difficult marketplace.

The Chief Compliance Officer of 2030, as envisioned by the American Bankers Association (ABA), will need to champion a culture of compliance within their organizations. This involves instilling a deep understanding of compliance requirements across all levels of the company, promoting ethical behavior, and providing comprehensive training programs to employees. A strong compliance culture not only reduces regulatory risks but also enhances the organization’s reputation and trustworthiness.

Looking beyond the immediate horizon, CCOs should adopt a forward-thinking approach. The Chief Compliance Officer of 2030 may require different skills and perspectives compared to today. Hence, nurturing a culture of adaptability and innovation within compliance teams becomes imperative. Future-proofing strategies involve staying abreast of emerging regulations, anticipating industry shifts, and preparing the organization to swiftly respond to regulatory changes.

5. Regulatory Examination Preparedness

Staying abreast of regulatory changes and aligning compliance efforts with the SEC’s examination priorities for 2024 is paramount. CCOs must ensure that their organizations are well-prepared for regulatory scrutiny. Conducting internal audits, implementing robust controls, and maintaining accurate and up-to-date documentation are essential to demonstrate compliance readiness.

6. Collaboration & Communication

Effective collaboration between different departments within an organization is key to successful compliance management. CCOs need to foster cross-functional communication, breaking down silos to ensure a cohesive approach to compliance. Establishing clear channels for reporting compliance concerns and encouraging open dialogue promotes a proactive compliance culture.

7. Hot Trends Evaluated by Compliance & Risks Experts

Joanne O’Donnell, Head of Global Regulatory Compliance team at Compliance and Risks

“The continuing rapid growth in laws, regulations and standards across all regulatory policy areas and across all countries continues to place a considerable burden on CCOs who face the challenge of keeping up with not just what is in force, but also what is potentially coming down the line. Regulatory compliance tools such as C2P are therefore critical in helping CCO’s to stay on top of this ever-changing regulatory environment, particularly in the face of newer challenges such as climate disclosures, ESG reporting, sustainable supply chains, circular economy, EPR, data privacy and cybersecurity to name a few.”

At Compliance & Risks, our regulatory experts have analyzed regulatory trends to create a list of hot topics and regulations that every compliance professional should be on the lookout for in 2024.

1. Chemicals in Products

- 1 February 2024: GB RoHS phase-out date for mercury in single-capped compact fluorescent lamps for general lighting purposes; all double-capped linear fluorescent lamps; ‘other’ low low pressure discharge lamps; High Pressure Sodium (vapor) lamps for general lighting purposes in lamps with improved color rendering index Ra > 60: P ≤ 155 W, Ra > 60: 155 W < P ≤ 405 W and Ra > 60: P > 405 W.

- Expected addition of four phthalates restrictions under China RoHS (implementation to follow in 2025)

- Taiwan – New inspection requirements for headphones, including those used with smartphones, including RoHS labelling, electrical safety and EMC from 1 January 2024

2. ESG Reporting

- The EU CSRD and ESRS standards come into force for the largest companies in scope in Jan 2024.

- Finalization of SEC rules

- Discussion around scope 3 emissions/ supply chain emissions

3. Climate Change: ESG Corporate Reporting

- Anticipated finalization of the US SEC climate disclosure rule in Q1 2024

4. Circular Economy

- Framework for Setting Ecodesign Requirements for Sustainable Products (ESPR), Regulation (this should be adopted in 2024, currently a draft since March 2022 – covers ecodesign and energy efficiency also)

- Right to repair – EU: Common Rules Promoting the Repair of Goods, Draft Directive, March 2023 (this should be adopted in 2024 – probably the first half of the year).

5. Climate Change

- Anticipated finalisation of the US SEC climate disclosure rule in Q1 2024.

6. Consumer Protection

- Possible adoption of the EU directive to empower consumers for the green transition.

7. Eco-design

- Framework for Setting Ecodesign Requirements for Sustainable Products (ESPR), Regulation (this should be adopted in 2024, currently a draft since March 2022 – covers circular economy and energy efficiency also).

8. Ecolabelling

- Adoption of new TCO Generation 9

9. EU Reach

- PFAS and restriction of the use of undecafluorohexanoic acid (PFHxA) proposals.

10. Packaging

- The Proposed EU packaging Regulation is anticipated to be approved in mid 2024, this will be a major development for EU packaging requirements.

- It is also anticipated that many packaging EPR Bills will be proposed and possibly approved in the US states.

- Canada is also in the process of developing packaging EPR systems across its territories and provinces, which may result in the release of Drafts etc over the next few months.

11. Product Safety

- December 2024: date of application of GPSR [Regulation (EU) 2023/988].

- UK modernisation of product safety legislation – outcome of consultation on proposed reform [awaiting publication – no date available].

- Machinery – Possible adoption of delegated/implementing acts by the EU Commission under the Machinery Regulation.

8. What Steps Can the CCO Take to Maintain Compliance Excellence?

1. Ruthless Prioritization

- Understand the initiatives that are most impactful to business goals.

- Get buy in and support for the ones that are most impactful.

- Put together a “tiger team” to aggressively address the most impactful initiatives.

2. Create a Simple Goal

- Use business language to ensure proper alignment

- Get buy in and support for the ones that are most impactful

- Ruthlessly prioritize and laser focus on the goal

3. Identify the Path of Least Resistance

- Understand the GTM strategy for the business.

- Map product compliance initiatives against GTM Strategy.

- Map product compliance initiatives against GTM Strategy

9. How Can Compliance & Risks Help You?

Built for modern compliance teams, C2P is a cloud-based enterprise-ready corporate compliance platform built by Compliance & Risks. A complete market access solution, acting as your single source of compliance truth, C2P platform enables you to unlock global market access – adapting to a world increasingly focused on sustainability.

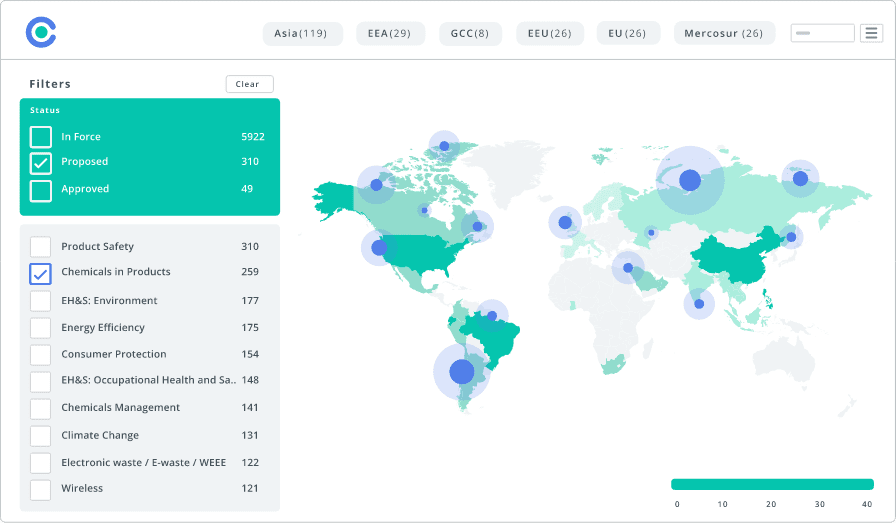

A strategic enabler empowering you to plan for the future, C2P Platform is purpose-built with comprehensive live-linking capabilities that keep up with the dynamic world of regulations – to revolutionize the management of global and local regulations, standards, compliance requirements & evidence. (See Image 2 below, Source: C2P Platform by Compliance & Risks)

Image 2: Global Regulations Heatmap Source: C2P Platform by Compliance & Risks

With our suite of Product Compliance & ESG Solutions, powered by the C2P Platform, you can seamlessly research, collaborate & align with stakeholders. Witness your ESG goals and targets materialize while effortlessly showcasing compliance with evolving regulatory demands and other stakeholder mandates.

But that’s not all – elevate your compliance journey with C2P’s customizable add-on packages. These offer specific insights into ESG and Product Compliance, with unparalleled access to global regulatory content, a dedicated team of subject matter experts, and an array of professional services meticulously designed to expedite your market access.

Please reach out to us here to learn more.

10. Conclusion

In conclusion, the role of a Chief Compliance Officer in 2024 demands a strategic focus on leveraging technology, addressing emerging risks, nurturing a compliance-centric culture, staying vigilant on regulatory changes, and fostering collaboration across the organization.

By prioritizing hot trends like ESG, technology upgrades, future-oriented strategies, and alignment with business goals, CCOs can effectively navigate the regulatory landscape while fostering a culture of compliance excellence within their organizations.

Sources

- C2P Platform by Compliance & Risks

- Compliance Week – Upgrading Compliance Tech

- Compliance Week – SEC 2024 Exam Priorities

- Banking Journal – The Chief Compliance Officer of 2030

- Gartner – What Matters to CEOs and CFOs Right Now

- Coalfire Compliance Report 2023

- Key Budget, Staffing and Spending Trends for Compliance in 2023

Is Your Compliance Process Optimized for Success?

We can help you. Design & build new products with full confidence you’ve met all compliance obligations.