ESG Regulations: What’s Coming Next?

This blog was originally posted on 17th October, 2023 and updated on February 6th, 2024.

Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY Joanne O’donnell, head of global regulatory compliance team and Celia le lievre, senior regulatory & requirements compliance specialist, compliance & risks

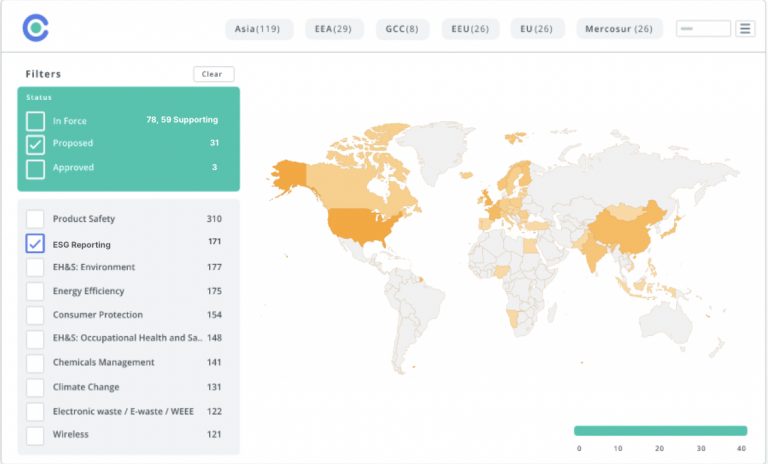

As the global community becomes increasingly aware of the impact of human activity on the environment, companies are facing mounting pressure to implement sustainable and socially responsible practices. In response, governments and regulatory bodies are introducing a wave of new environmental, social, and governance (ESG) regulations aimed at promoting sustainable business practices and protecting the planet. These regulations cover a wide range of issues, from carbon emissions and energy efficiency to worker safety and human rights. (See Image 1 below)

If you’re a business owner or investor, it is imperative to stay up-to-date on these upcoming ESG regulations and their implementation dates.

In this blog, we will take a closer look at some of the most significant ESG regulation dates on the horizon.

Table of Contents

- European Union (EU) / European Economic Area

- France

- Brazil

- Taiwan

- South Korea

- Singapore

- Australia

- New Zealand

- California

- Turkey

- International

- Stay Ahead Of ESG Regulations

- See Our ESG Solution In Action

Image 1: Looming global ESG deadlines. Source: C2P Platform by Compliance & Risks

European Union (EU) / European Economic Area

Corporate Sustainability Reporting Directive (EU) 2022/2464

- Jan 01, 2024 –

Date of Application - Jul 06, 2024 –

Deadline for transposition by Member States - 2025 –

Compliance Deadline: Reporting on the financial year 2024 for companies already subject to the EU Non-Financial Reporting Directive (NFRD) - 2026 –

Compliance Deadline: Reporting on the financial year 2025 for companies that are not currently subject to the NFRD - 2027 –

Compliance Deadline: Reporting on the financial year 2026 for listed SMEs except micro undertakings, small and non-complex credit institutions and captive insurance undertakings - 2029 –

Compliance Deadline: Reporting on the financial year 2028 for third-country undertakings

EU Sustainability Reporting Standards, Delegated Regulation (EU) 2023/2772

- Jan 01, 2024-

Date of application

Delegated Directive (EU) 2023/2775 amending Directive 2013/34/EU (Accounting Directive) as regards the adjustment of the size criteria for micro, small, medium-sized and large undertakings or groups

- Jan 01, 2024 –

Date of appliction

Revised size criteria:

- Micro-undertakings:

– Total balance sheet: EUR 450 000 (instead of EUR 350 000)

– Net turnover: EUR 900 000 (instead of 700 000) - Small companies:

– Total balance sheet: EUR 5 million (instead of 4 million)

– Net turnover: EUR 10 million (instead of EUR 8 million)

– Max 50 employees - Large and medium-sized companies:

– Total balance sheet: EUR 25 million (instead of 20 million)

– Net turnover: EUR 50 million (instead of eur 40 million)

– Max 250 employees (unchanged)

Proposal for a Decision amending Directive 2013/34/EU as regards the time limits for the adoption of sustainability reporting standards for certain sectors and for certain third-country undertakings

- June 30, 2026 –

Proposed revised due date for adoption by EU Commission of sector-specific ESRS and ESRS for non-EU undertakings - January 24, 2024 –

EU Parliament votes in favor of the proposal to delay the adoption of sector specific ESRS and third-country undertakings ESRS by two years

Exposure Draft Voluntary Sustainability Reporting Standards for Listed SMEs and Unlisted SMEs (ESRS LSME ED and ESRS VSME ED)

- January 31, 2024 –

End of call for participation in the field test of draft standards. - May 21, 2024 –

End of public consultation on draft ESTS LSME and VSME ED)

EU: Corporate Sustainability Due Diligence Directive, Draft Directive, February 2022

- February 23, 2022 –

Date proposed - June 1, 2023 –

Date adopted in first reading by EU Parliament. - December 14, 2023 –

Provisional agreement reached between EU Parliament and Council. - 20 days after publication –

Proposed date of entry into force - Two years after date of entry into force –

Deadline for transposition by Member States. - Three years after date of entry into force –

Proposed date of application of due diligence obligations for large companies that had more than 1000 employees on average and had a net worldwide turnover of more than EUR 150 million in the last financial year (or parent company of a group that has the same numbers worldwide). - Four years after date of entry into force –

Proposed date application of due diligence obligations for EU and parent companies with more than 500 employees on average and a net worldwide turnover of more than EUR 150 million in the last financial year. - Four years after date of entry into force –

Proposed date of application of due diligence obligations for EU companies with more than 250 employees on average and a net worldwide turnover of more than EUR 40 million.

EU Technical Screening Criteria for Determining the Conditions Under which an Economic Activity Qualifies as Contributing Substantially to the Transition to a Circular Economy, Pollution Prevention etc,Regulation, June 2023 (Taxonomy Environmental Delegated Act)

- Jan 01, 2024

Date of application - From Jan 01, 2024 to Dec 31, 2024 –

Compliance deadline: non-financial undertakings must disclose the proportion of Taxonomy-eligible and Taxonomy non-eligible economic activities in their total turnover, capital and operational expenditure - Jan 01, 2025 –

Compliance deadline: the key performance indicators of non-financial undertakings must cover the economic activities set out in this Regulation from this date

France

France: Corporate Sustainability Reporting, Ordinance No. 2023-1142

- January 1, 2024 –

Date of entry into force - January 1, 2024 –

Large companies and companies that are part of a large group shall submit a non-financial report in accordance with the Non-financial Reporting Directive for the financial year commencing on this date. - January 1, 2025 –

Date of entry into force of reporting obligations in accordance with this Ordinance for large companies and companies combined into a large group. - January 1, 2026 –

Date of entry into force of new reporting obligations for public small and medium sized enterprises with security admitted to trading, small and non-complex credit institutions, insurance and reinsurance companies (first report due in 2027). - January 1, 2028 –

Date of entry into force of reporting requirements for third-country undertakings (mentioned in Articles L. 232-6-4 and L. 233-28-5 of the French Commercial Code). - January 1, 2028 –

SMEs (Article L. 230-1 of the French Commercial Code) may decide not to disclose sustainability information for financial years commencing before this date, provided that they briefly justify this decision in their management report.

France: Sustainability Reporting Content and Size Thresholds for Reporting Entities, Decree No. 2023-1394

- January 1, 2025 –

Date of entry into force of reporting obligations (for financial year 2024) for large companies (balance sheet: 20 m€, net turnover: €40m, average number of employees employed: 250) and companies combined into a large group. - January 1, 2026 –

Date of entry into force of reporting obligations for public small and medium sized enterprises with security admitted to trading, small and non-complex credit institutions, insurance and reinsurance companies (first report due in 2027 for financial year 2026).

Brazil

Brazil: Preparation and Disclosure of the Sustainability Financial Information, Resolution CVM NO. 193, 2023

- November 1, 2023 –

Date of entry into force - January 1, 2024 –

Publicly traded companies, investment funds and insurance companies may disclose IFRS-aligned sustainability-related information on a voluntary basis. - January 1, 2026 –

IFRS-aligned sustainability-related disclosures become mandatory for publicly traded companies from fiscal year beginning on or after January 1, 2026.

Taiwan

Taiwan: Roadmap for Taiwan listed companies to align with IFRS Sustainability Disclosure Standards, August 2023

- January 01, 2026 –

Adoption of ISSB IFRS standards from the financial year 2026 - January 01, 2026 –

Expected date of application for listed companies with capital over NT$10 billion - January 01, 2027 –

Expected date of application for listed companies with capital over NT$5 billion and less than NT$10 billion - January 01, 2028 –

Expected date of application for all listed companies

Taiwan: Timelines of Climate-Related Disclosures for TWSE and TPEx Listed Companies, Order No. 11203852314, 2023

- November 13, 2023 –

Date of entry into force - January 01, 2024 –

Compliance deadline: starting from this date, listed companies with a paid-in capital ≥ NT$10 billion shall complete disclosure of information regarding greenhouse gas inventory and assurance. - January 01, 2025 –

Compliance deadline: starting from this date, consolidated financial reporting subsidiaries of listed companies with a paid-in capital ≥ NT$10 billion and parent companies of listed companies with a paid-in capital ≥ NT$5 billion but less than NT$10 billion shall complete disclosure of information regarding greenhouse gas inventory. - January 01, 2026 –

Compliance deadline: starting from this year, consolidated financial reporting subsidiaries of listed companies with a paid-in capital ≥ NT$5 billion but less than NT$10 billion and parent companies of listed companies with a paid-in capital < NT$5 billion shall complete disclosure of information regarding greenhouse gas inventory. - January 01, 2027 –

Compliance deadline: starting from this year, consolidated financial reporting subsidiaries of listed companies with a paid-in capital ≥ NT$10 billion and parent companies of listed companies with a paid-in capital ≥ NT$5 billion but less than NT$10 billion shall complete disclosure of information regarding greenhouse gas assurance. - January 01, 2027 –

Compliance deadline: starting from this year, consolidated financial reporting subsidiaries of listed companies with a paid-in capital < NT$5 billion shall complete disclosure of information regarding greenhouse gas inventory. - January 01, 2027 –

Compliance deadline: from this year, listed companies with a paid-in capital < NT$5 billion shall complete disclosure of information regarding their carbon reduction targets, strategies, and specific action plans. - January 01, 2029 –

Compliance deadline: starting from this year, consolidated financial reporting subsidiaries of listed companies with a paid-in capital < NT$5 billion shall complete disclosure of information regarding greenhouse gas assurance.

Taiwan: Amendment to Regulations Governing Information to be Published in Annual Reports of Public Companies (on disclosure of carbon reduction targets, strategies and action plans in annual reports of listed companies) Order No. 1120385231, 2023

- November 10, 2023 –

Date of entry into force - 14 days before each shareholder meeting –

TWSE or TPEX listed companies with a capital ≥ NT$2 billion shall submit to the competent authority an annual report containing additional information on individual directors’ remuneration, carbon reduction targets, strategy and action plan.

South Korea

South Korea: Human Rights and Environmental Protection for Corporate Sustainable Management, Draft Law, September 2023 (Bill No. 2124147)

- One year after publication –

Proposed date of entry into force - Annually –

Proposed compliance deadline: in-scope companies must assess human rights and environmental risks, prepare a due diligence plan and submit it to the Board of Directors for approval; in-scope companies are undertakings with headquarters in South Korea or foreign companies with a business place in South Korea that have at least 500 employees or revenue equal to or greater than 200 billion KRW in the previous financial year.

Singapore

Singapore: Extending Mandatory Climate Reporting Obligations to Large Non-listed Companies, Consultation Paper, July 2023

- January 01, 2025 –

Proposed compliance deadline: listed issuers shall make ISSB-aligned climate disclosures for financial years starting on or after this date. - January 01, 2027 –

Proposed compliance deadline: large non-listed companies with at least $1 billion in revenues shall make ISSB-aligned climate disclosures for financial years starting on and after this date. - January 01, 2027 –

Proposed compliance deadline: from this date, listed issuers must obtain [external] limited assurance in respect of their scope 1 and 2 GHG emissions. - January 01, 2029 –

Proposed compliance deadline: large non-listed companies with at least $100 million in revenues shall make ISSB-aligned climate disclosures for financial years starting on and after this date (proposed compliance deadline subject to review). - January 01, 2029 –

Proposed compliance deadline: from this date, non-listed entities (with annual revenue of at least $1 billion) must obtain [external] limited assurance in respect of their scope 1 and 2 GHG emissions.

Australia

Australia: Disclosure of Climate-related Financial Information, Draft Australian Sustainability Reporting Standards (ASRS) 1, 2 and 101, October 2023

- October 23, 2023 –

Date proposed - March 01. 2024 –

End of consultation of draft exposure standards - July 01, 2024 –

Proposed compliance deadline: entities in Group 1 shall prepare climate-related financial disclosures for annual periods beginning on or after 1 July 2024; - July 01, 2026 –

Proposed compliance deadline: entities in Group 2 shall prepare climate-related financial disclosures for annual periods beginning on or after 1 July 2026; - July 01, 2027 –

Proposed compliance deadline: entities in Group 3 shall prepare climate-related financial disclosures for annual periods beginning on or after 1 July 2027;

Australia: Draft Legislative proposal on climate-related disclosures, Draft Law, January 2024

- January 12, 2024 –

Date proposed - February 09. 2024 –

Deadline for comments - July 01, 2024 to June 30, 2025 –

Proposed compliance deadline: Group 1 entities must prepare an annual sustainability report for the financial year commencing between these dates; - July 01, 2026 to June 30, 2027 –

Proposed compliance deadline: Group 2 entities must prepare an annual sustainability report for the financial year commencing between these dates; - July 01, 2027 –

Proposed compliance deadline: Group 3 entities must prepare a sustainability report for each financial year that commences on or after this date; - July 01, 2024 to June 30, 2030 –

Proposed compliance deadline: sustainability reports prepared by in-scope companies must be verified by an external auditor on the basis of limited assurance - July 01, 2030 –

Proposed compliance deadline: sustainability reports prepared for a financial year commencing on or after this date must be verified by an external auditor on the basis of reasonable assurance; - July 01, 2024 –

Proposed deadline for issuance of auditing standards by the Auditing and Assurance Standards Boards (AASB)

New Zealand

New Zealand: NZ CS 1 Climate Standard 1 – Climate-related Disclosures, 2022

- January 01, 2023 –

Compliance deadline: climate reporting entities shall prepare annual climate statements in accordance with this standard (for reporting periods beginning on or after this date)

New Zealand: NZ CS 2 Climate Standard 2 – Adoption of Aotearoa New Zealand Climate Standards, 2022

- January 01, 2023 –

Compliance deadline: climate reporting entities shall prepare annual climate statements in accordance with this standard (for reporting periods beginning on or after this date)

New Zealand: NZ CS 3 Climate Standard 3 – General Requirements for Climate-related Disclosures, 2022

- January 01, 2023 –

Compliance deadline: climate reporting entities shall prepare annual climate statements in accordance with this standard (for reporting periods beginning on or after this date)

New Zealand: Financial Markets Conduct, Regulations, 2014/326 and other – Amendment – (on climate-related disclosures and fees) Regulations 2023/281

- January 01, 2024 –

Date of entry into force - January 01, 2024 –

Climate reporting entities shall lodge their climate statements in the Climate-related Disclosures Register and pay applicable climate statements fee

New Zealand: Financial Markets Conduct, Regulations, 2014/326 – Amendment – (on climate-related disclosures) Regulations, 2023/222

- October 02, 2023 –

Date of entry into force - October 02, 2023 –

Climate reporting entities shall ensure that climate-related disclosures made pursuant to Part 7A of the Financial Markets Conduct Act 2013 are recorded in English or te reo Māoriin and kept in a way that enables them to be identified and inspected for compliance with the Act.

California

California : Climate Corporate Data Accountability, Senate Bill 253 Enacted, 2023

- January 01, 2024 –

Date of entry into force - January 01, 2025 –

State board to adopt regulations to require reporting entities to annually disclose scope 1, 2 and 3 emissions and to obtain an assurance engagement performed by an independent third-party assurance provider. - 2026 and annually thereafter –

Reporting entities to publicly disclose to the emissions reporting organization all scope 1 and 2 emissions for prior fiscal year; reporting entities shall obtain limited assurance engagement for scope 1 and scope 2 emissions. - 2027 and annually thereafter –

Reporting entities to publicly disclose scope 3 emissions no later than 180 days after scope 1 and 2 emissions are publicly disclosed. - 2030 and annually thereafter –

Reporting entities shall obtain reasonable assurance engagement for scope 1 and scope 2 emissions

California : Climate-Related Financial Risk Reporting, Senate Bill 261 Enacted, 2023

- January 01, 2024 –

Date of entry into force - Jan 01, 2026 and bi-annually thereafter –

Covered entities to prepare and make publicly available climate-related financial risk reports.

California: Voluntary Carbon Market Disclosures, Assembly Bill 1305, 2023

- January 01, 2024 –

Date of entry into force - January 01, 2024 and annually thereafter –

Entities operating in California that market or sell voluntary carbon offsets, or make claims regarding the achievement of net zero emissions or similar claims shall disclose certain specified information relating to the applicable carbon offset project or accuracy/achievement of the net zero or carbon reduction claim on the entity’s website.

Turkey

Turkey: Sustainability Reporting Standard TSRS 1 and TSRS 2, Decision, December 2023

- January 01, 2024 –

Compliance deadline: regulated banks, investment institutions and large companies above specified thresholds shall start making IFRS-aligned sustainability disclosures for the fiscal year beginning on or after this date. - January 01, 2026 –

Compliance deadlines: regulated banks, investment institutions and large companies above specified thresholds shall include scope 3 emissions in their annual sustainability reports

International

IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information

- January 01, 2024 –

IFRS S1 effective for annual reporting period beginning on or after this date - January 01, 2025 –

End of first year transition reliefs for entities

IFRS S2 Climate-related Disclosures

- January 01, 2024 –

IFRS S2 effective for annual reporting period beginning on or after this date - January 01, 2025 –

End of first year transition reliefs for entities

Taskforce on Nature-related financial Disclosures (TNFD)

- December 19, 2023 –

Date published

Draft International Standards on Requirements for Sustainability Assurance Engagements

- Expected publication date –

End of 2024

Proposed ISSA 5000 can be applied to:

– Information about all sustainability topics and aspects of topics

– Information prepared in accordance with any sustainability reporting framework, standard or other suitable criteria

– All sustainability information regardless of the mechanism for reporting the information

– Limited and reasonable assurance engagements

GRI: Biodiversity Reporting Standards (GRI: 101)

- January 24, 2024 –

Date published - January 01, 2026 –

GRI 101 effective for annual reporting year starting on or after this date

Stay Ahead Of ESG Regulations

Compliance & Risk’s ESG Solution enables organizations to manage their ESG program by

- Staying on top of evolving ESG Regulations

- Setting and managing their ESG goals and targets.

- Demonstrating compliance to evolving regulatory requirements, and other Internal and external stakeholder requirements.

See Our ESG Solution In Action

Watch a bite-sized demo of our ESG solution, on-demand and at your convenience